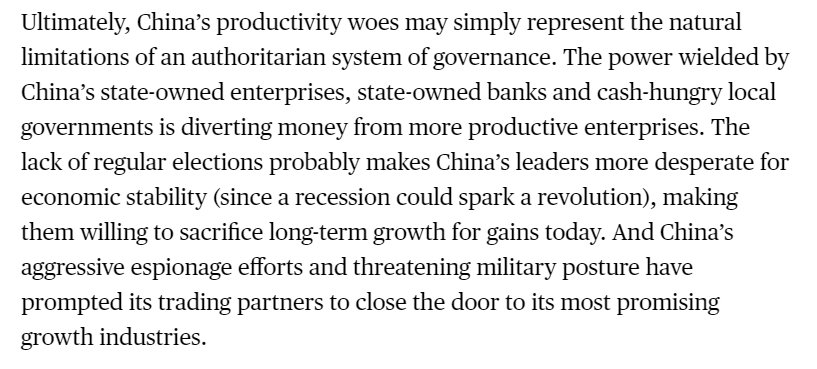

But more broadly, it's about whether China's authoritarianism will hurt its long-term growth.

bloomberg.com/opinion/articl…

bloomberg.com/opinion/articl…

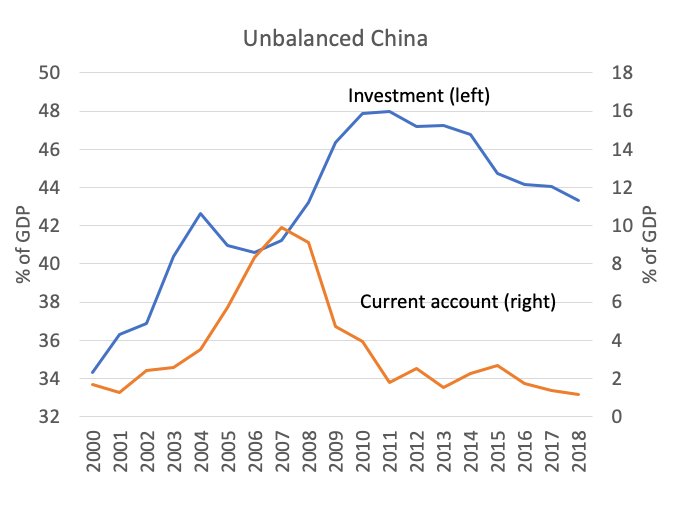

He has a great graph showing that the Great Recession is when China's big trade surpluses collapsed, but when investment kept right on going.

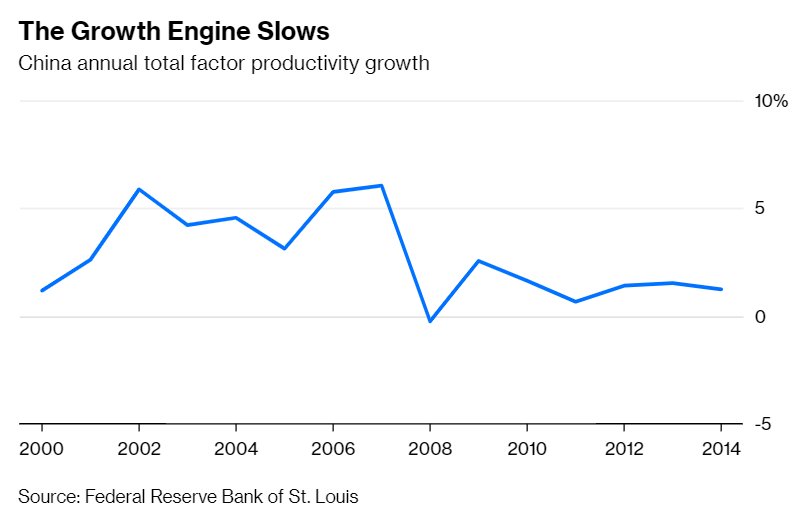

China seems to be doing less of this since 2008.

amazon.com/How-Asia-Works…

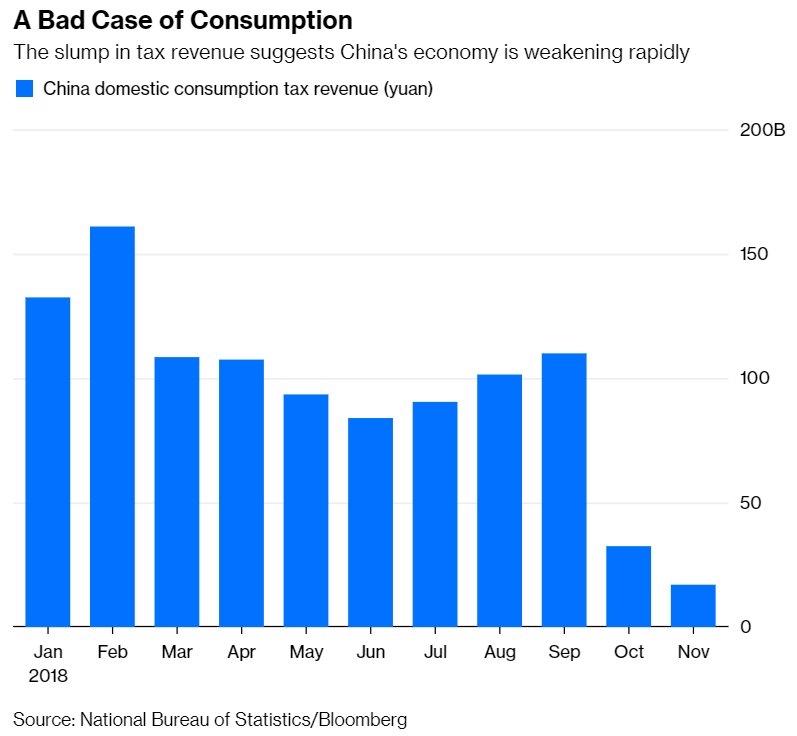

bloomberg.com/news/articles/…

bloomberg.com/opinion/articl…

And instead of dominating the world, it may simply be a little bigger than its far richer rivals.

Well, China did wake, and it did move the world. But if it can't get out of this productivity rut, it may not end up moving it as much as many predicted.

(end)