The Fact is simple #franklintempleton has tried & is trying hard in the larger interest of #investors since day one. (1)

@bsindia @livemint @EconomicTimes @ETNOWlive @thetribunechd @DainikBhaskar @AmarUjalaNews @businessline @BloombergQuint @CNBC_Awaaz @CNBCTV18Live @NDTVProfit

@bsindia @livemint @EconomicTimes @ETNOWlive @thetribunechd @DainikBhaskar @AmarUjalaNews @businessline @BloombergQuint @CNBC_Awaaz @CNBCTV18Live @NDTVProfit

Time & again most #MFDs & FT itself letting Actual Investors of these 6 schemes know that even in times of #COVID they have accumulated more than ₹11000 crores without #monetization but still few people are having unnecessary doubts. (2)

I personally believe that if #History will be written, the #historians will focus on the solution not on the problem.

Saying Yes, to both Winding Up Consent & Active #Monetization is only & solely in the best possible move for #investors. (3)

Saying Yes, to both Winding Up Consent & Active #Monetization is only & solely in the best possible move for #investors. (3)

#Money hasn't been #invested with wrong intent by FT.

Case of FT has shown what is #LiquidityRisk, they tried to avoid but to no avail & were about to monetize after seeking consent of all unitholders but some handful of investors went to courts & whole process got delayed. (4)

Case of FT has shown what is #LiquidityRisk, they tried to avoid but to no avail & were about to monetize after seeking consent of all unitholders but some handful of investors went to courts & whole process got delayed. (4)

Ironically, the same has worked in best #interest of #investors.

Even if people have doubts on #FranklinTempleton, 1 can do nothing about it. Remember, actions speak louder than words. One must see the actions taken by FT, not to go by rumours & hearsay. #MutualFundSahiHai (5/5)

Even if people have doubts on #FranklinTempleton, 1 can do nothing about it. Remember, actions speak louder than words. One must see the actions taken by FT, not to go by rumours & hearsay. #MutualFundSahiHai (5/5)

Voting 'YES' To Winding Up of 6 Schemes of #FranklinTempleton is the first step to be taken by the #investors.

They have accumulated INR 11000 crores out of INR 28000 crores, that is blocked. @livemint @CNBC_Awaaz @NDTVProfit @BloombergQuint

They have accumulated INR 11000 crores out of INR 28000 crores, that is blocked. @livemint @CNBC_Awaaz @NDTVProfit @BloombergQuint

If #FranklinTempleton #investors still have second thoughts on Voting YES or NO!

If some XYZ Group of Individuals or Some Individuals who have won some awards are confusing you or saying to say 'NO' then feel free to connect with us for clarity. #MutualFundsSahiHai

#mutualfunds

If some XYZ Group of Individuals or Some Individuals who have won some awards are confusing you or saying to say 'NO' then feel free to connect with us for clarity. #MutualFundsSahiHai

#mutualfunds

We still see that few #investors are still in dilemma or are being misinformed by some specific individuals or a group of individuals to Vote for a 'YES' or 'NO' in lieu of #franklintempleton winding up of 6 schemes. #mutualfunds

By far ₹11907 crs have been received till date

By far ₹11907 crs have been received till date

We are sure that once active monetization of these 6 schemes under winding up of #franklintempleton starts things will be much better.

Seems that this delayed recovery in actual is working in the #interest of #investors, which few still won't accept. #mutualfunds @bsindia

Seems that this delayed recovery in actual is working in the #interest of #investors, which few still won't accept. #mutualfunds @bsindia

We reiterate that voting 'YES' is in the #Interest of #Investors & voting 'NO' is going to harm #Investors #interest.

Do You Being An #Investor Still Need Further Clarity Feel Free To Connect With Us, Non-Investors Kindly Excuse!

#franklintempleton #mutualfundssahihai @livemint

Do You Being An #Investor Still Need Further Clarity Feel Free To Connect With Us, Non-Investors Kindly Excuse!

