Normally I do two things. I first point out that yeah Floridian oranges would be great ... if you don't mind oranges that have been sprayed with antibiotics banned in Europe and even Brazil.

floridaphoenix.com/2019/01/02/don…

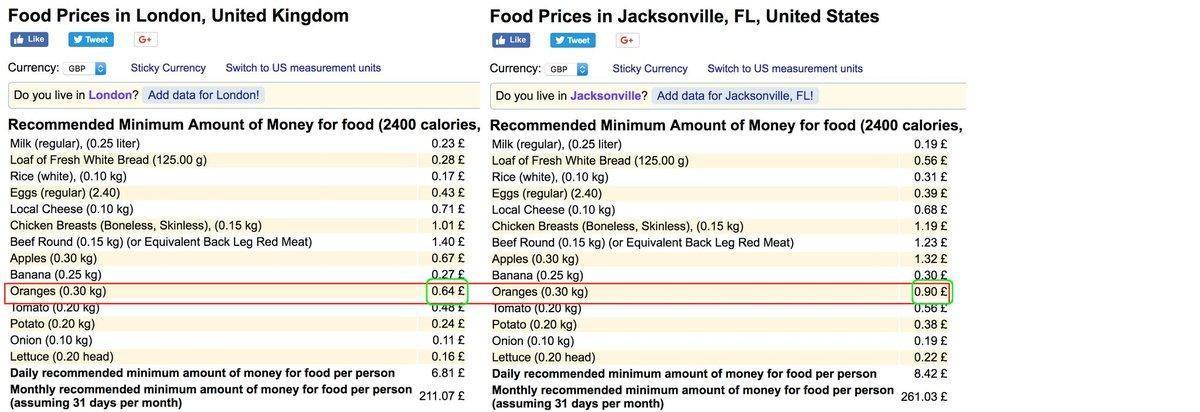

I then use numbero.com and point out that retail prices of oranges in London appear to cheaper than in Jacksonville, Florida.

However, I've never been entirely satisfied with this particular comparison for a couple of reasons. Firstly it uses crowd-sourced data.

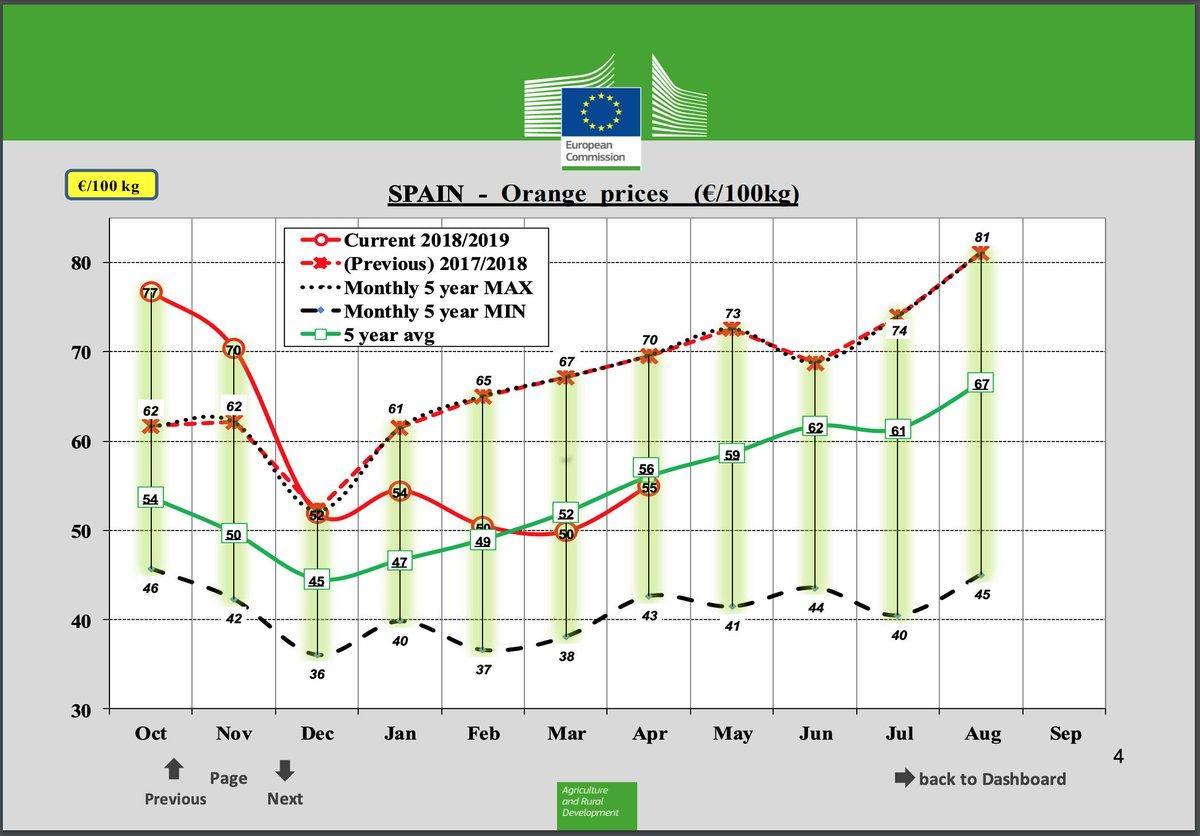

The dashboards provide a quick summary of the market for a particular crop, livestock or commodity.

