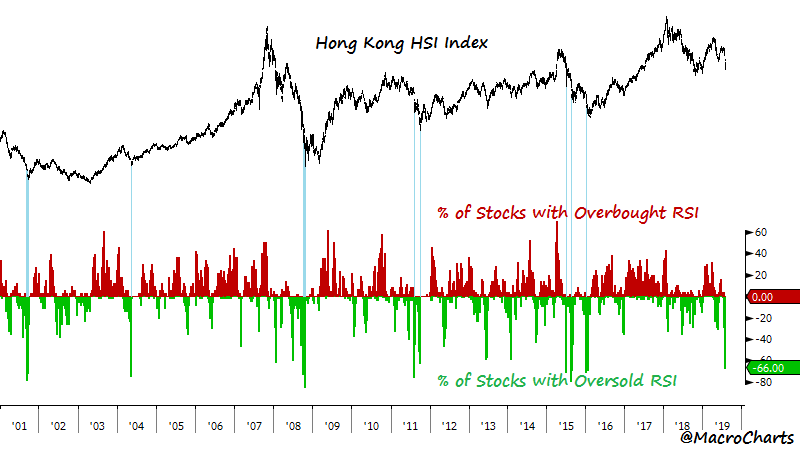

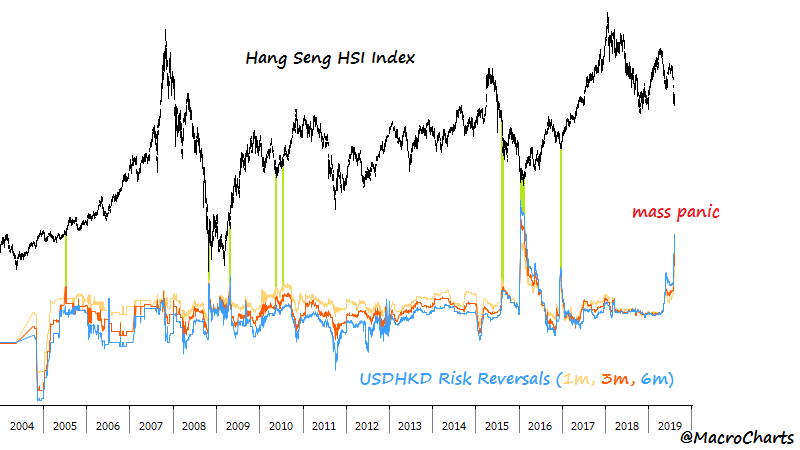

The USD/HKD options market is acting panicky, for sure. Historically this has marked some of the previous intermediate & longer-term bottoms.

No indicator is perfect.

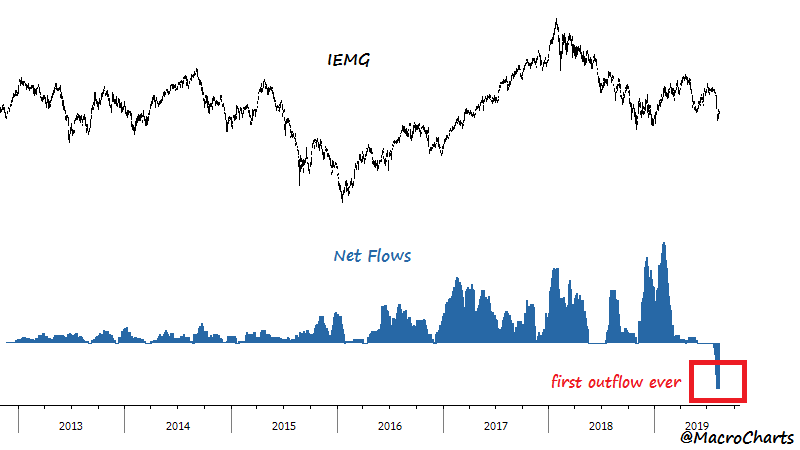

Moving along, while some popular FinTwit people are predicting "The End of The World", Frontier Markets $FM are NOT acting as if the global economy is about to tank into the dark ages.

After a serious equity spike, rising over 30% in a few months, I ended up selling for a handsome profit. To my surprise...