#franklintempleton #mutualfundssahihai @livemint

Would like to demystify 2 things:

1) Comparing of #franklintempleton winding up of 6 schemes with a scam is altogether wrong

2) Voting 'YES' for winding up will assist the very AMC to get away of any sort of wrongdoing, 'IF ANY' - "NO IT WON'T"

'Remember, Matter Is Sub Judice'

1) Comparing of #franklintempleton winding up of 6 schemes with a scam is altogether wrong

2) Voting 'YES' for winding up will assist the very AMC to get away of any sort of wrongdoing, 'IF ANY' - "NO IT WON'T"

'Remember, Matter Is Sub Judice'

The 6 schemes of #franklintempleton

received total cash flows of ₹13,120 crs as of Dec 31, 2020 from maturities, pre-payments & coupon payments since April 24, 2020. Over the latest fortnight (December 16-31) these schemes received ₹1,213 crs. #mutualfunds #MutualFundsSahiHai

received total cash flows of ₹13,120 crs as of Dec 31, 2020 from maturities, pre-payments & coupon payments since April 24, 2020. Over the latest fortnight (December 16-31) these schemes received ₹1,213 crs. #mutualfunds #MutualFundsSahiHai

Franklin India Short Term Income Plan is the latest scheme to turn cash positive. The cash available for the 5 cash positive schemes stands at ₹8,527 crs as on today, which will surely improve with each passing day. #FranklinTempleton actions are speaking for itself.

#FranklinTempleton 5 Schemes AUM in cash as on today:

Franklin India Low Duration Fund: 52%

Franklin India Ultra Short Bond Fund: 49%

Franklin India Dynamic Accrual Fund: 41%

Franklin India Credit Risk Fund: 23% Franklin India Short Term Income Plan: 8%

@bsindia @livemint

Franklin India Low Duration Fund: 52%

Franklin India Ultra Short Bond Fund: 49%

Franklin India Dynamic Accrual Fund: 41%

Franklin India Credit Risk Fund: 23% Franklin India Short Term Income Plan: 8%

@bsindia @livemint

#Investors Update:

Borrowing levels in Franklin India Income Opportunities Fund continue to come down steadily & currently stands at 6% of its AUM.

Naysayers must accept the facts; not assumptions. @bsindia @livemint @DainikBhaskar @EconomicTimes @CNBC_Awaaz @financialexpres

Borrowing levels in Franklin India Income Opportunities Fund continue to come down steadily & currently stands at 6% of its AUM.

Naysayers must accept the facts; not assumptions. @bsindia @livemint @DainikBhaskar @EconomicTimes @CNBC_Awaaz @financialexpres

6 #FranklinTempleton schemes have received total cash flows of ₹13,789 crs as of Jan 15, 2021 from maturities, pre-payments & coupon payments since Apr 24, 2020.

Over the latest fortnight (Jan 1 - 15 ), these schemes received ₹669 crs, of which ₹617 crs was as pre-payments.

Over the latest fortnight (Jan 1 - 15 ), these schemes received ₹669 crs, of which ₹617 crs was as pre-payments.

The cash available as of Jan 15, 2021 stands at ₹9,190 crs for the 5 cash positive schemes of #franklintempleton under winding up. #mutualfunds #mutualfundssahihai

Individually, Franklin India Low Duration Fund, Franklin India Ultra Short Bond Fund, Franklin India Dynamic Accrual Fund, Franklin India Credit Risk Fund & Franklin India Short Term Income Plan have 63%, 50%, 41%, 26% & 9% of their respective AUM in cash. #mutualfunds

#Investors Update:

Borrowing levels in Franklin India Income Opportunities Fund continue to come down steadily & currently stands at 6% of AUM

#mutualfunds #mutualfundssahihai #franklintempleton #debtfunds @bsindia @OutlookMoney @livemint @cafemutual @financialexpres @ETNOWlive

Borrowing levels in Franklin India Income Opportunities Fund continue to come down steadily & currently stands at 6% of AUM

#mutualfunds #mutualfundssahihai #franklintempleton #debtfunds @bsindia @OutlookMoney @livemint @cafemutual @financialexpres @ETNOWlive

#Investors update:

The 6 schemes of #franklintempleton have received total cash flows of ₹14,391 crs till Jan 29, 2021 from maturities, coupons & prepayments. #mutualfunds #MutualFundsSahiHai @bsindia @livemint @OutlookMoney @EconomicTimes @businessline @FinancialXpress

The 6 schemes of #franklintempleton have received total cash flows of ₹14,391 crs till Jan 29, 2021 from maturities, coupons & prepayments. #mutualfunds #MutualFundsSahiHai @bsindia @livemint @OutlookMoney @EconomicTimes @businessline @FinancialXpress

Total number of cash positive schemes stands at 5. These schemes have ₹9,770 crs cash available to return to unitholders, subject to fund running expenses. Balance ₹4,621 crs has been used to repay borrowings & interest thereon of the 6 schemes within the ambit of regulations.

