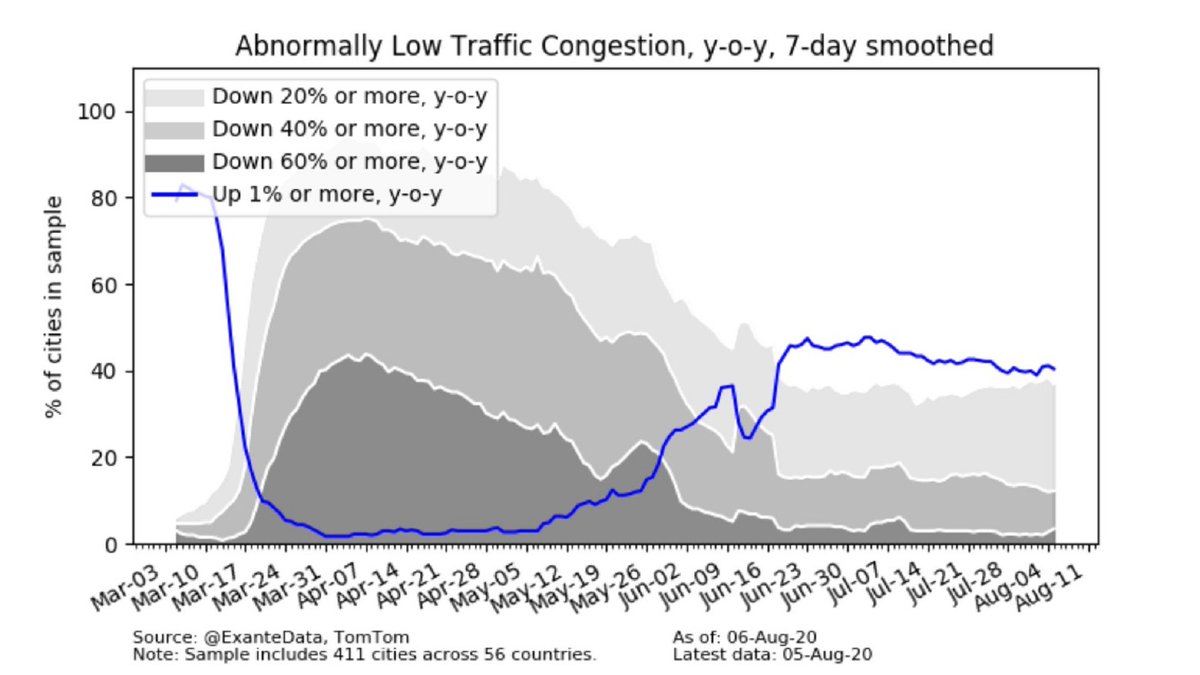

**October 6th marked 6 months since MAX GLOBAL #lockdown**. That was achieved on April 6 when 76% of global cities had #traffic congestion down 40% y/y or more. Now, only 8% of cities have congestion down 40%. (see thread - 6mo mark)

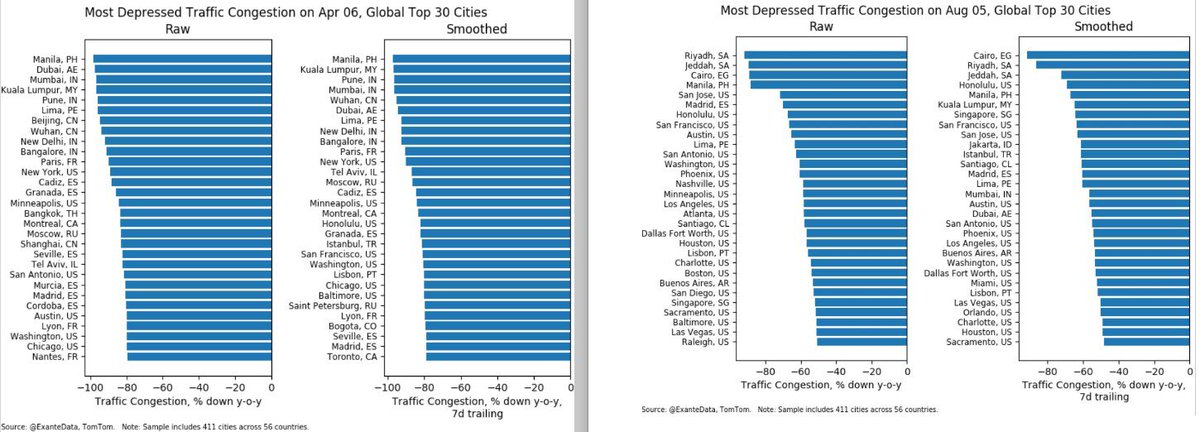

Charts: Side-by-Side Comparison - Top 30 Global Cities Most Depressed #Traffic Congestion. April 6 (Max lockdown) % Oct 6. Apr 6 (left): smoothed shows cities Manila & Kuala Lumpur top 2. The US had 7 cities in top 30. #India had 4. Other cities included: #Wuhan #Paris #Istanbul

Oct 6: smoothed data (right) US has 2 of the 3 top cities: #Honolulu #SanJose. #TelAviv is top city most depressed traffic congestion. #China cities make list, but has to do w/ Golden Week holiday.#Melbourne #Australia on list - has been a recent coronavirus hotspot

Re: #TelAviv #Israel #COVID19 - it is top city for most depressed traffic congestion. Israel recently issued #lockdown restrictions. #pandemiclife bbc.com/news/world-mid…

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh