- the at home fitness market will ultimately settle back to where it was in the late 90s, before the incumbent players could no longer finance low monthly installments as they had been able to previously and can again now

- in theory, there is an increase in access by training at home, though, motivation and accountability is drastically decreased through home-based exercise

- there are far more variables that come into play when looking at home fitness and while access is, in theory, increased, “ability” is not changed much. Take out your commute and insert your kids or the couch that’s staring you in the face

- is there really a need for more access? Is the problem having to wait for a class or committing to be part of a class. Exercising is deliberate and I don't see much utility in on-demand delivery. At least I dont think it’s solving for much, for most people

- those speaking to the viability of the business are directly aligned with the core consumer, there’s a bit of a fanboy effect

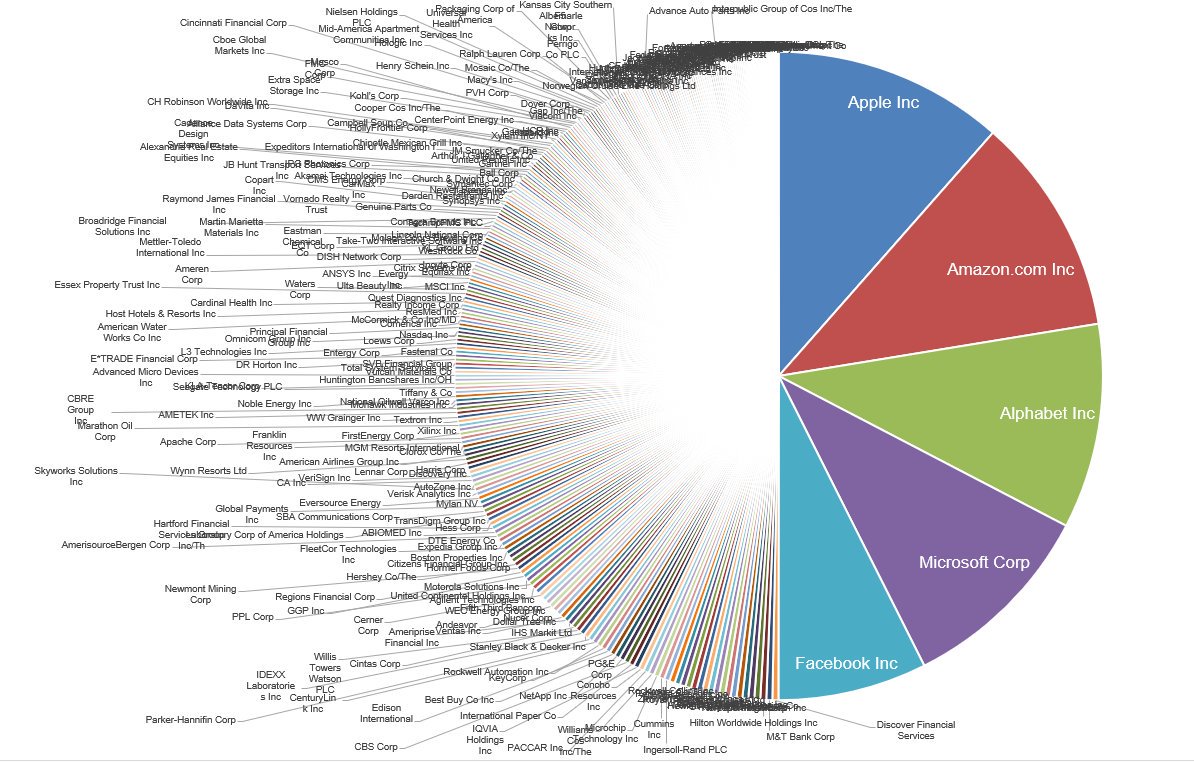

- the barrier of entry is still incredibly high. Investors focus on the upside of the ongoing software subscription, but that is irrelevant if the hardware is only affordable to small part of the market

- people talk about the cost in comparison to a gym membership, but >80% of peloton members have at least 1 gym membership

- the margins aren’t as big as people think they might be, when you factor in the astronomical costs associated with installation and ongoing maintenance and low economies of scale

- if usage does end up being close to where some think it is, the bikes won’t last very long… that’s just a fact any gym owner could tell you re: usage hours and cost of maintenance/hour of usage

- urban markets are housing a lot of the current peloton bikes and space is an issue, if the bike takes up 100sf and the tread takes up 300sf… the price point has shrunken the TAM but the amount of people who have 400sf of available space, shrinks it even more

- the most sizable financial outcome of late has been MindBody… imagine a reorg and efficiency play that can be driven into the health club market, instead of the boutique market

- MindBody and Classpass have extracted value from the newer and growing boutique market, not because the opportunity was larger than the health club market, but because it was easier.

- the name of the game is increasing accountability and/or compliance to process, for long enough so that the consumer can see a physical change, that is the tipping point

- when the consumer sees physical change, it becomes harder for them to not do, what was previously hard… at that point they have created a habit, at that point they are becoming addicted.

- not removing the human because than you’re democratizing access to group exercise and I think i’ve made it clear that there isn’t really an access problem as it relates to group-x

- doubling down on the humanity of the 1-1 relationship and leveraging the excess capacity of the current supply to drive a more scalable and holistic solution

- not replacing “in-person” training, but moving to a world where everybody works with a coach, but potentially less frequently “in-person”

- when that happens, when h/w coaching becomes scalable and standardized; we can learn and we can prove a delineation between service providers relative to which coaches are better at servicing which types of people and furthermore, which types of chronic conditions.

- when that happens we take the biggest chunk out of the $47trillion that is projected to be spent, over the next decade, on what are theoretically preventable chronic conditions

- when that happens we change the dynamic and we move from a place where people pay for fitness, to a place where people get fitness for free, to a place where people actually get paid for fitness

- when that happens, I'll have enough money to buy a peloton, and a mirror, and a tonal.