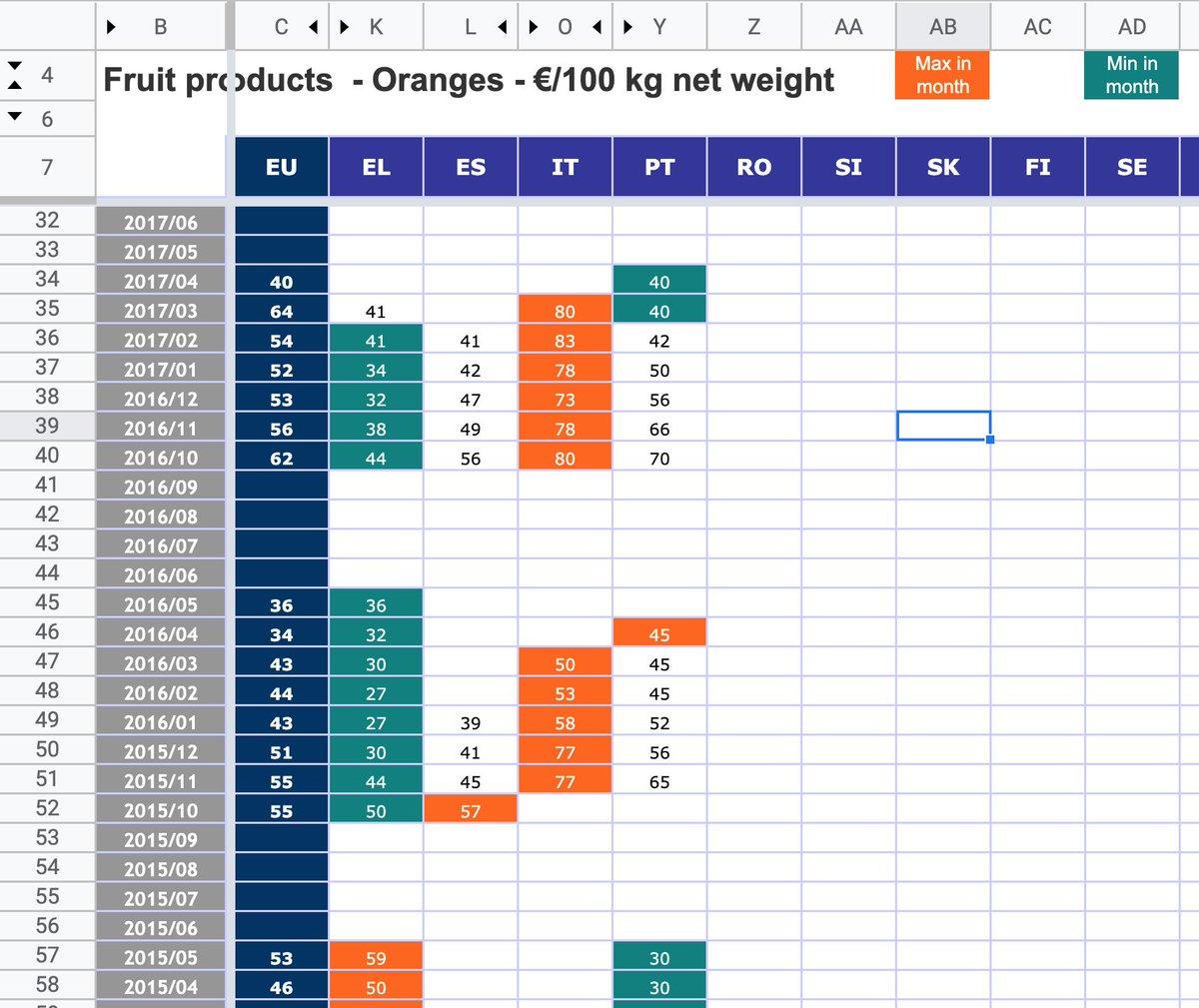

It shows prices for each main orange producer Italy, Spain, Greece and Portugal, but really I want this in a format I can easily use in a spreadsheet.