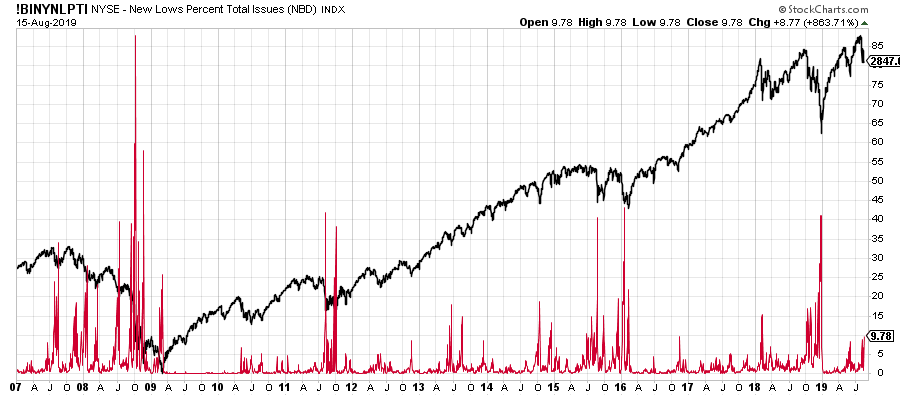

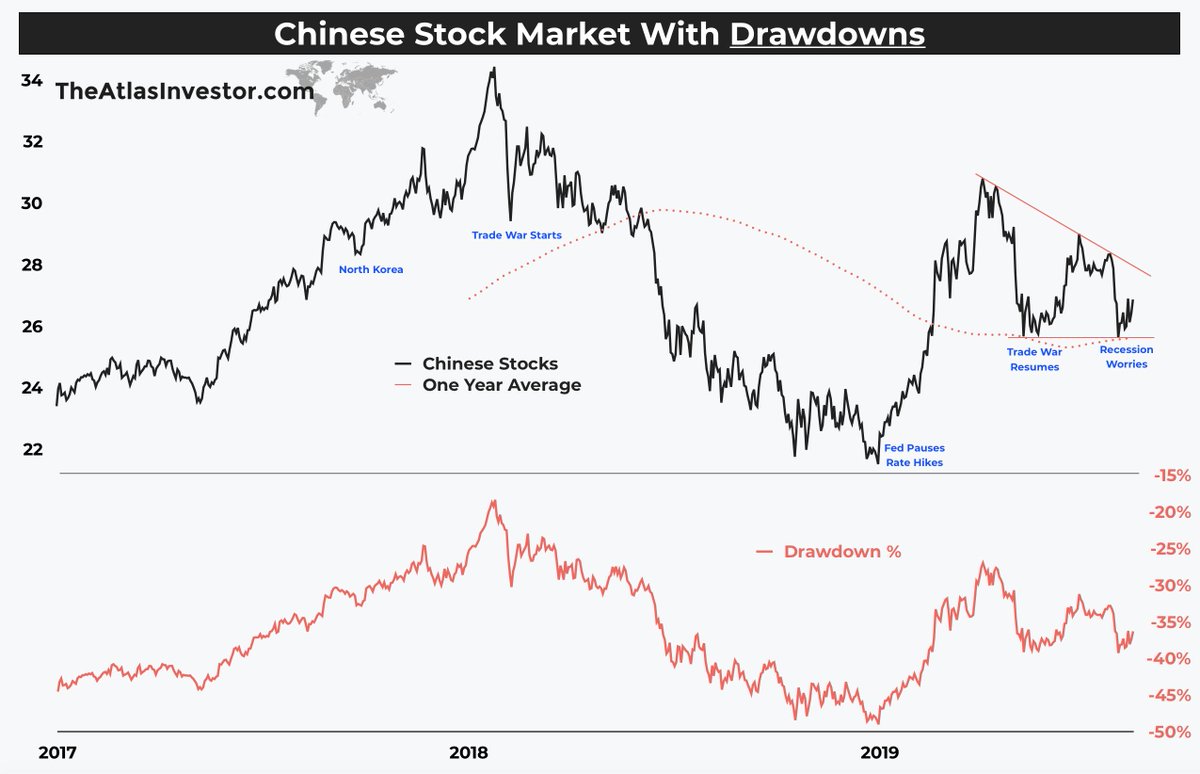

Macro gurus continue to forecast China's mega-crash (note: Hugh Hendry started it in 2010 & is out of business now).

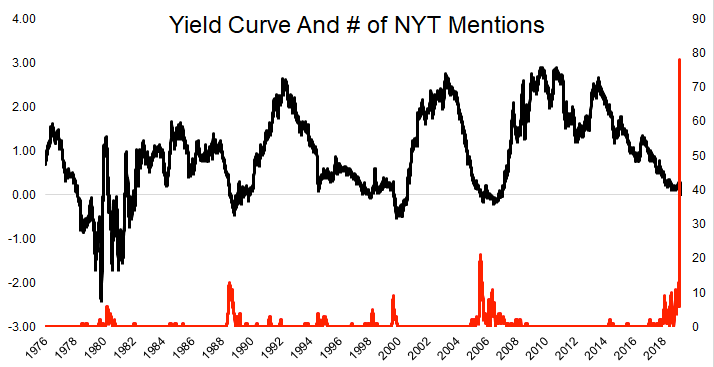

As @michaelbatnick recently said: "Everyone knows everything."

