Choose between:

1. Direct claim on central bank or on a narrow bank (or hybrid)

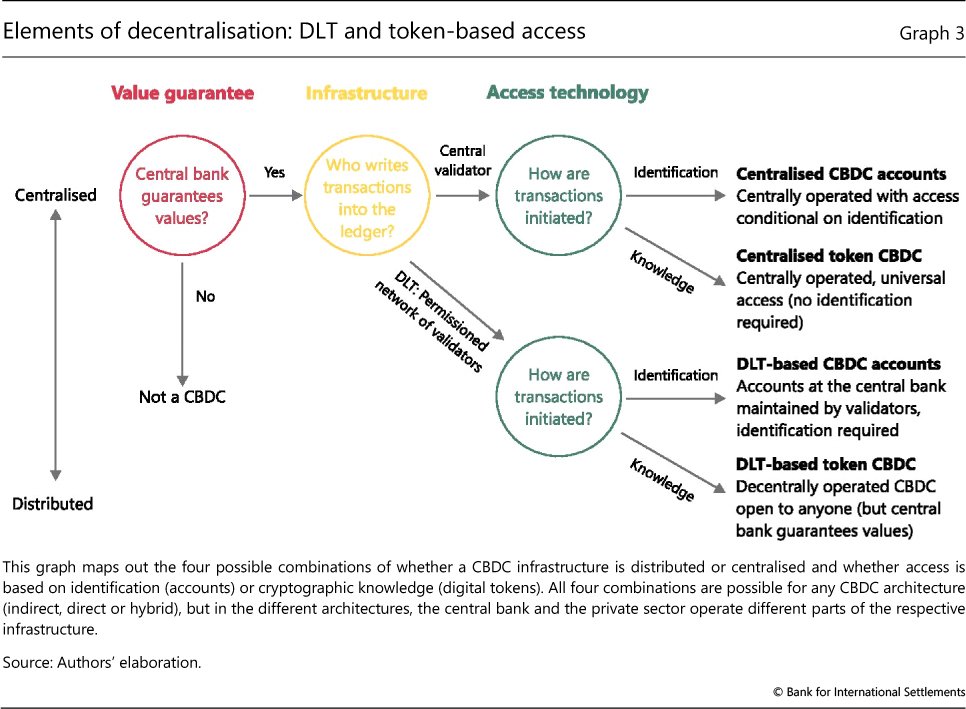

2. Centralised ledger or a distributed ledger (DLT)

3. Account-based or token-based system

bis.org/publ/qtrpdf/r_…

Direct claim on the central bank is closest in spirit to digital cash, but entails customer-facing role (you will need to call your central bank if your rent payment to your landlord doesn't get through)

Indirect CBDC through a narrow bank (with 100% reserves at the central bank) farms out the customer-facing role, but then the data will need to be safeguarded

Next, consider the choice between a centralised ledger or a distributed ledger

Distributed ledger technology (DLT) came of age with Bitcoin and similar "permissionless" systems, where there is no central authority; rather, truth is a matter of decentralised consensus

A central bank digital currency (CBDC) can operate either with a decentralised ledger or a centralised ledger, but the decentralised ledger will be "permissioned" type where the nodes are authorised by the central bank

The decentralised ledger will have the virtue of robustness coming from the duplication of the ledger, but will be slow to operate - imagine having everyone agree to every transaction in the economy; this makes the DLT system unsuitable for large economies

Finally, on the choice between account-based and token-based systems, the issues revolve around how central is the role of digital identity

Above all, the issue of data looms large when designing a CBDC; how to safeguard privacy when a ledger (or ledgers) record all transactions of everyone in the economy