I´ve decided to sell my entire Rockrose position.I bought Aercap instead where now I hold a big position in my portfolio

$AER is a great business that Mr. Market cant value properly with a lot of upside

But first,I wanna thank my friend @financialsigma who told me this idea

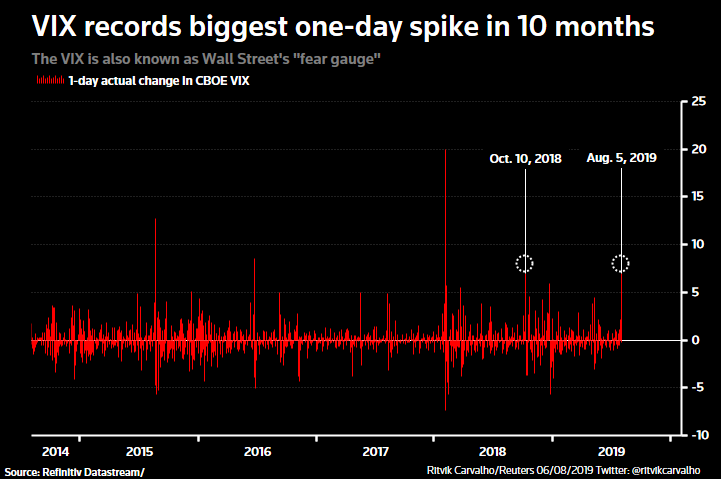

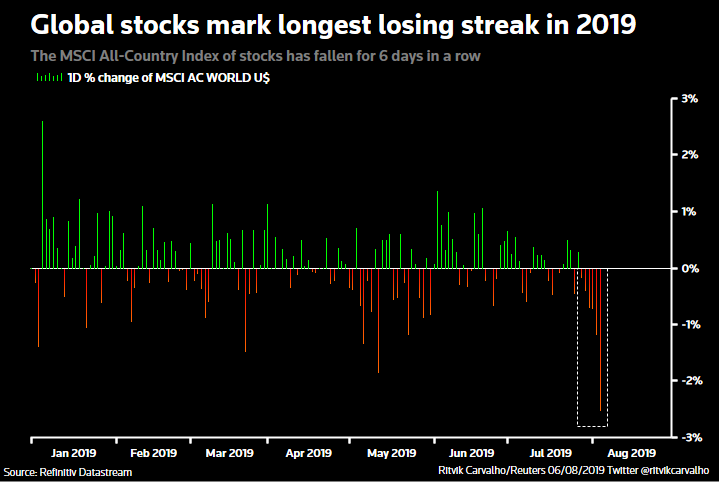

Some years it will go up, some down, it depends on Mr. Market mood. On 2019 Mr. Market was on LSD so it went up.

IRs do not affect Aercap cause they transfer it to the clients, it´s actually signed in the contract and that´s the only way IRs affect credit business.

They have a system of leasing and scale that gives them a competitive advantadge. They can take a plane in one week if the client don´t pay.

You can´t replicate that.

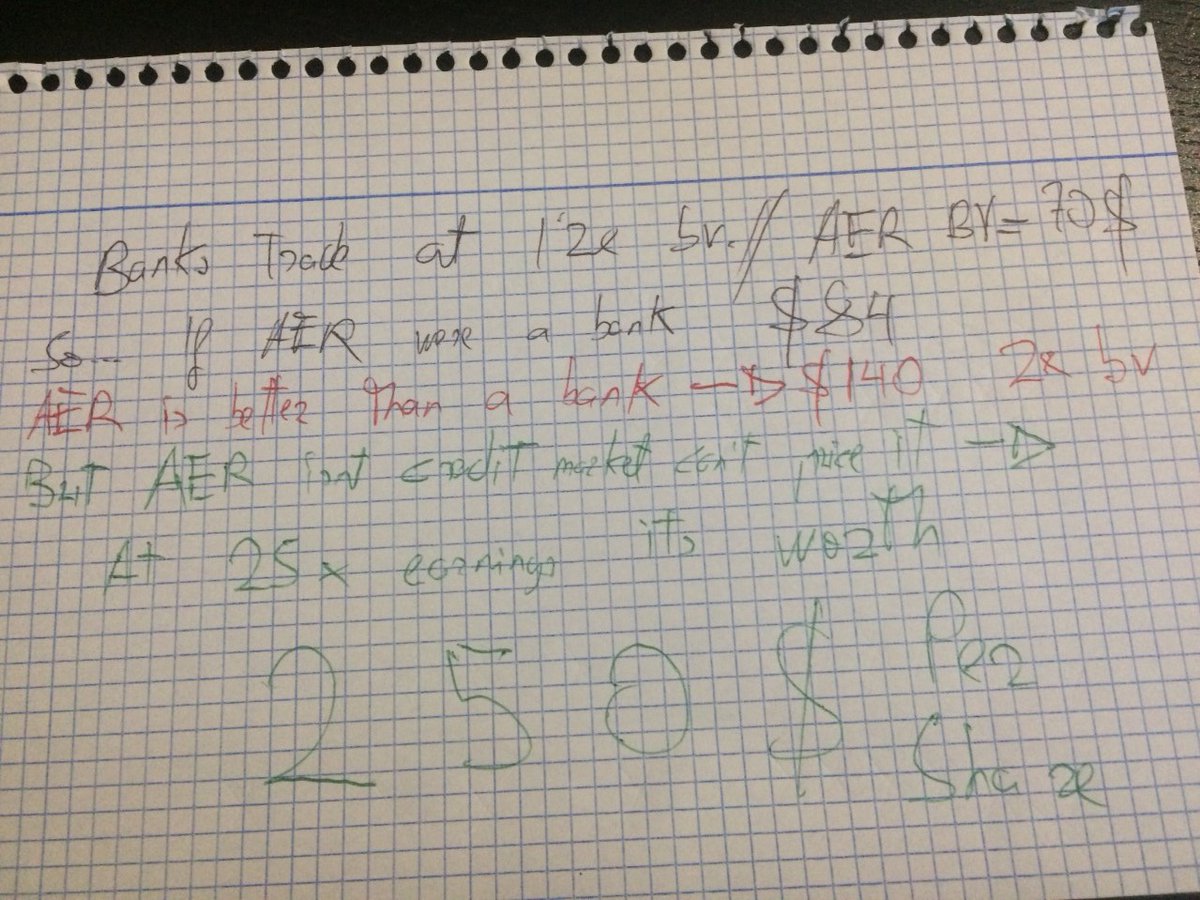

Basically AER is like a bank but better in all the aspects.

Banks have trillions at 0% on deposits, access to the discount window, access to LIBOR, yield on excess reserves overnight, FDIC insurance (banks are GSEs...), Congress charters, voice on FED, more leverage....

AER wins in all aspects:

- They only have one type of asset (great!)

- Less leverage (This can shock you but when you are a value investor less leverage is good in credit) and

- Who wants LIBOR if you can borrow in the HY market???

- Two providers (who wants deposits?)

Liquidity isn´t an issue too for AER. HY never freeze, when things are bad you will raise 2b at LIBOR+300bps overnight,

This was a one time event:

spglobal.com/marketintellig…

I also heard Powell never opens his mouth before phoning aircraft and the lobbies of aircraft lessors are feared along Washington.

Now Im gonna tell you how much this must be valued. Market is wrong, they value AER as credit but it´s actually a quality niche compounder.

AER is undervalued by any known measure. I am long with 50% of my portfolio

I don´t know what AER it´s gonna do this year cause nobody knows what moves credit valuations but one day of the next 15 years market will understand aircraft lessors.

Thanks Alex

#valueinvesting