ec.europa.eu/agriculture/da…

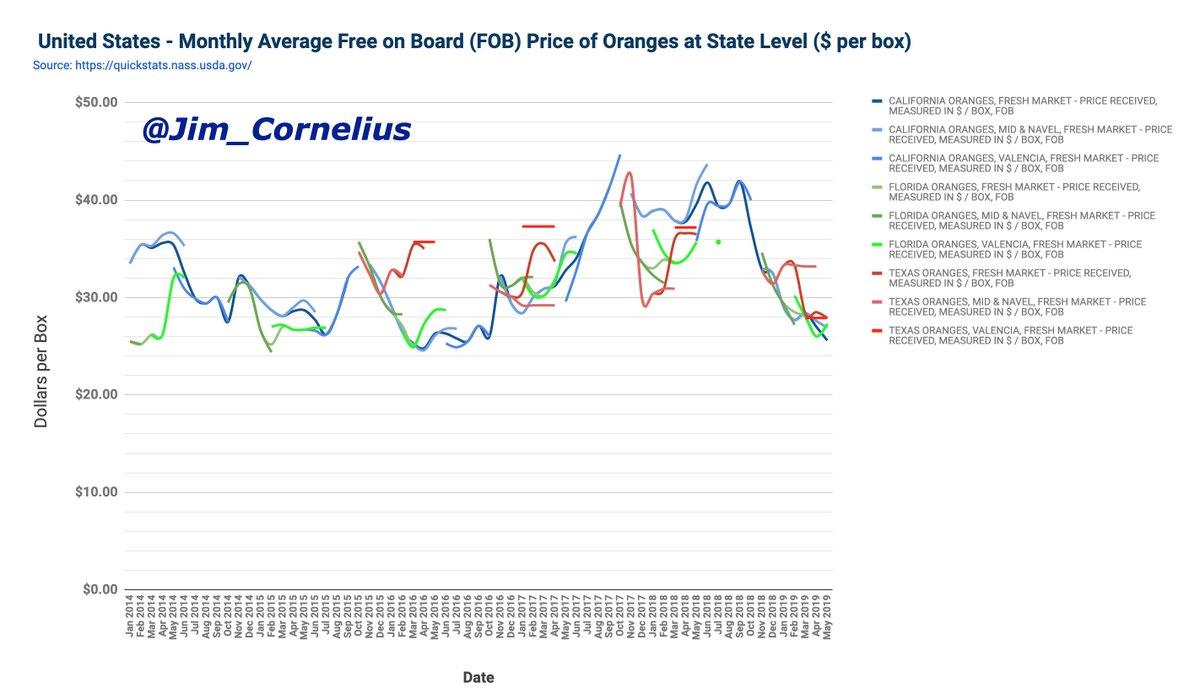

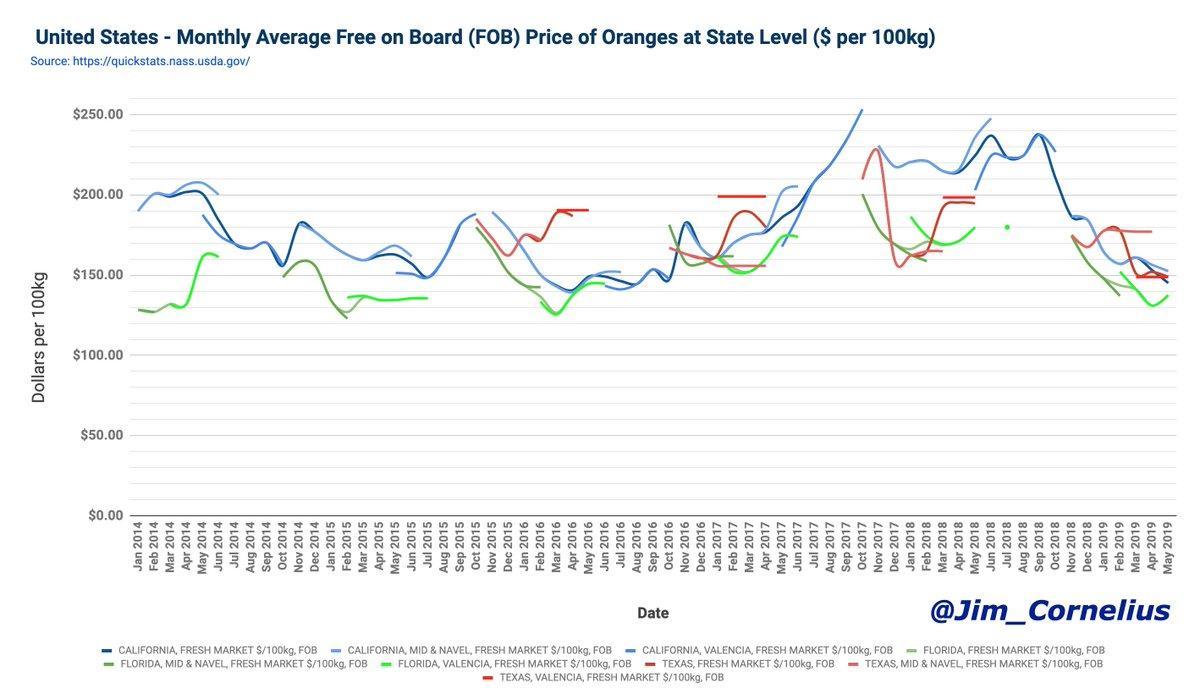

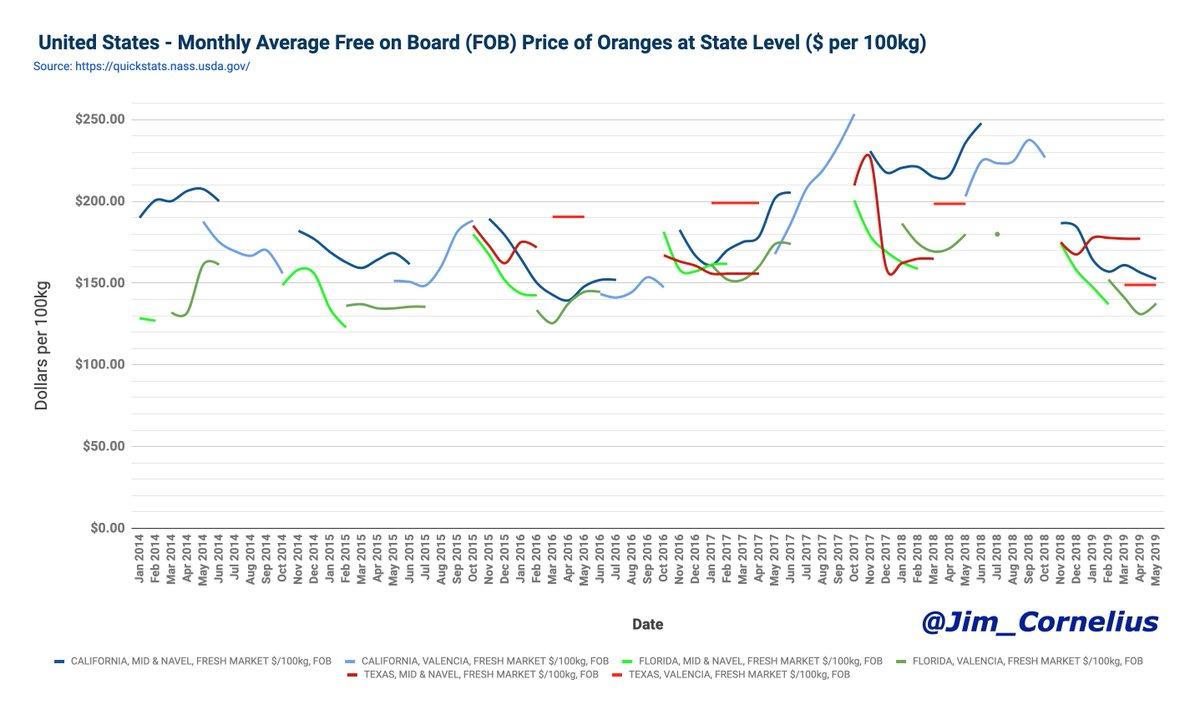