From Jan 16 - 29, these schemes received ₹602 crs, of which ₹350 crs was as pre-payments. All naysayers should think logically, as they are causing more pain to #investors of these 6 schemes of @FTIIndia, but will they? Certainly Not As These So Called Groups Have invested ₹0!

Individually, Franklin India Low Duration Fund, Franklin India Ultra Short Bond Fund, Franklin India Dynamic Accrual Fund, Franklin India Credit Risk Fund & Franklin India Short Term Income Plan have 65%, 53%, 41%, 27% & 11% of their respective AUM in cash. #mutualfunds #debtfund

Last but not least, Borrowing levels in Franklin India Income Opportunities Fund continue to come down steadily & currently stands at 5% of AUM. @cafemutual @ET_Wealth @ETNOWlive @EconomicTimes @bsindia @businessline @BloombergQuint @livemint @OutlookMoney #MutualFundsSahiHai

Naysayers are making totally baseless arguments, as they are smelling a SCAM, the definition of the SCAM is altogether different but there are certain vested interest individuals or groups who only see SCAM. They have ZERO evidence & trying to prove there bunch of lies.

"Empty vessels make the most noise."

Seems the case here for all the naysayers. But, they will keep on doing their mischievous, malicious, defamatory, vindictive acts until someone give them the taste of own medicine.

Hope these naysayers better understand this & stop the act.

Seems the case here for all the naysayers. But, they will keep on doing their mischievous, malicious, defamatory, vindictive acts until someone give them the taste of own medicine.

Hope these naysayers better understand this & stop the act.

In the best interest of #investors, the Hon’ble #SupremeCourt has directed distribution of INR 9,122 crs (distributable surplus as of 15 Jan 2021) to respective unitholders in proportion to their holdings in the schemes under winding up, subject to fund running expenses. (1/3)

To preserve value for #investors, as evidenced by generation of cash in these schemes over the last 9 months @FTIIndia had to take up the tough call to wind up these 6 schemes. (2/3) @bsindia @businessline @FinancialXpress @CNBCTV18Live @moneycontrolcom @livemint @DainikBhaskar

This distribution of monies will provide #investors with much needed liquidity & now @FTIIndia will be working with the regulator @SEBI_India & @SBIMF to distribute the cash within the period stipulated by the Court i.e. 20 days from the date of order. (3/3) #mutualfunds

We at #MasterMindFinnAsset firmly believe that #franklintempleton #investors of these 6 #MutualFund schemes will get the remaining proceeds without any haircut as is still being projected by the naysayers.

We are highly thankful to Hon'ble #SupremeCourt for the final order.

We are highly thankful to Hon'ble #SupremeCourt for the final order.

Please find below the process of distribution of monies for the five cash positive #mutualfund schemes under

winding up of #FranklinTempleton as notified.. (1/n)

winding up of #FranklinTempleton as notified.. (1/n)

Payment will be made by extinguishing proportionate units at the prevailing NAV on the date of processing to all investors whose accounts are KYC compliant with all details available will be made during the week of February 15, 2021. (2/n)

Please note that the distribution for unitholders, whose PAN/KYC, FATCA/UBO, Minor through guardian or Transmission details / documentation are not available/invalid, will be made after completion of the regulatory/

compliance requirements. (3/n)

compliance requirements. (3/n)

Payment will be made by @SBIMF from bank accounts (1 per scheme) opened by them for this purpose & will be made electronically to all eligible customers. In case your bank account is not eligible for an electronic payment, a DD will be issued & sent to registered address. (4/n)

#Investors will receive an account statement from @FTIIndia showing the details of units extinguished and payment made. #CapitalGains statements will also be made available. (5/n)

#FranklinTempleton will be responsible for deduction of TDS & issue of TDS certificates for NRI #investors. They will assist with query resolution, unclaimed payments or any other payment issues. (6/n)

Above thread will assist #investors of #FranklinTempleton in particular to #mutualfunds under winding up @SumairaAbidi @jaysh88 @MitaliLive @NuraRadha @thesuniljain @Neha__Tyagi @latha_venkatesh @_soniashenoy @ShereenBhan @_nirajshah @nikunjdalmia @shefalianand @SurabhiUpadhyay

