Some of u asked questions on twitter and WA regarding sector, financials, list of companies etc. This thread is for all details

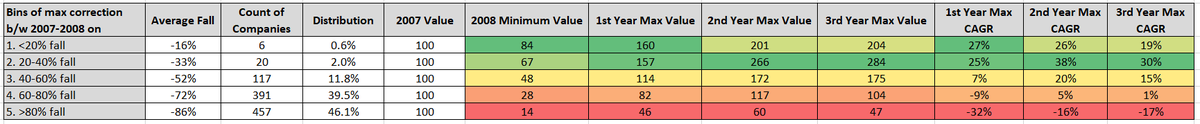

2/N 1. Companies with more than 6 month of trading data available in each of year 2007 to 2011 considered.

2. Few companies got removed due to lack of financial information

3. A total 996 companies considered

4. Data has been taken from ace equity but not verified

6. Auto, Aviation, Metals, Commodities, Oil& Gas, mining, Retail, Textile etc got heavily butchered.

6/N There was a strong correlation between ROCE and these 4 bands. The band with best mean

Now, let us look at recovery post crash for these buckets. To replicate actual investment behavior and to normalize extreme top and bottom, the average price of 2007 topping year, 2008 bottoming year and 2011 (3 year post melt down) has been taken based on closing monthly

10. The 40 to 60% bucket if invested in 2007 gave decent 13% return but if invested in 2008 gave equally good 20% return.