The #BullBearReport is out.

The #rally runs into resistance and backtracks as #overbought conditions slow the #bulls. Is the run over, or just resting? We review the #FOMC minutes, what it means for #investors, the #technical backdrop and #allocations.

realinvestmentadvice.com/fomc-minutes-e…

The #rally runs into resistance and backtracks as #overbought conditions slow the #bulls. Is the run over, or just resting? We review the #FOMC minutes, what it means for #investors, the #technical backdrop and #allocations.

realinvestmentadvice.com/fomc-minutes-e…

At 2-standard deviations above the 50-dma, and the 200-dma acting as resistance, the #market pullback, as discussed last week, was expected. Support levels reside just below between 4000 and 4160.

realinvestmentadvice.com/fomc-minutes-e…

realinvestmentadvice.com/fomc-minutes-e…

Great note from BofA this weekend.

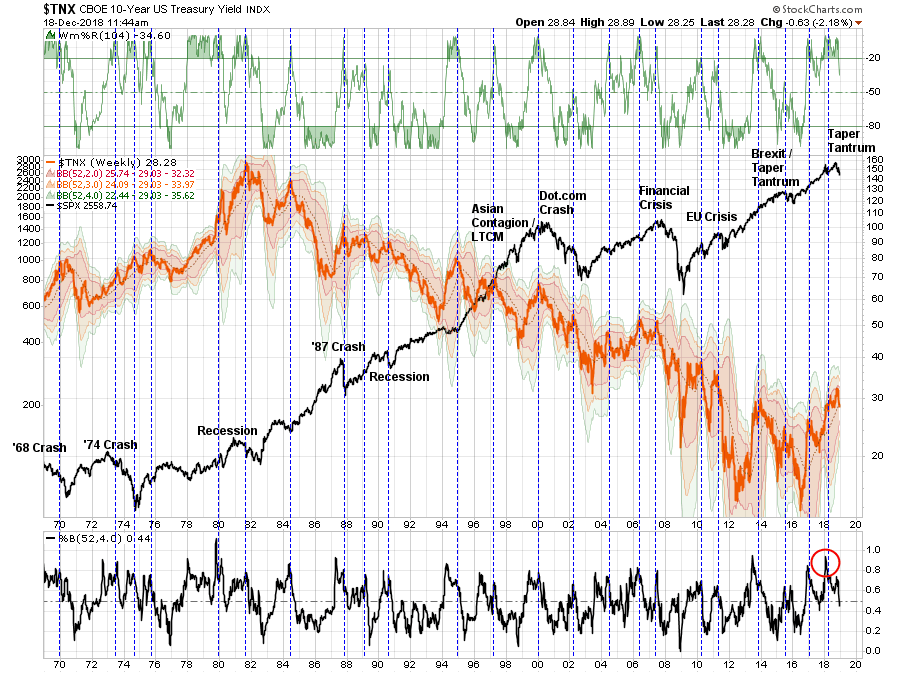

“Applying a 20th century PE of 15x gets you to an S&P500 index of 3300, applying a 21st century PE of 20x gets you to an S&P500 of 4400; there’s your range."

Problem: The drivers of the 21st century range are reversing.

realinvestmentadvice.com/fomc-minutes-e…

“Applying a 20th century PE of 15x gets you to an S&P500 index of 3300, applying a 21st century PE of 20x gets you to an S&P500 of 4400; there’s your range."

Problem: The drivers of the 21st century range are reversing.