@SBIMF is the authorized liquidator of @FTIIndia 6 schemes under winding-up. No separate E-Voting & further process will be duly notified to #investors.(1/n)

@SumairaAbidi @MitaliLive @NuraRadha @thesuniljain @latha_venkatesh @_soniashenoy @ShereenBhan @_nirajshah @nikunjdalmia

@SumairaAbidi @MitaliLive @NuraRadha @thesuniljain @latha_venkatesh @_soniashenoy @ShereenBhan @_nirajshah @nikunjdalmia

#Investors interest has been given priority not the agenda that naysayers were propagating. We are highly thankful to #SupremeCourt for this big relief.

We are sure that @SBIMF in unison with @FTIIndia will ensure that each & every #investor get with interest principal. (2/n)

We are sure that @SBIMF in unison with @FTIIndia will ensure that each & every #investor get with interest principal. (2/n)

The judgement clarifies lot many aspects but we at #MasterMindFinnAsset are confined to the interest of the #investors. The process of payment may come in tranches or as per the final decision taken by both @SBIMF & @FTIIndia as per best of their abilities. (3/n)

To preserve the value @FTIIndia will leave no stone unturned as they committed from day one that #investors interest is prime for us & we will do the needful whosoever may get the authority be it us or any other entity. (4/n) #FranklinTempleton #MutualFunds #MutualFundsSahiHai

Below is 1st page of our #Tax Reckoner for #MutualFund #investors which will also be helpful to unitholders in the 6 schemes under winding-up of #FranklinTempleton.

If one requires complete #TaxReckoner simply DM us your #Whatsapp Number.

#MutualFundsSahiHai #SaarthiZarooriHai

If one requires complete #TaxReckoner simply DM us your #Whatsapp Number.

#MutualFundsSahiHai #SaarthiZarooriHai

Flow of Funds from FT to SBI Funds Mgmt. & then SBI Funds Mgmt. to #Investors. So, refund process is initiated by SBI Funds Mgmt. As per info the banker of SBI Funds Mgmt. from which transfers are being made is SBI. Credit of funds timing will vary from bank to bank.

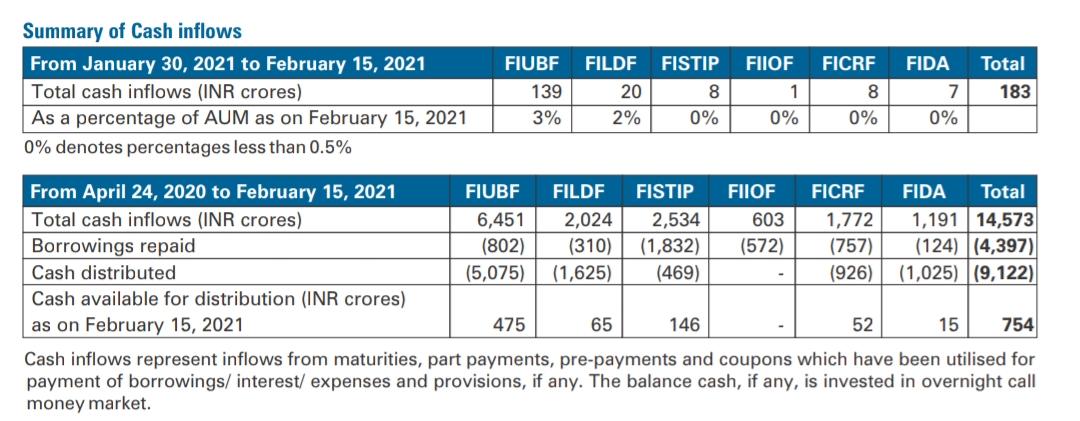

6 schemes of @FTIIndia have received total cash flows of ₹14,573 crs till Feb 15, 2021 from maturities, coupons & prepayments.

Over the latest fortnight ended February 15, 2021, the 6 schemes received ₹183 crs.

#FranklinTempleton @bsindia

@businessline @SumairaAbidi @livemint

Over the latest fortnight ended February 15, 2021, the 6 schemes received ₹183 crs.

