*takes deep breath*

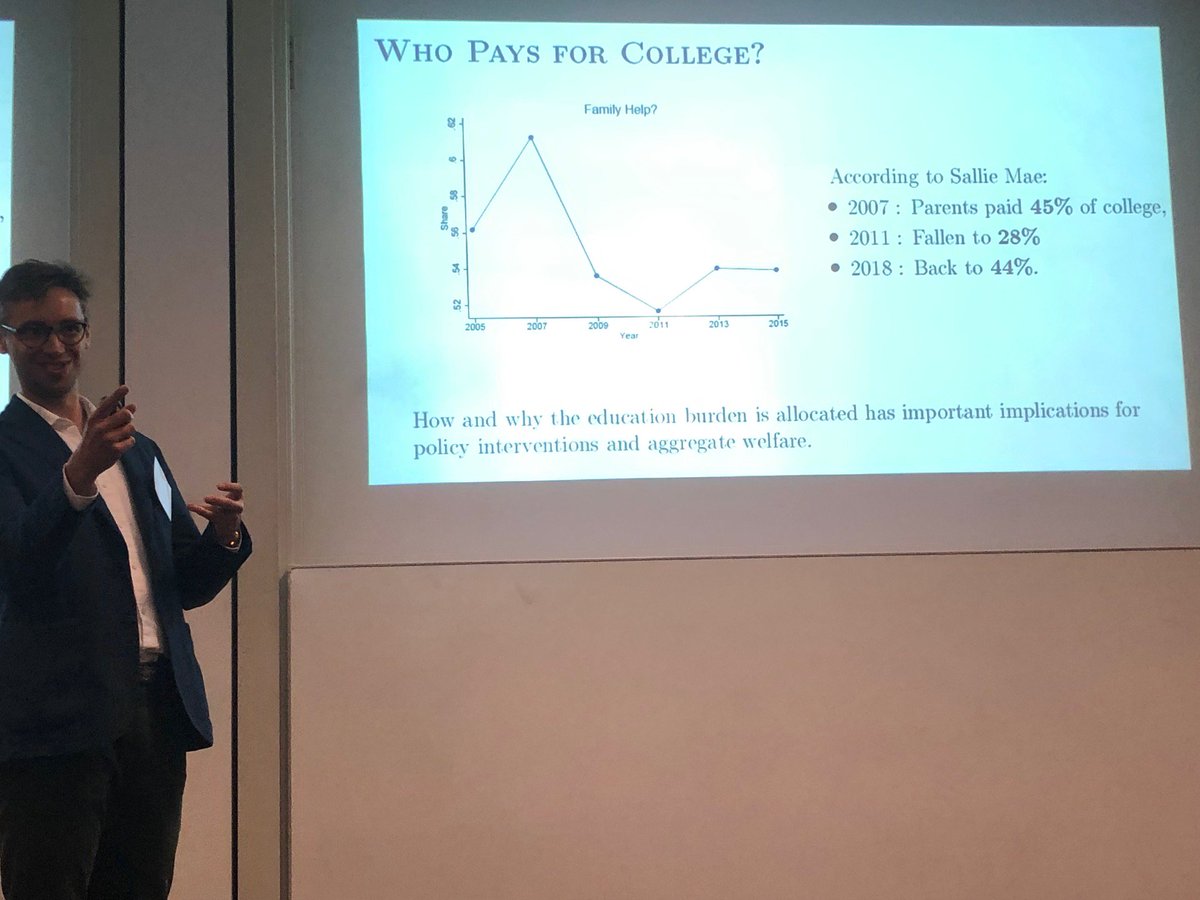

Let me tell you about my job market paper

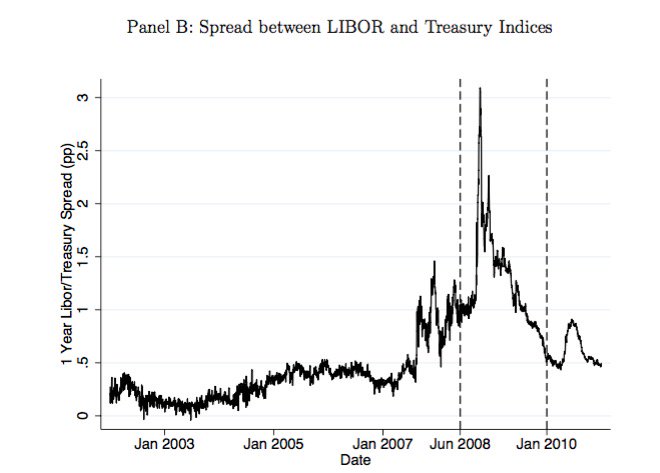

But there was also a run by the *bank * on the borrower in the adjustable-rate mortgage market.

Wait, how can a bank run on the borrower?

Pre-crisis, borrowers would commonly get adjustable-rate mortgage (ARM) contracts which had fixed initial periods of 2, 3, or 5 years; after which they "reset" so payments are benchmarked against the floating market rate.

Instead of a 30-year mortgage, it's more of a sequence of short-term borrowing from the bank, which can deny you credit when interest rates are high and house prices are low

Happened where my parents live: negative equity neighbor strategically defaulted, and people talked about it

chansman.github.io/GuptaHansman.p…