realinvestmentadvice.com/fomc-minutes-e…

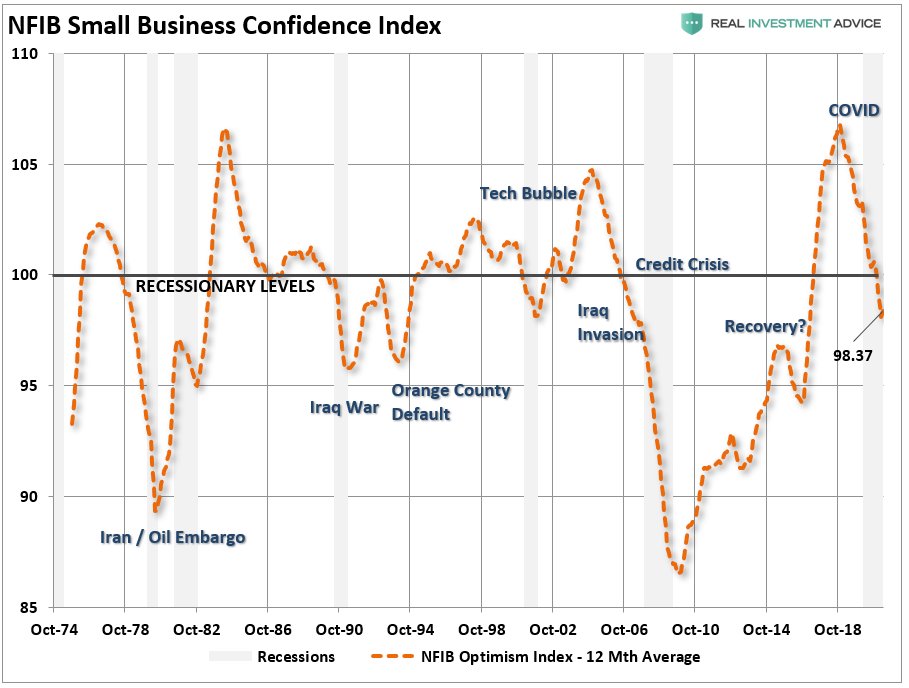

Critically, when it comes to the #markets, both high inflation and rising Fed funds rates are already impacting #profit and #earnings growth. Such will only worsen as the “monetary lag effect” arrives in early 2023.

realinvestmentadvice.com/fomc-minutes-e…

realinvestmentadvice.com/fomc-minutes-e…

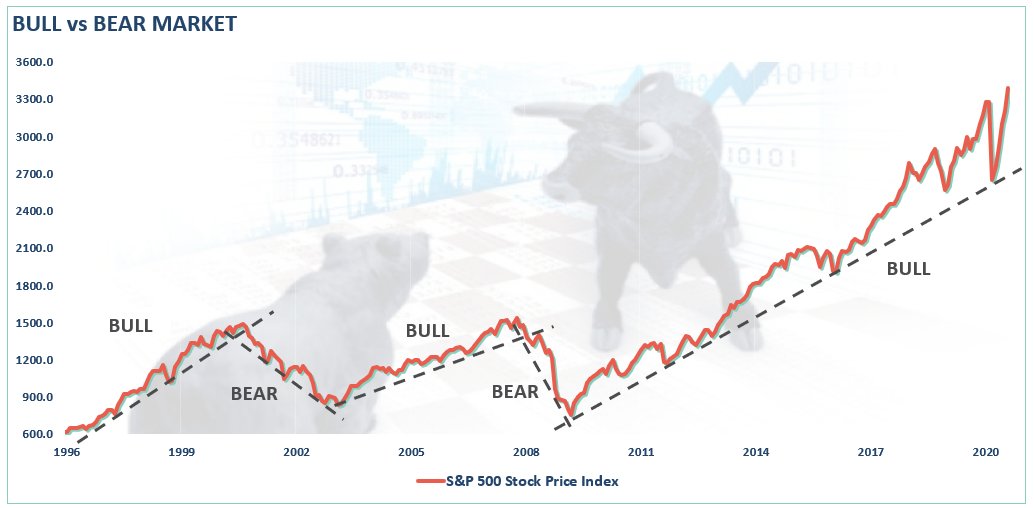

"A 50% retracement of declines always mark the end of a #bearmarket."

There was only one period the market rallied while the Fed was hiking rates. Such was the beginning of a multiple bear market sequence that ended in 1974 with valuations at 7x earnings.

realinvestmentadvice.com/fomc-minutes-e…

There was only one period the market rallied while the Fed was hiking rates. Such was the beginning of a multiple bear market sequence that ended in 1974 with valuations at 7x earnings.

realinvestmentadvice.com/fomc-minutes-e…

• • •

Missing some Tweet in this thread? You can try to

force a refresh