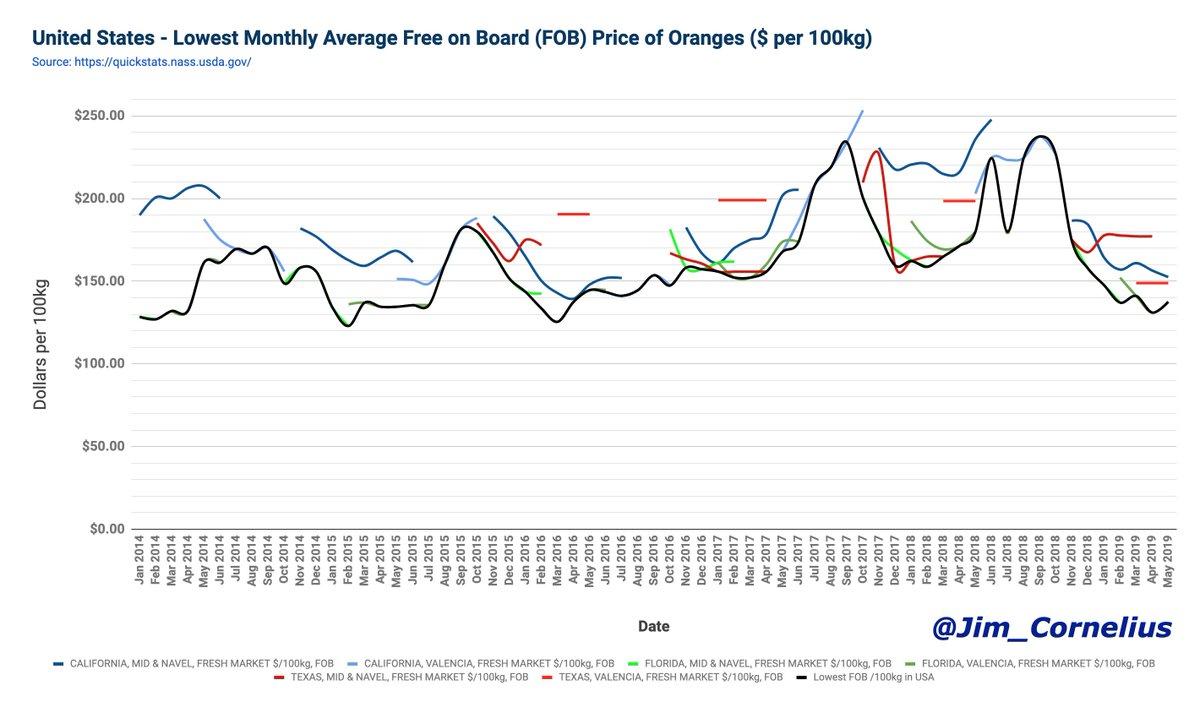

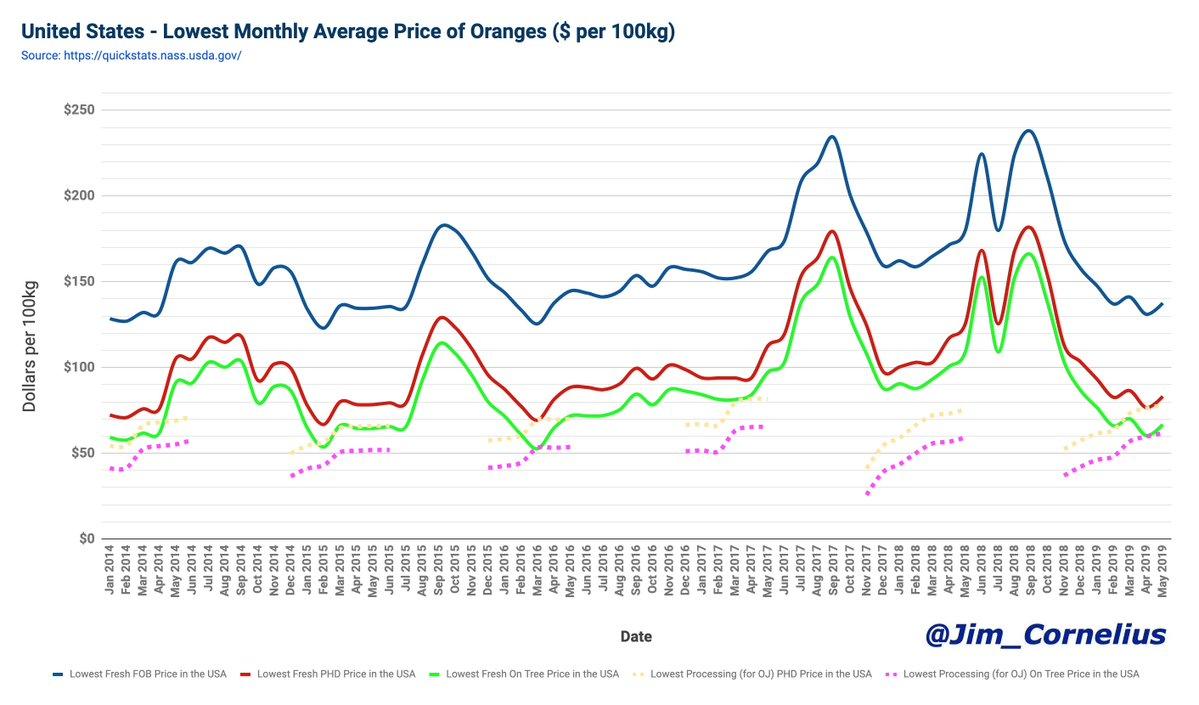

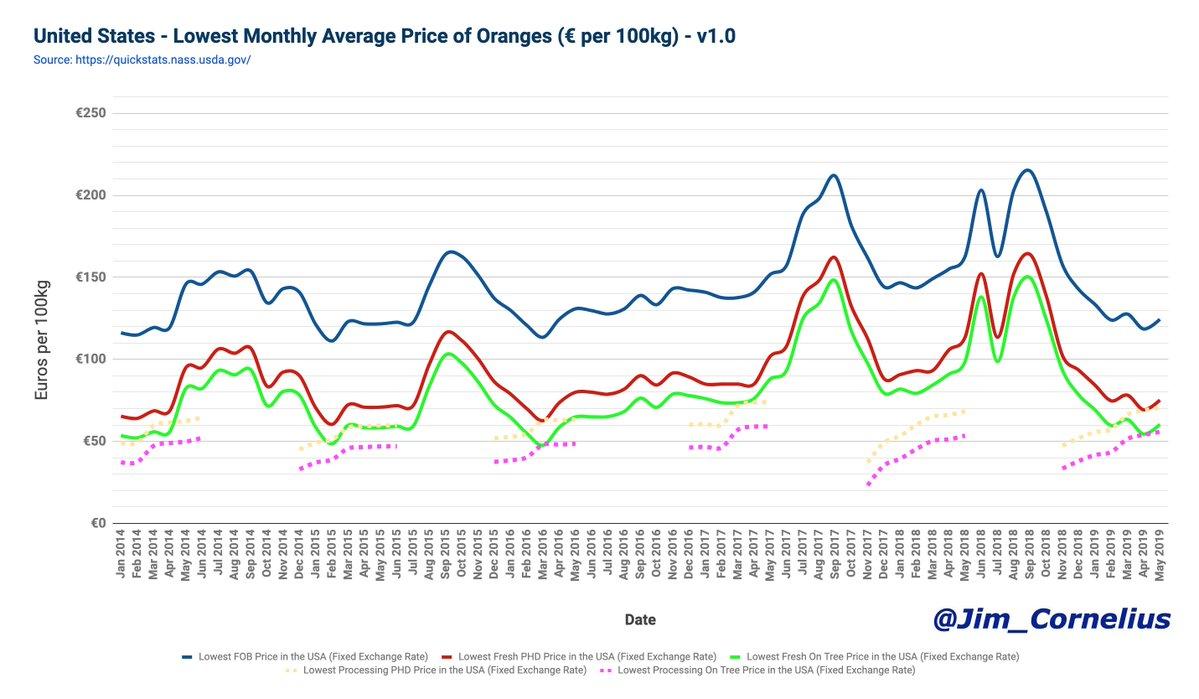

What I want to be able to do is produce a graph a bit like the dashboard graph but also showing market prices in the USA.

I had hoped that I would be able to get the source data for the EU dashboard from Eurostat. But it only has annual figures.

