A THREAD!

premiumtimesng.com/news/headlines…

#MTNRefund

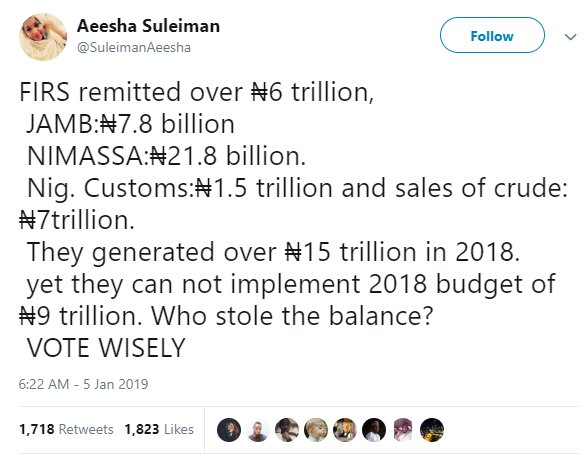

According to the CBN, their investigation revealed the following:

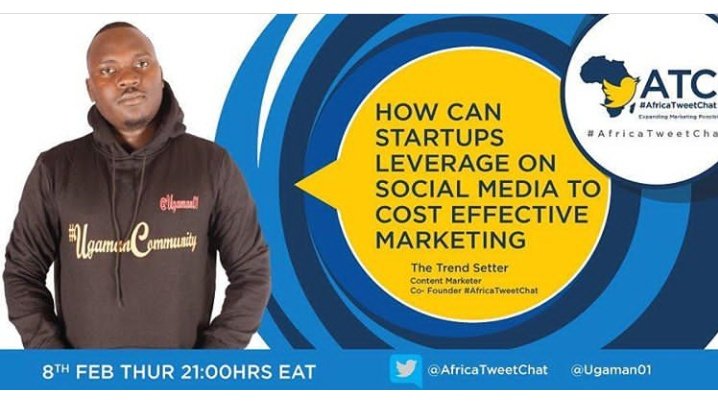

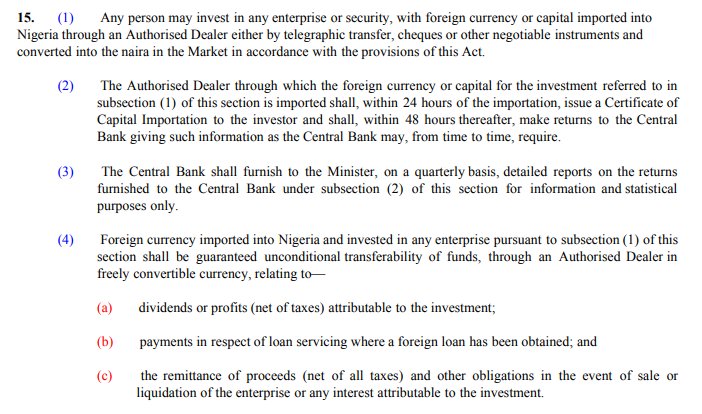

1. That MTN shareholders invested and imported $402m in MTN Nigeria between 2001 – 2006.

There seem to be no dispute about this from all parties.

#MTNRefund

This means that indeed CCIs where issued to confirm that MTN imported $402m into d country. No dispute here as well

#MTNRefund

a. Implementation of decision in item 5B of their BR and #MTNRefund

See the correct continuation below