The old saying on Wall Street is "when it becomes obvious to the public, it's obviously wrong."

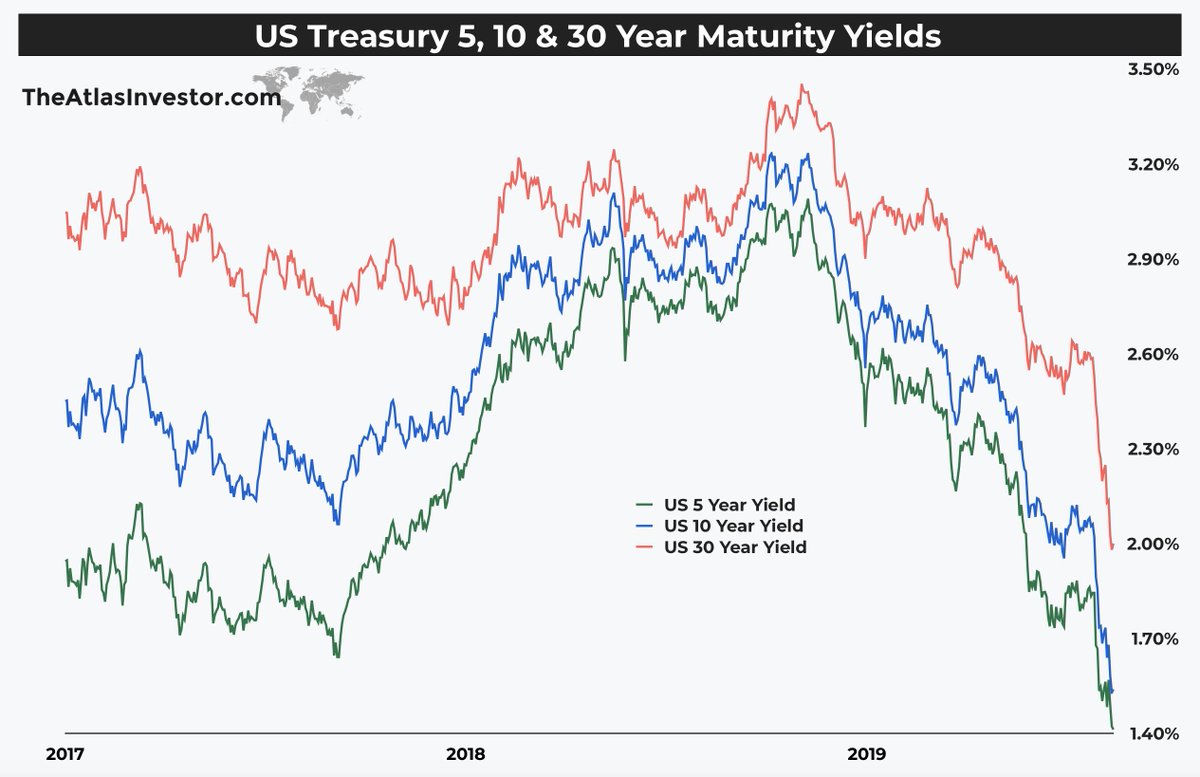

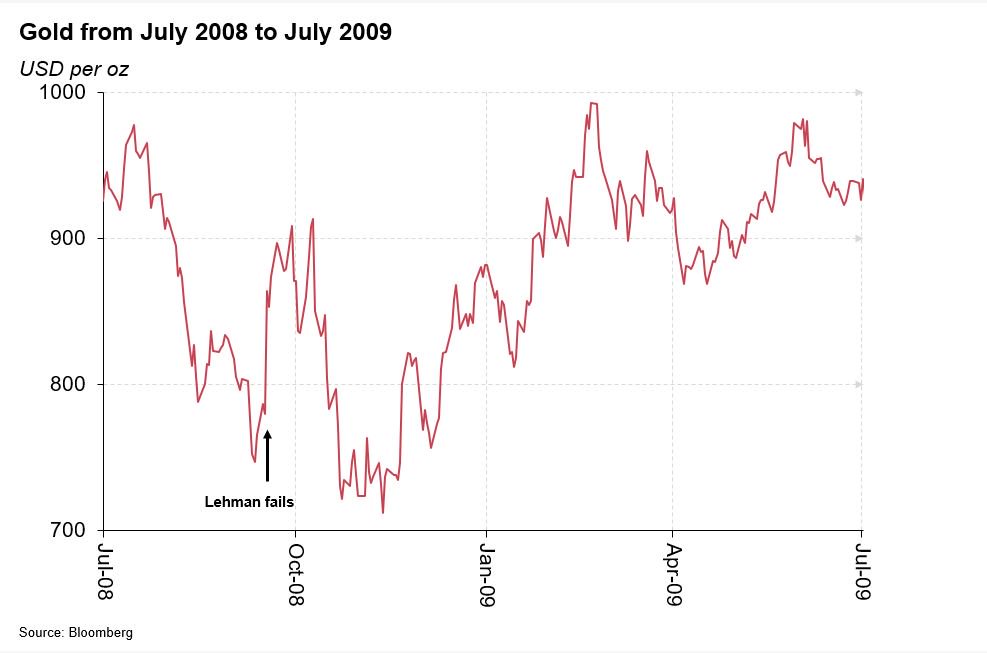

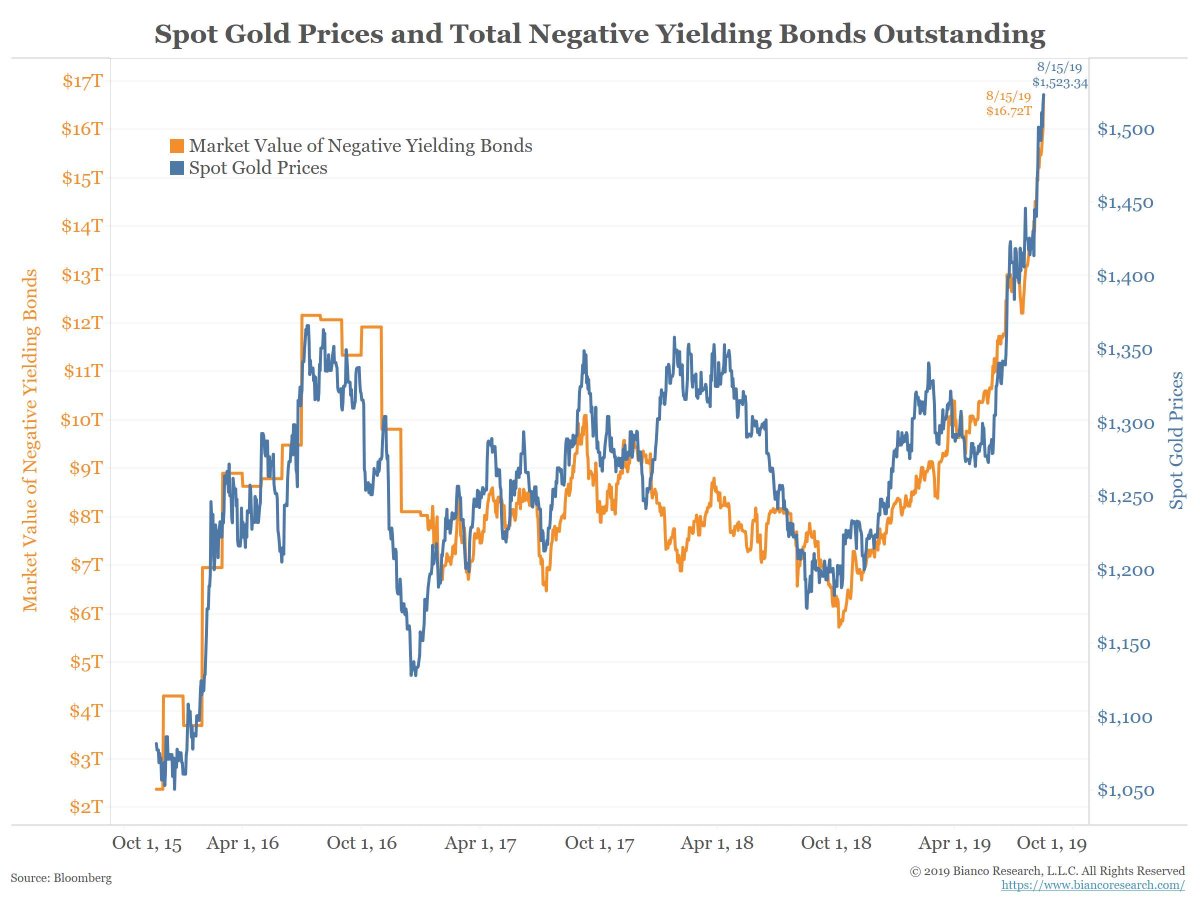

It does well during periods when real rates (inflation-adjusted) start becoming less attractive. As we pass $16 trillion of negative-yielding bonds, Gold has been shining. @biancoresearch

The recession hysteria probably tells us this is one of the most hated bull markets in history!