#FranklinTempleton @bsindia

@businessline @SumairaAbidi @livemint

The NAVs of all the six schemes of @FTIIndia were higher as on February 16, 2021 vis-à-vis their respective NAVs on April 23, 2020, the date on which the winding up decision was taken. #FranklinTempleton @SumairaAbidi #MutualFunds #MutualFundsSahiHai #Investors #Investment

Remember, #MutualFunds are subject to Market Risks. Read all scheme related documents carefully.

Risks are part of life & #investments. In order to understand #investors risk profile & product suitability check, a professional is must. As #SaarthiZarooriHai & #PlanZarooriHai..

Risks are part of life & #investments. In order to understand #investors risk profile & product suitability check, a professional is must. As #SaarthiZarooriHai & #PlanZarooriHai..

There are voices of making the forensic report public & of insider trading. We believe that the learned bench of #SupremeCourt will decide the course of action, not some media houses. Those alleging of Insider Trading - What is their Source of information? #FranklinTempleton

More questions to those alleging of Insider Trading: Have they examined the Forensic Report? We noticed a tweet from someone - Which no where mentions the source of info! People can allege anything even in matters that are subjudice is a strange phenomenon! #FranklinTempleton

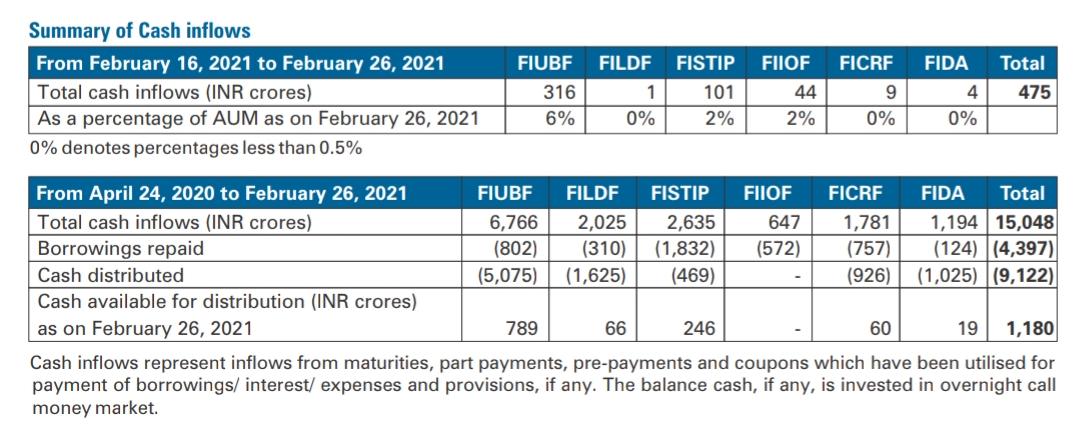

6 schemes have received total cash flows of INR 15,048 crs till Feb 26, 2021 from maturities, coupons & prepayments.

Over the latest fortnight ended Feb 26, 2021, the 6 schemes received cash flows of INR 475 crs. #FranklinTempleton #MutualFunds #MutualFundsSahiHai #investors

Over the latest fortnight ended Feb 26, 2021, the 6 schemes received cash flows of INR 475 crs. #FranklinTempleton #MutualFunds #MutualFundsSahiHai #investors

Cash available for distribution in 5 cash positive schemes stands at INR 1180 crs as on Feb 26, 2021.

NAVs of all the 6 schemes were higher as on Feb 26, 2021 vis-à-vis their respective NAVs on Apr 23, 2020, the date on which the winding up decision was taken. #FranklinTempleton

NAVs of all the 6 schemes were higher as on Feb 26, 2021 vis-à-vis their respective NAVs on Apr 23, 2020, the date on which the winding up decision was taken. #FranklinTempleton

#Investors should focus upon the way @FTIIndia is trying its level best to accumulate the monies. Key to its timely distribution depends upon #SBIFundsManagement / @SBIMF, even for the cases where Cheques/ Drafts are supposed to be sent, in the best interest of every #Investor.

No #investor should fall in the trap of naysayers as far as #MutualFunds are concerned as #MutualFundsSahiHai. For any wrong doing @SEBI_India is always there. Doubting the very integrity of the regulator is a thought process of wrong mindframe. @amfiindia @MFSahiHai #investors

No one should forget that, #MutualFunds are subject to market risks. Read all scheme related documents carefully. For a better understanding #MutualFundDistributors are always there. #SaarthiZarooriHai #PlanZarooriHai #MutualFundsSahiHai #Investment #wealth #investments #money

Unable to understand that few people including some media people are requesting Hon'ble #SupremeCourt for the forensic report. The point is that this matter should be raised in Court in the front of judges by the Lawyers, not on twitter by individuals or group of individuals.

