#DBL #DilipBuildcon

Dilip Buildcon Ltd. is an India-based company engaged in the business of #infrastructure facilities on engineering procurement and construction (#EPC) basis for #roads #Bridges #Irrigation & #UrbanProjects.

@srslysaurabh @avinashmehta123 @Agarwal_Ishu

Dilip Buildcon Ltd. is an India-based company engaged in the business of #infrastructure facilities on engineering procurement and construction (#EPC) basis for #roads #Bridges #Irrigation & #UrbanProjects.

@srslysaurabh @avinashmehta123 @Agarwal_Ishu

Why should one look into this? And does this deserve a place in my portfolio. Here’s my rational below.

#DBL started as a #Road Construction company for the western region and now has diversified into multiple segments and the co. has covered almost all the states in #India.

#DBL started as a #Road Construction company for the western region and now has diversified into multiple segments and the co. has covered almost all the states in #India.

#DBL has secured orders worth INR 10703 Cr. In FY 21 and the total order book stands at approximately INR 26115 Cr. Orders are balanced between state govt. and central govt. entities. The company has successfully reduced risk on all parameters as far as business is concerned.

The order book currently is the highest in company’s history.

On a consolidated level there is a drop in revenue due to Covid. DBL’s revenue in FY20 was ₹ 9,725 crore and profits ₹ 358 cr. DBL’s revenues, EBITDA and PAT have grown at 41.2%, 41.1% and 27.9% CAGR from FY11-FY20.

On a consolidated level there is a drop in revenue due to Covid. DBL’s revenue in FY20 was ₹ 9,725 crore and profits ₹ 358 cr. DBL’s revenues, EBITDA and PAT have grown at 41.2%, 41.1% and 27.9% CAGR from FY11-FY20.

DBL owns more than 12,901 vehicles and construction equipment, and employs approx. 33,700 people.

@Sachsharma12

@Sachsharma12

DBL’s strategy going forward is to (a) focus on road EPC for government clients (b) divest BOT assets freeing capital (c) geographical diversification (d) projects clustering (e) Target smaller project size to reduce overdependence on large projects (f) Deleverage balance sheet.

It has a policy of no subcontracting and no equipment on rental. This has helped it build good human resource and execution capabilities. They do a faster execution of projects. DBL has completed 90% of their projects early, and has received bonuses on many of their projects

DBL carefully selects projects and strives for geographical clustering of these outside MP. This helps in utilization of construction assets and reduce environmental and forest clearance risks. It also paves the way for regional strengths

DBL leverages its manpower, equipment and materials and saves transportation costs, thus achieving economies of scale.

Drones and UAV are emerging technologies used to reduce project time, improve safety and control project costs. UAV is used to collect engineering data at site

Drones and UAV are emerging technologies used to reduce project time, improve safety and control project costs. UAV is used to collect engineering data at site

#GPS technology is used to track machine life, fuel usage, and consumables. It provides mapping and replays vehicle location history with real time alerts and notifications. Using this tech, #DBL is able to guide drivers and operators, enabling fuel savings of ~25%. #Tech

So what are the strengths of #DBL, this is why one should look into this company.

DBL is a sector leader in Indian roads EPC. It has a large order book and rising revenues.

DBL has a good pan India presence.

DBL is a sector leader in Indian roads EPC. It has a large order book and rising revenues.

DBL has a good pan India presence.

It operates in geographical clusters for projects which helps with efficiency and asset utilization. So DBL has an efficient business model. The execution through strong operations helped DBL receive early completion bonuses for many projects.

#DBL has seen a strong growth in financials and order book. In Q1FY21, it has improved order book and also diversified into new #infra verticals like #tunnels and #irrigation projects, amid the lockdown challenge.

