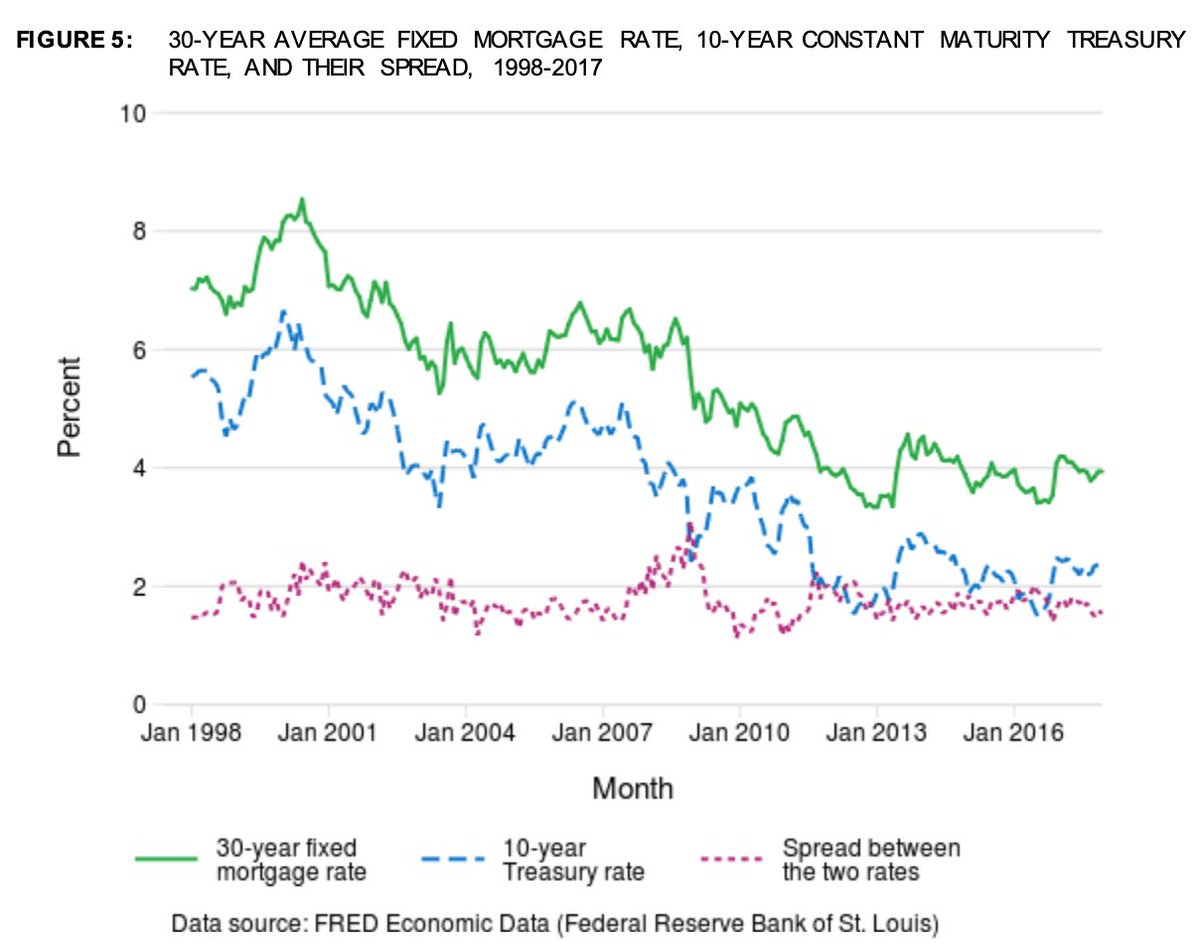

Boring but true observation: when rates go down, prices of debt-sensitive assets go up.

Houses are the most prominent example, but "publicly traded equities" are another really important one for many people who follow me, since they directly impact your comp package and/or your company's valuation.

Perhaps that is a life lesson for some people.