Earlier, these very people claimed of Insider trading on the basis of one individuals tweet which is being quoted in tweets & articles. But what is his source of information, he has not revealed? When you have info, What stops you from sharing the source? #FranklinTempleton

On 9th Mar, we had stated that SOP is expected to be filed by the end of this week by @SBIMF / #SBIFundsManagement in #SupremeCourt & the same has been communicated to the impacted #investors by @FTIIndia today via email.

Active monetization is expected to begin shortly & we are highly hopeful that with the support of @FTIIndia; @SBIMF / #SBIFundsManagement will distribute the monies within a time frame of 3 to 12 months. #mutualfunds #MutualFundsSahiHai #franklintempleton

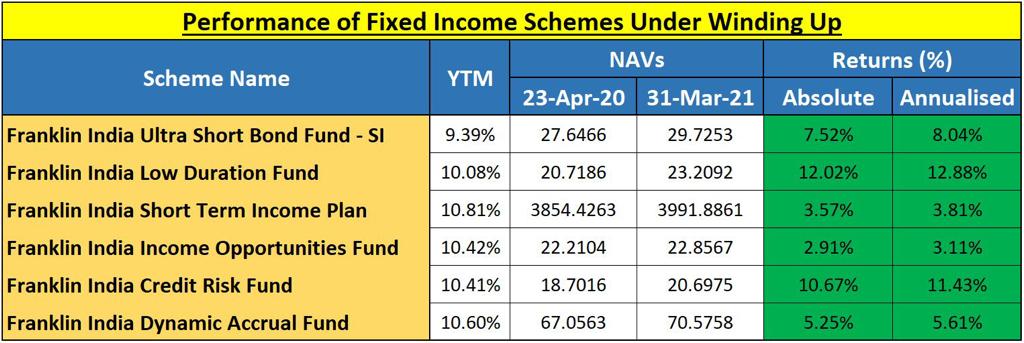

The NAV of all 6 schemes today are higher than those values when the trustee determined to wind up the schemes back in April of 2020. #Investors can go through the image for the same.

