ft.com/content/9d24c1…

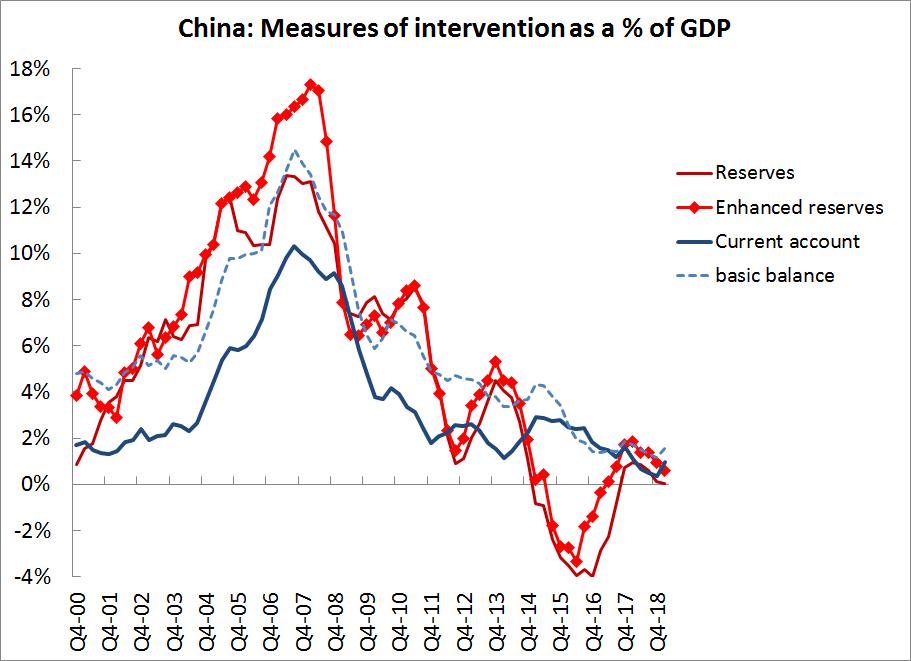

China clearly met the current criteria for manipulation from 2003 to 2013 ...

but it hasn't been consistently intervening to block appreciation over the last five years.

home.treasury.gov/news/press-rel…

(background in link)

cfr.org/blog/china-man…

imf.org/~/media/Files/…

see Alan Beattie way back when

ft.com/content/9dd058…

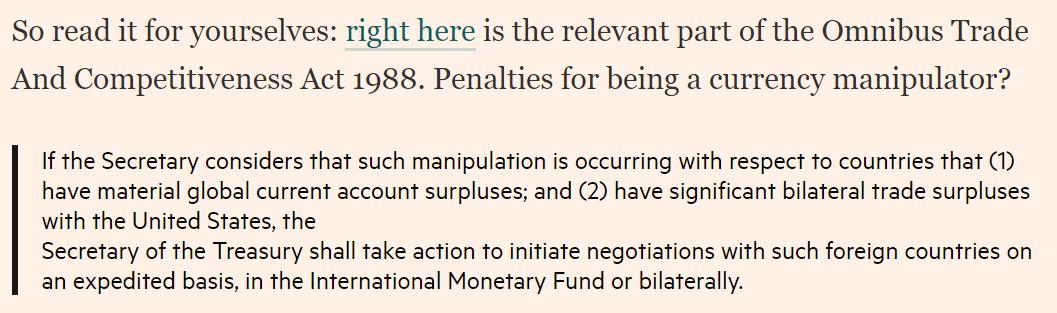

There is a lot of legal detail in my 2016 blog on the legal authority available to the Treasury for a designation, and I think it has stood the test of time

cfr.org/blog/china-man…