But why & on what?

wsj.com/articles/famil…

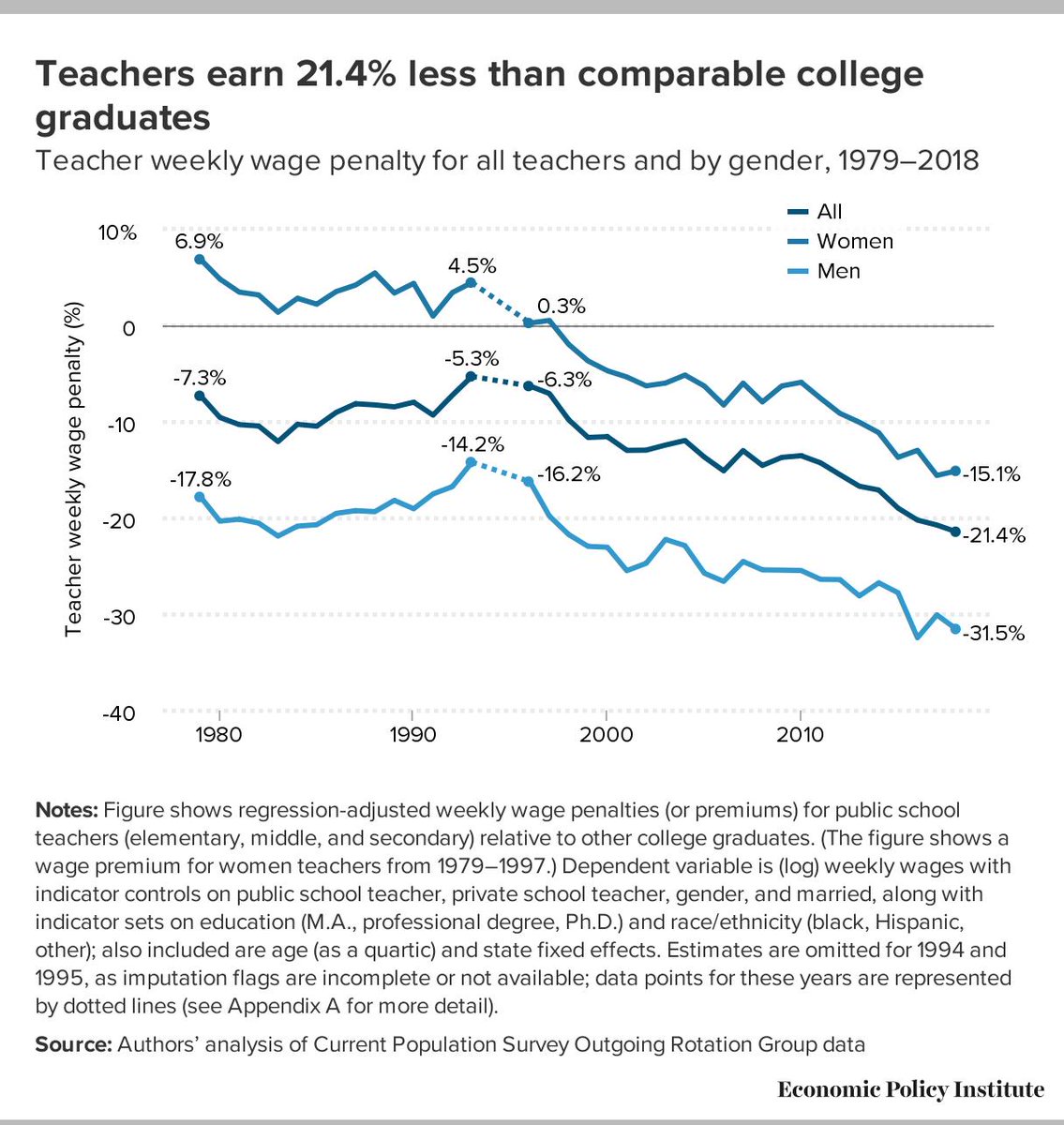

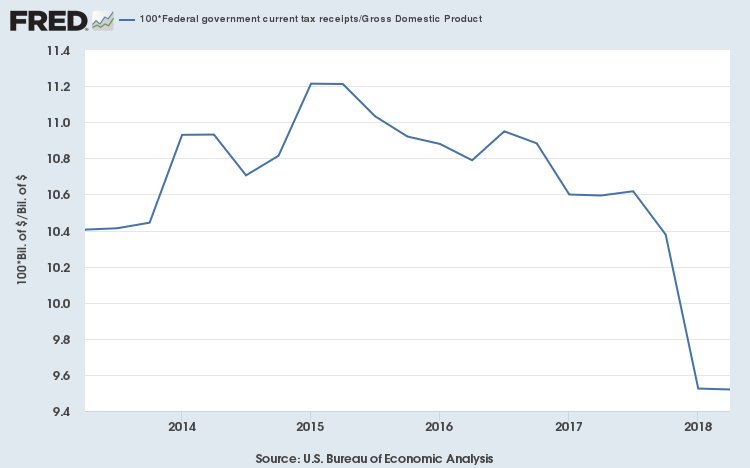

Americans need to be educated on this.

What is middle class? Before we answer, let's talk about what is insinuated as middle class: THINGS.

They BOUGHT a lot of stuff to fill their house because they are TAUGHT to buy stuff by the media.