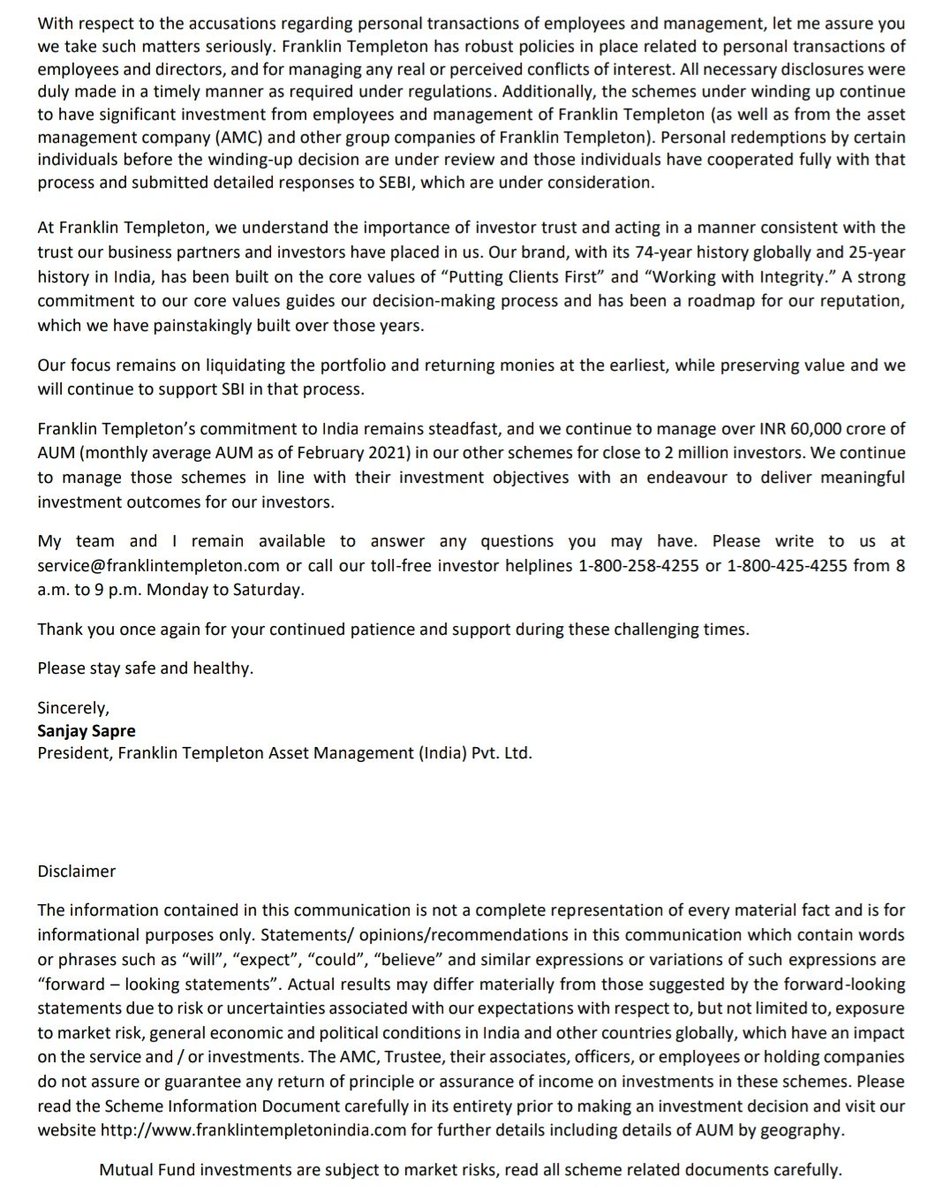

@FTIIndia has clarified on recent unsubstantiated reports by a selected few individuals or group of individuals in the letter annexed.

The 6 schemes of #FranklinTempleton have received total cash flows of ₹15,272 crs till March 15, 2021 from maturities, coupons and prepayments.

Over the latest fortnight ended March 15, 2021, the 6 schemes received cash flows of ₹224 crs.

Over the latest fortnight ended March 15, 2021, the 6 schemes received cash flows of ₹224 crs.

Cash available for distribution in the five cash positive schemes stands at ₹1,370 crs as on March 15, 2021

Borrowing levels in Franklin India Income Opportunities Fund continue to come down steadily and currently stands at less than 1% of AUM (approx. ₹10 crs) #investors

Borrowing levels in Franklin India Income Opportunities Fund continue to come down steadily and currently stands at less than 1% of AUM (approx. ₹10 crs) #investors

The NAVs of all the six schemes of @FTIIndia were higher as on March 15, 2021 vis-à-vis their respective NAVs on April 23, 2020, the date on which the winding up decision was taken. #franklintempleton #mutualfunds #MutualFundsSahiHai #PlanZarooriHai

Franklin India Income Opportunities Fund has turned cash positive after repaying all its outstanding borrowings. Thus, all 6 schemes under winding up are now cash positive. #FranklinTempleton