ec.europa.eu/eurostat/web/a…

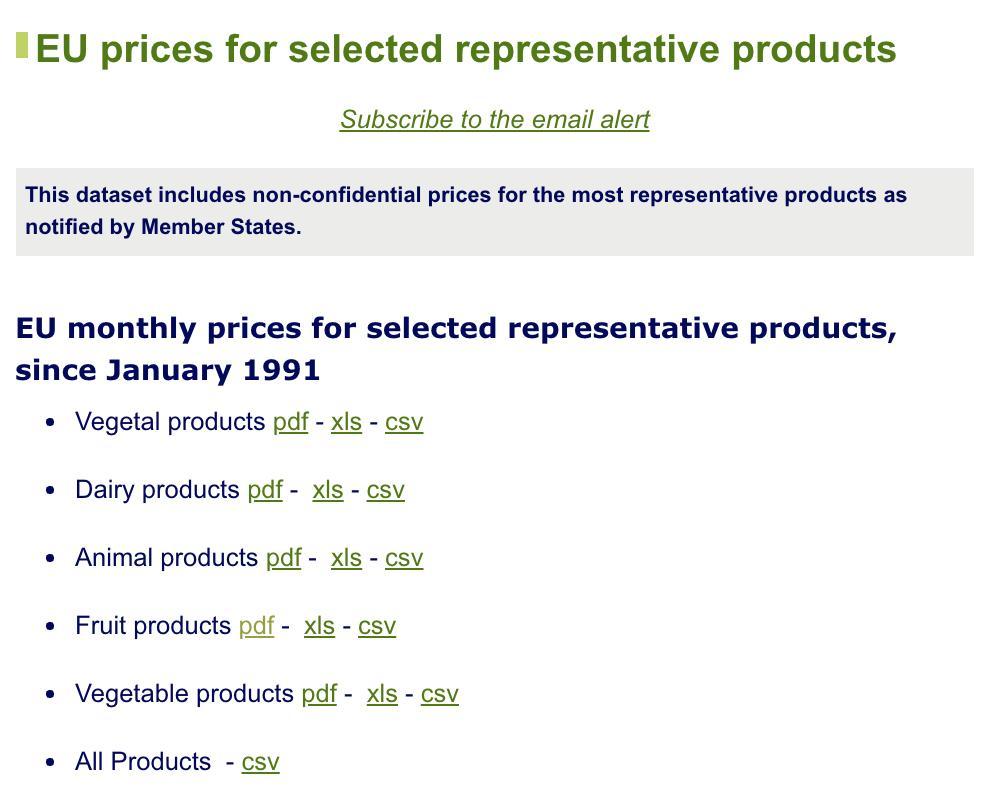

Thankfully there is an alternative. This page link to monthly fruit prices and the data is available in Excel format. It's not all good though. The report, while up to date on other fruits only has data on oranges up to April 2017 and is a bit patchy.

ec.europa.eu/agriculture/ma…

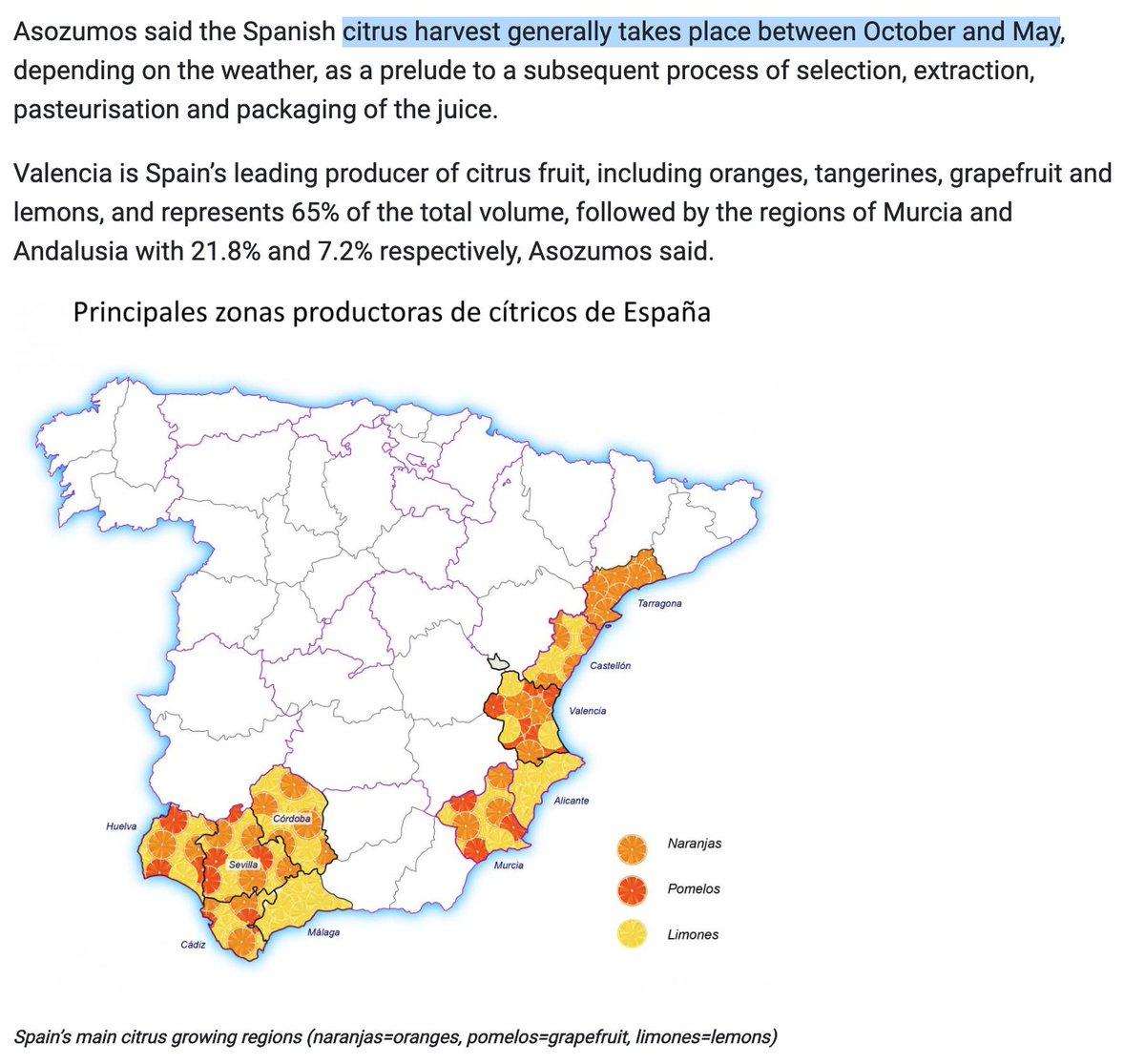

Patchy because the harvesting season in Europe is only from around October to May. Unlike bananas and some other fruit, oranges cannot be ripened once picked, beyond the harvest season they must be cold-stored which affects the quality long-term.

