₿ The ban is canceled: new concept of #cryptocurrency regulation in #Russia.

Which Russian companies have already prepared?

Thread 🧵👇

Which Russian companies have already prepared?

Thread 🧵👇

For Russian investors, #cryptocurrencies have become important asset class – there are twice as many funds in crypto accounts as in brokerage accounts. Ban could have a negative impact on credibility of Central Bank and the authorities in general.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

🔝 If you can't win - lead!

Central Bank, together with Ministry of Finance, found best way out of situation instead of a complete ban - to allow trading in #cryptocurrencies through banks, which will make all transactions transparent to Central Bank.

Central Bank, together with Ministry of Finance, found best way out of situation instead of a complete ban - to allow trading in #cryptocurrencies through banks, which will make all transactions transparent to Central Bank.

https://twitter.com/rdv_analytics/status/1491353620520255489?s=20&t=J5AkJqzPLnOtMqY8BNhBBg

According to Kremlin, legal entities - #crypto exchanges and intermediaries - can bring 90-180 bn rubles to the budget annually. With a tax rate of 20%, it turns out that the net profit of crypto exchanges in #Russia is 360-720 bn per year.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

But is anyone ready to provide platform for #cryptocurrency trading to Russians?

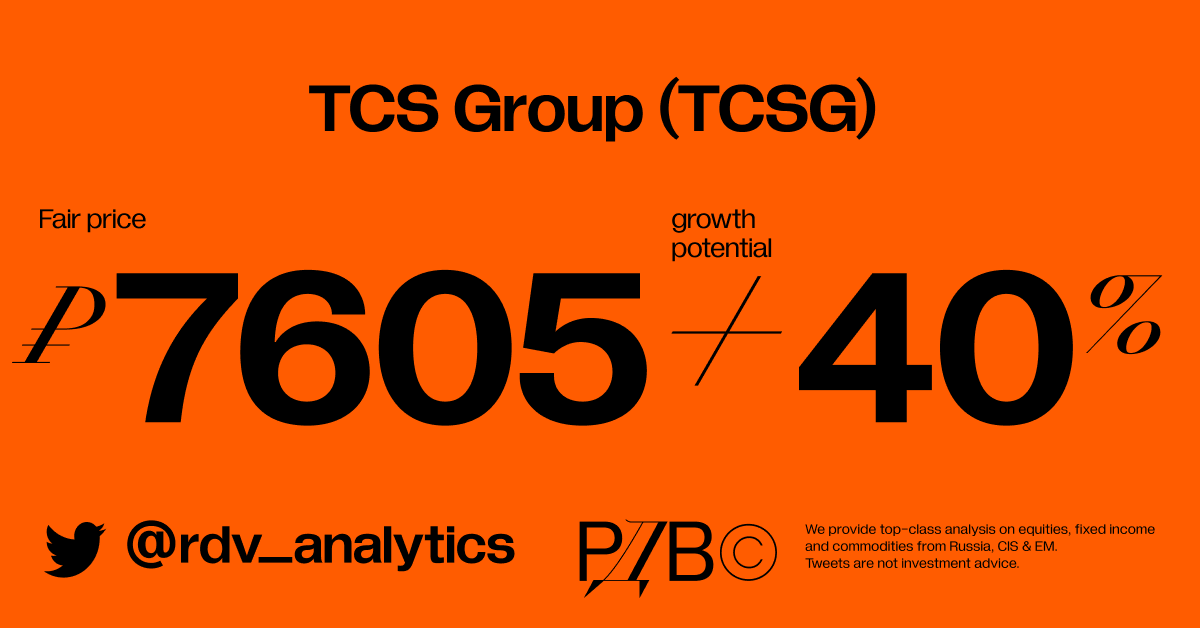

❗️ Yes. New legislation could make @tinkoff_bank one of the main organizers of exchange of cryptocurrencies in #Russia. $TCSG was first to start dealing with crypto - bought Swiss exchange Aximetria

❗️ Yes. New legislation could make @tinkoff_bank one of the main organizers of exchange of cryptocurrencies in #Russia. $TCSG was first to start dealing with crypto - bought Swiss exchange Aximetria

Due to cryptocurrencies, net profit could grow by RUB 216-432 bn (3.5x) if $TCSG can take 60% of #cryptocurrency trading market, as it has done with shares. Tinkoff has the largest investor base in #Russia - 1.26 mn people or 66% of the total market.

https://twitter.com/rdv_analytics/status/1491374605210390529?s=20&t=h7wgMNVVvfywSyonbyC0cw

• • •

Missing some Tweet in this thread? You can try to

force a refresh