The US stock market entered one of the longest rallies in its history (10 years and counting).

Graph: en.wikipedia.org/wiki/U.S._Doll…

en.wikipedia.org/wiki/Negative_…

en.wikipedia.org/w/index.php?ti…

blog.bitmex.com/the-road-to-10…

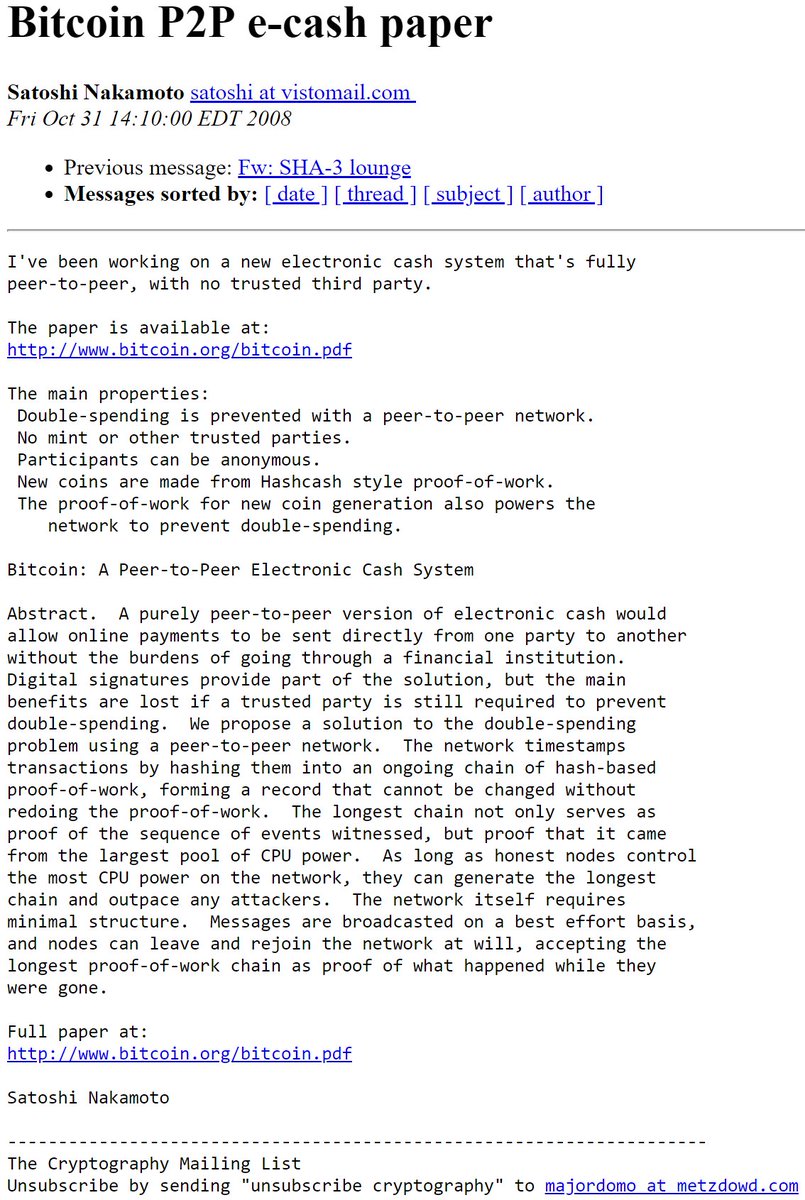

"It would be naïve to think this ‘experiment’ is going to end without significant market stress. A bet on Bitcoin is opting out of this experiment"

theblockcrypto.com/2019/04/01/bit…