eurofresh-distribution.com/news/spain%E2%…

So the data reflects this. The season is longer closer to the equator, we thus also import from Northern Africa & Israel during this period. Outside of the harvest season, we rely on imports from outside the EU, particularly from South Africa.

ec.europa.eu/agriculture/si…

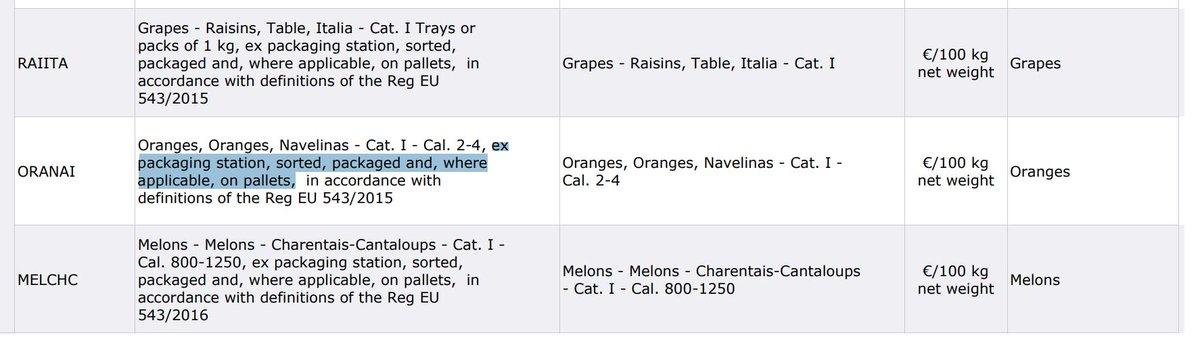

If we're going to do any kind of meaningful comparison it's important to understand what these prices represent and thankfully the report (page 614 in the PDF) helps here.

The are the prices at the first point of sale outside of the packing station.

ec.europa.eu/agriculture/si…

So this is from August 2018 and I really wanted something current but this will do for the moment. What can it tell us about orange prices?

nass.usda.gov/Publications/T…

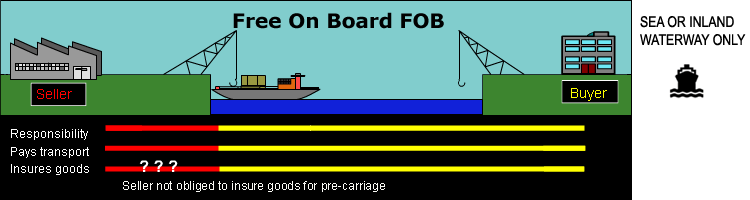

A brief but clear explanation of FOB and other related terms can be found here. What's important to understand is that it is going to cost an importer even more than the FOB due to shipping costs. This is true of all imports and distance is a factor.

incotermsexplained.com/the-incoterms-…

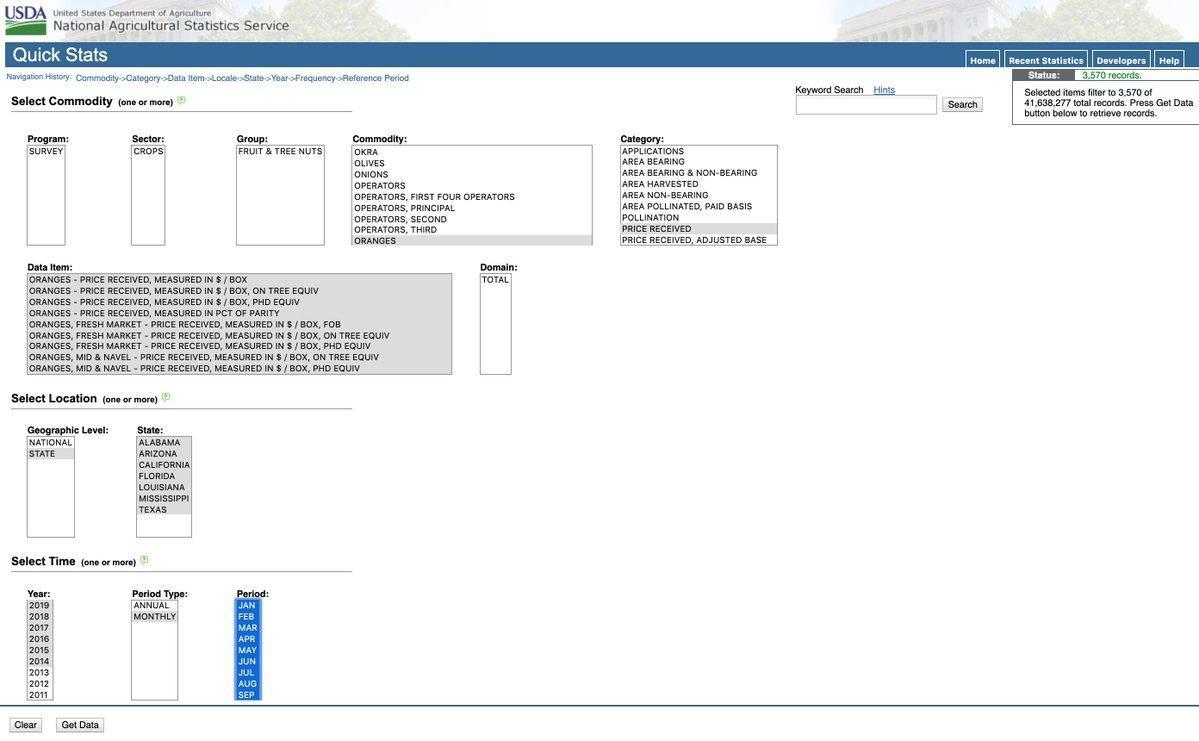

Yes it is! It turns out it is exactly what I was after; a searchable database with monthly orange prices where I can download the results. This is what I was hoping Eurostat would have. Let's get the data for each state going back 5 years or so.

