instituteforsupplymanagement.org/ISMReport/MfgR…

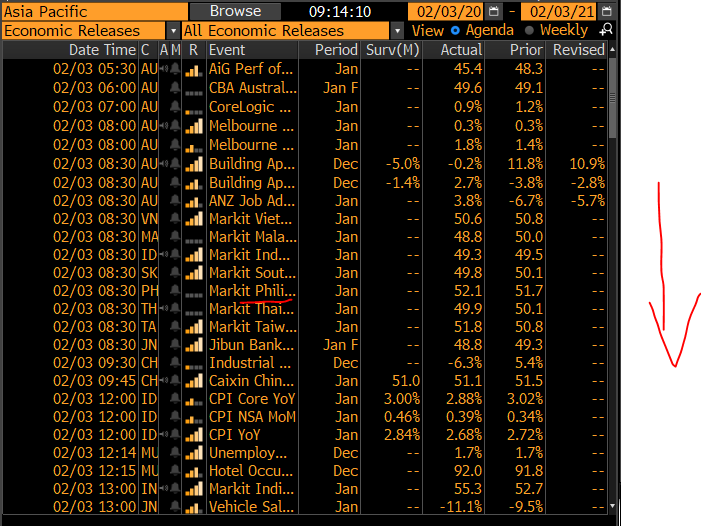

Busy wk!

Watch real estate

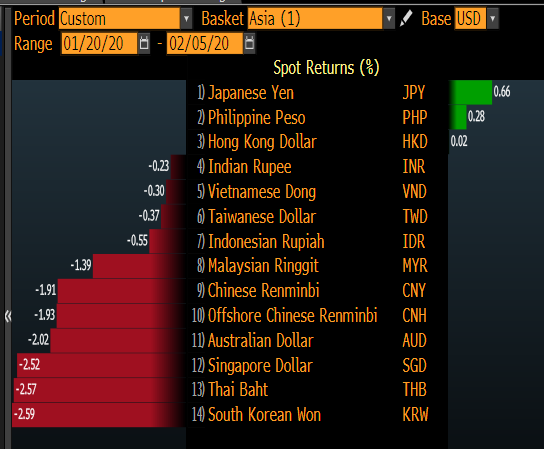

Key are the following:

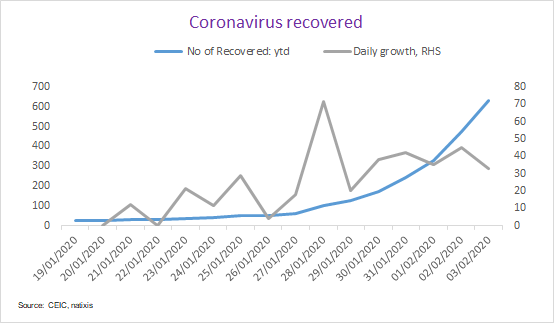

a) Need this virus to peak soon - some estimate early Q220 so not good so need this to be contained to Q1 & longer this lasts it strikes at weak corporate balance sheets

b) Key is policy support, not just broad but targeted.

S&P expects NPL to tripple!

Not sure about this stats...

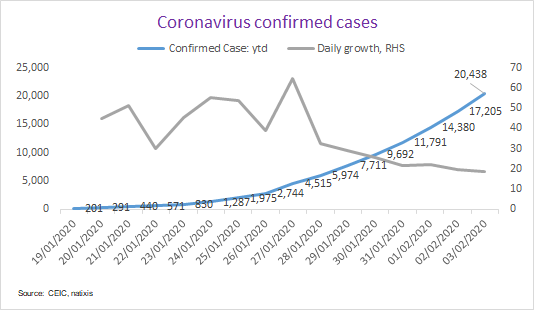

Note that this growth is exponential on a daily basis even if slowing. This doesn't assume higher growth rates but slower...

Urgh, now I see why my family was like why are you leaving California to go to Hong Kong.

WEAR YOUR MASKS!!! 😷😬

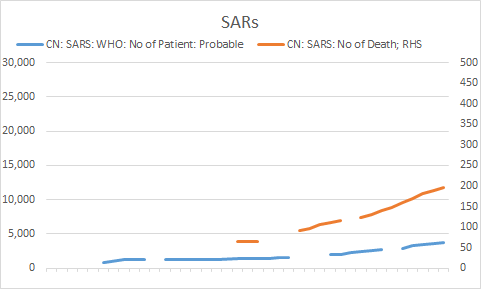

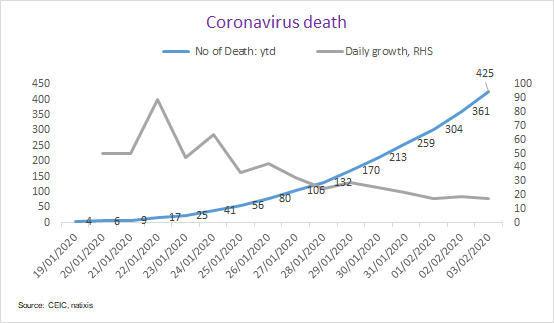

* SARs TOTAL deaths in mainland 348 vs 425 by 3 Feb 2020 of coronavirus; if the rate of death slows, we'll double SARs by the end of this wk alone;

*SARs mainland infected total was 5,327 vs 20,438 on 3 Feb 2020 for corona or roughly 4 times that!