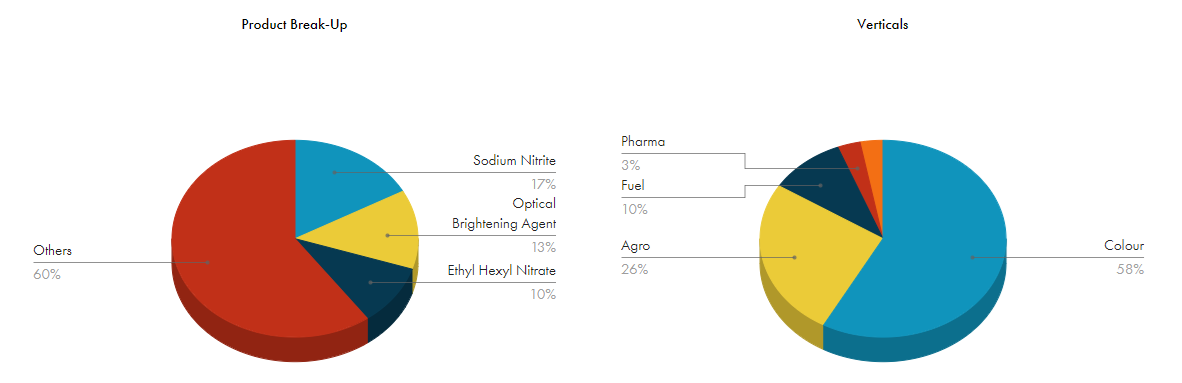

#Diversification by DBL from roads to a number of adjacent infra sectors is a sign of #aggression and #dynamism. There are business model #synergies with these #sectors and they are high potential sectors.

The sale of road assets to Shrem and Cube is helping reduce capital tied up and so debt is being reduced. DBL should be able to sharply reduce its interest payments by continuing to sell road assets as well as take advantage of the lower interest regime and reduce cost of loans.

Road projects used to be riskier earlier as NHAI etc. used to bid out projects while having acquired only a small portion of the land required for construction. This has now changed and most of the land is acquired before bidding it out.

#Promoters Dilip Suryavanshi, Devendra Jain and top management are highly experienced in infra space. #Largest #Caterpillar equipment fleet owning company in Asia.

Next generation is getting groomed for the company’s future. Rohan Suryavanshi (Strategy and Planning) & Karan Suryavanshi (Business Development) are having great credentials and are already driving the company ahead using futuristic technologies to improve efficiency further.

Company is trying to save as much as possible and reduce dependence on external parties. This is visible from the backward integration which company has undertaken.

The company has received numerous awards for its execution capabilities in all segments. A short brief on why this company is worth looking into is below.

Point to note here is that the company is involved in a cash intensive business, hence it’s important to have a look at liquidity position of the company.

Company has a Debt to equity ratio of 2.84 currently and Net Debt to Equity is 0.92. Interest coverage ratio is 1.36.

Company has a Debt to equity ratio of 2.84 currently and Net Debt to Equity is 0.92. Interest coverage ratio is 1.36.

Promotors holding is 75% where 25.2% is pledged, however this is only till award of certain projects. The pledges will be released as soon as they receive financial closure on the same from banks. Pledging of shares by promoters reduces the stability of the share in the market.

There are lot of players in EPC segment and competition is present in all the segments inspite of that #DBL has been able to perform and diversify revenues.

Currently #DBL is fairly valued and when compared to other EPC Players it looks expensive but it’s a well-managed and growing company. #ROE for 5 years is 21.1% #ROIC is 16.3% #ROCE is 14.6% Company also pays #dividend to investors.

#DBL has positive cash flow from operations. Have a look at the credit rating report for #DBL indiaratings.co.in/PressRelease?p… Outlook for the company is stable.

There is an urgent need to build infrastructure such as roads and highways. This is reflected in the Indian budget allocations. Project awarding and completion has never been so fast in roads sector all thanks to @nitin_gadkari Ji.

In this sector #DBL has built a momentum of business, and has a national presence, a fast growing order book that is diversifying from roads to attractive adjacent sectors like bridges, tunnels, mining, metros, airports and irrigation. It has a good strategy and business model.

Road projects undertaken include work on BOT, HAM and EPC models. However two recent large deals of sale of infra assets is releasing tied up capital and helping focus on core EPC.

Key Risks: 1) high #debt an large working #capital requirement 2) #pledged shares 3) #high competition 4) #covid and weather disruptions 5) Sector #perception

Excellent financial management, galloping revenues and order book, sectoral tailwinds along with a low price entry point makes Dilip Buildcon an excellent BUY. Average broker target currently is INR 500+

Some #risk factors are #litigations relating to land and project cancellations. Uncertainty on #Land acquisition Act, sector perception. #Credit crunch for the company due to any factors. These things should be monitored.

It could take some time for DBL to start performing, but once capex starts flowing from Govt. which is feel is necessary for the economy to bring on track DBL will start booming. Also if the stock price falls below 275 then it would become a worry for me.

Finally i would keep on holding #DBL for decent gains for next few years. Please let me know if any other information needs to be added. #Technical views are much appreciated.

@PiyushAshtikar

@PiyushAshtikar

@threadreaderapp unroll.

@drprashantmish6

@drprashantmish6

• • •

Missing some Tweet in this thread? You can try to

force a refresh