quickstats.nass.usda.gov

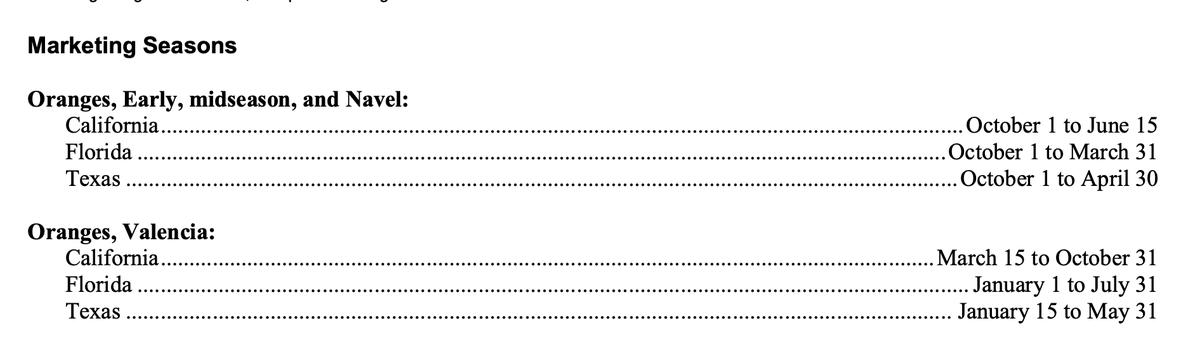

The report I linked to earlier shows the marketing season for each variety.

nass.usda.gov/Publications/T…

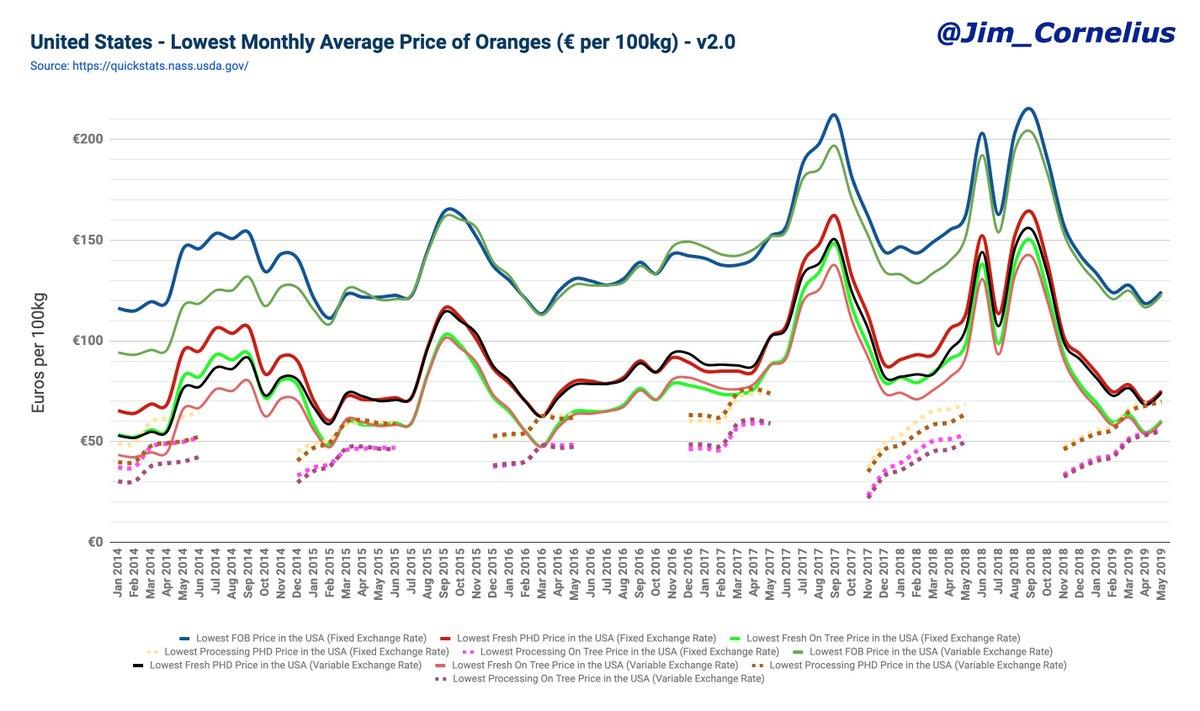

The next step is to covert the prices from $ per 100kg to € per 100kg. I'm using the Sept 2019 exchange rate from the site below. I'll deal with the issue of floating exchange rates afterwards.

ofx.com/en-gb/forex-ne…

I explained a little about what the EPS trigger price is in his thread here (as well as in numerous other threads).

So what's the conclusion?

I think it's clear that oranges in the USA are not competitive with oranges from Spain and other EU countries. So a trade deal with the USA would not lower the price of oranges if we imported them from there.

But this raises another question ...

What about oranges from other sources? I've maintained for some time that oranges from Morocco and other countries virtually never face tariffs even under the entry price system because they almost never breach the EPS trigger price.

I thought it would be interesting to update this study; and that's what I've been up to recently. But that is a story for another thread.

/END