Trump wants to look good for 2020. No surprise there. Strong economic numbers--especially GDP--are crucial.

So: trade war! Force a huge economy (China) to buy more of our products. Cranks up GDP. Yay us, right?!

Except China's fighting back.

A weaker Yuan makes it harder for China to import goods (they can't afford to buy other countries' stuff).

But also makes it cheaper for others to buy Chinese goods (our bucks go further).

The $USD is already expensive relative to everyone else's currency. So what can Trump do? He *needs* to increase our exports... but we're expensive to buy from.

How? By increasing inflation. Inflation is a weakening of the buying power of USD. So just as with China, our goods get a little cheaper for others to buy.

So how can he increase inflation*?

So instead it encourages spending. And flooding the economy with more money increases inflation. Why?

But as cash flows more freely, that premium disappears. Easier cash = lower $USD value = higher prices = inflation.

marketwatch.com/story/dow-open…

Plus how long can the stock market run continue if our middle class isn't thriving? No buyers = no business.

$1000 of buying power today will be about $600 in 15 years. If you sit still, you're getting poorer.

It has to be an asset that exists **outside** the realm of government control, can't be used as a weapon against trade partners, can't be devalued by gov't decree.

But the US real estate market is correlated to the US economy. Where one goes, the other follows.

marketwatch.com/story/trumps-t…

But the people with the least stable gov'ts facing the worst inflation (see: Venezuela) won't turn to gold. They need to escape to a different *currency*. Something more interchangeable, storable, transportable than gold. They need utility.

Can't be confiscated by a nat'l bank (bitcoin doesn't even need banks!). Easily transportable across borders. Exchangeable enough (it's sufficiently currency-like, though not optimized for that use case).

It exists completely outside the realm of *all* gov'ts.

It cannot be controlled by any of them.

cointelegraph.com/news/bitcoin-a…

"some experts argue it's shielded from some of the geopolitical news that moves other markets."

markets.businessinsider.com/currencies/new…

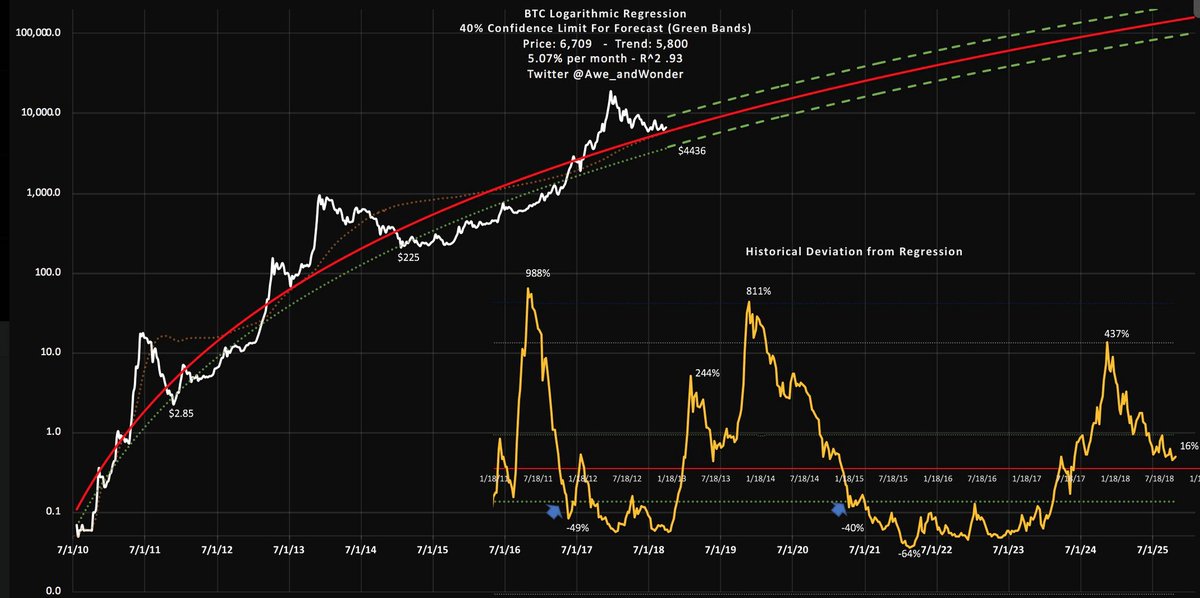

Yep, it's a thing. The swings are big. But zoom out and focus on the long term trend.

Also think about future global instability. Is more turmoil ahead or less? Will safe political hedges be more or less important?

Eager to learn more.

But #tldr: I'm definitely #longbitcoin.