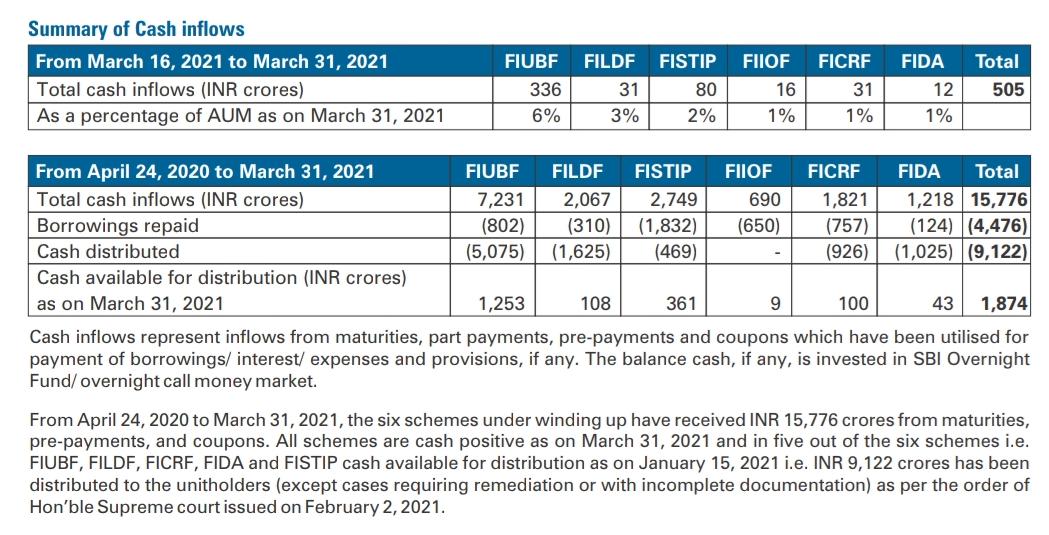

The 6 schemes of @FTIIndia have received total cash flows of ₹15,776 crs till Mar 31, 2021 from maturities, coupons, sale & prepayments since winding up. #FranklinTempleton #MutualFunds #MutualFundsSahiHai

Cash available for distribution in all schemes now stands at ₹1,874 crs as on Mar 31, 2021 post distribution of ₹9,122 crs in Feb 2021. #franklintempleton #mutualfunds #MutualFundsSahiHai @livemint @OutlookMoney @CNBC_Awaaz @CNBCTV18Live @ETNOWlive @ETMutualFunds @bsindia

Over the latest fortnight ended Mar 31, 2021, the 6 schemes received cash flows of ₹505 crs.

NAVs of all the six schemes were higher as on Mar 31, 2021 vis-à-vis their respective NAVs on Apr 23, 2020, the date on which the winding up decision was taken. #franklintempleton

NAVs of all the six schemes were higher as on Mar 31, 2021 vis-à-vis their respective NAVs on Apr 23, 2020, the date on which the winding up decision was taken. #franklintempleton

@FTIIndia primary focus over the last several months has been & remains, on returning money to unit holders as quickly as possible.

Media houses & impacted #investors must focus on facts, not rumours.

If there is any wrongdoing in reality then @SEBI_India will handle.

Media houses & impacted #investors must focus on facts, not rumours.

If there is any wrongdoing in reality then @SEBI_India will handle.

Update for the #investors in @FTIIndia that @SBIMF would be distributing next tranche of INR 2,962 crs to unitholders across all 6 schemes. Payment to all #investors whose accounts are KYC compliant with all details available will be made during the week of 12 April 2021. (1/n)

Amount to be paid to unitholders will be calculated as per the below table & will be paid by extinguishing proportionate units at the NAV dated 9 Apr, 2021. #franklintempleton #MutualFundsSahiHai (2/n)

Accordingly, the units held by you being an #investor in the #MutualFund scheme will reduce to that extent. Post this above stated payout, the 6 schemes would have paid the above mentioned percentages (column D) of their AUM as on April 23, 2020. (3/n) #FranklinTempleton

Amount payable to unitholders of the respective schemes will be in the same proportion (as per column C in the above table) of the unitholder’s portfolio value, prior to extinguishment, as of

9 April 2021. (4/n) #franklintempleton #Investment

9 April 2021. (4/n) #franklintempleton #Investment

The same proportion (column C) of units will also be extinguished as per the scheme wise plan level NAV as on 9 April 2021. The plan level NAVs for the six schemes are tabulated in the image below. (5/n) #franklintempleton #MutualFund #MutualFunds

6 schemes of @FTIIndia have received total cash flows of ₹17,312 crs till April 15, 2021 from maturities, coupons, sale & prepayments since winding up.

Cash available for distribution in the 6 schemes stands at ₹447 crs as on Apr 15, 2021 post the payout of the second tranche.

Cash available for distribution in the 6 schemes stands at ₹447 crs as on Apr 15, 2021 post the payout of the second tranche.

Total disbursement to unitholders across 6 schemes now stands at ₹12,084 crs post the pay-out of the second tranche of ₹2,962 crs to unitholders in the week of April 12, 2021. (except cases requiring remediation or incomplete documentation). #FranklinTempleton #MutualFunds

Over the latest fortnight ended Apr 15, 2021, the 6 schemes received cash flows of ₹1,536 crs.

NAVs of all the 6 schemes were higher as on Apr 15, 2021 vis-à-vis their respective NAVs on Apr 23, 2020, the date on which the winding up decision was taken. #franklintempleton

NAVs of all the 6 schemes were higher as on Apr 15, 2021 vis-à-vis their respective NAVs on Apr 23, 2020, the date on which the winding up decision was taken. #franklintempleton

• • •

Missing some Tweet in this thread? You can try to

force a refresh