Labor income (L)+Capital Income (K)+Transfers (G) -Taxes (T)=Consumption (C)+Saving (S)

where T should be thought of here as taxes other than consumption/income tax that we are about to introduce.

I’ll mostly ignore foreigners 2/29

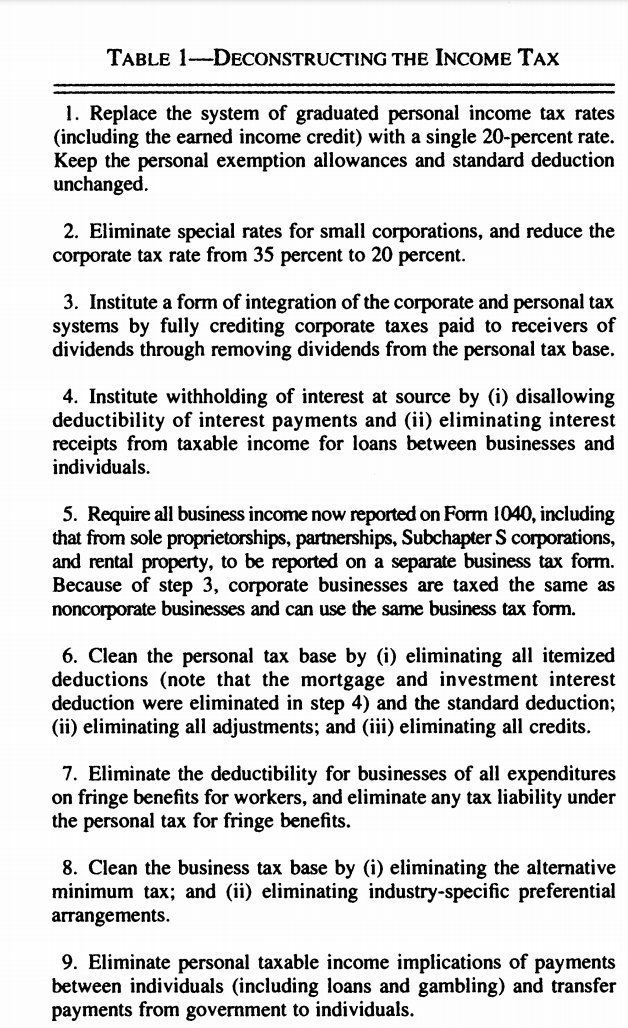

Right there, from the accounting identity, you have the key insight. A tax on consumption is the same as a tax on all sources of income with a deduction for saving. 4/29

where r is the rate of return. 10/29

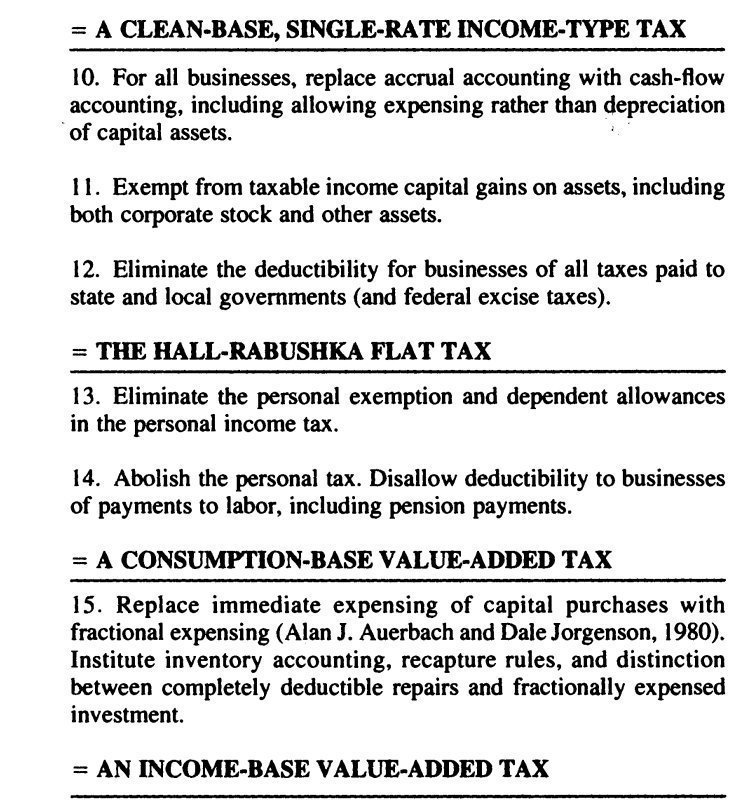

Straightforward implementation: measure VA for each firm, tax that (subtraction method VAT; only? Japan uses it). 15/29