Today's #MacroView is out. Why today isn't 1982 and Jerome Powell isn't Paul Volker.

realinvestmentadvice.com/paul-volker-an…

realinvestmentadvice.com/paul-volker-an…

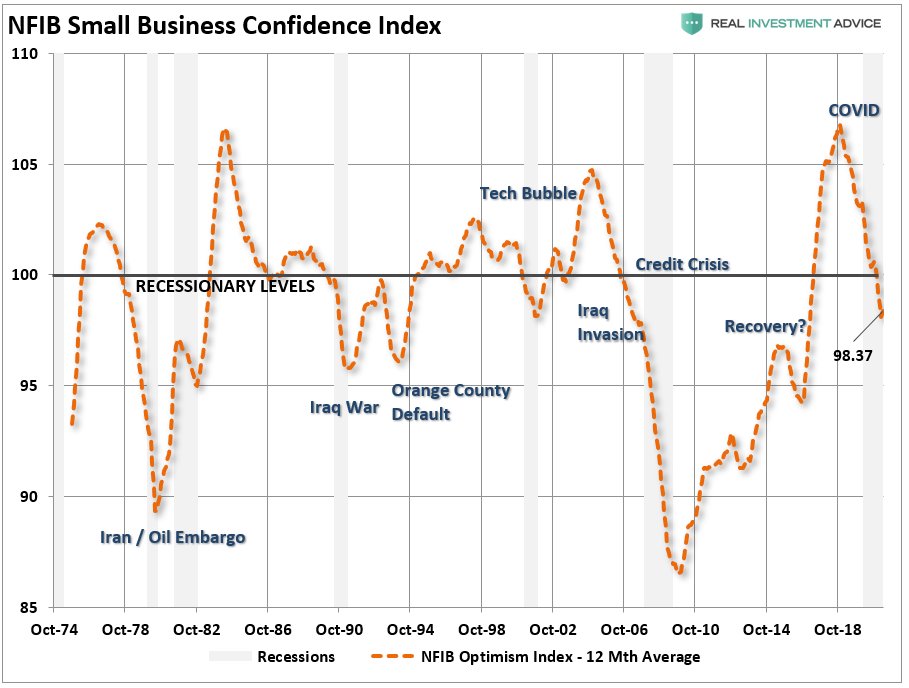

The road to 1982 didn’t start in 1980. The buildup of #inflation started long before the #ArabOil Embargo. Economic growth, wages, and savings rates catalyzed “demand push” inflation.

realinvestmentadvice.com/paul-volker-an…

realinvestmentadvice.com/paul-volker-an…

Furthermore, the Government ran no deficit, and household debt to net worth was about 60%. So, while #inflation increased and interest #rates rose, the average household could sustain their living standard.

realinvestmentadvice.com/paul-volker-an…

realinvestmentadvice.com/paul-volker-an…

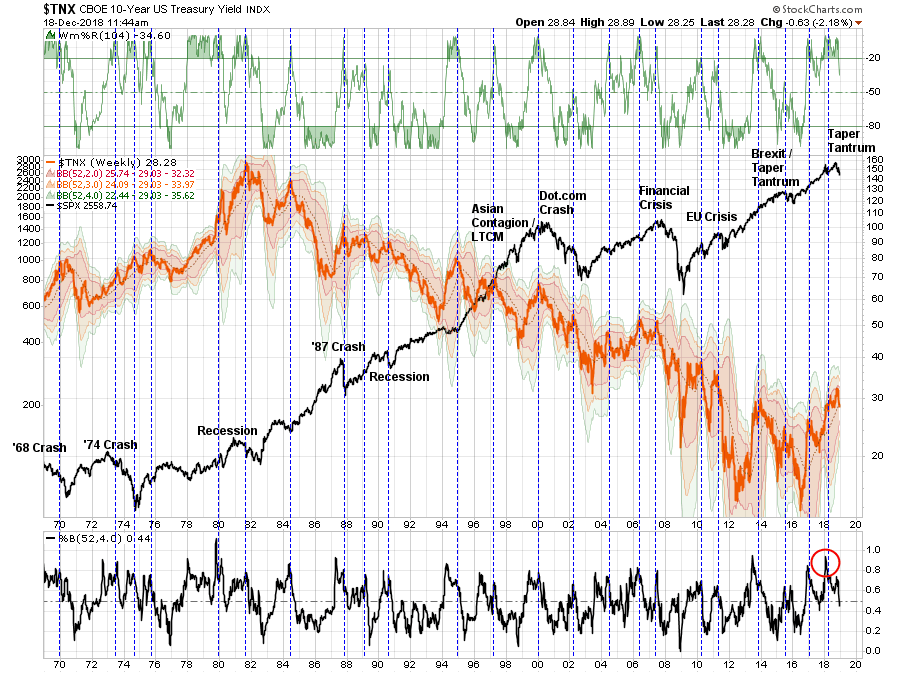

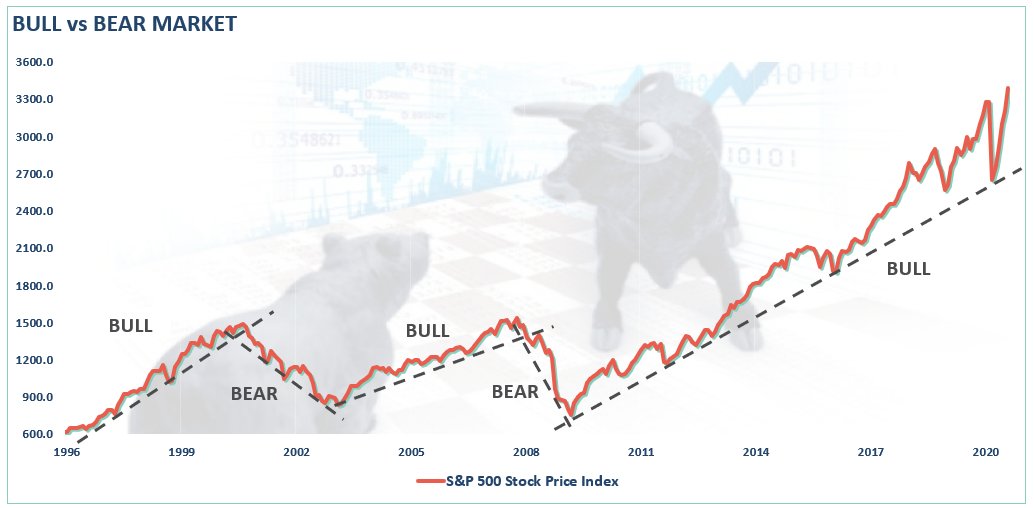

The #Fed steadily fought the repeated bouts of inflation. The resulting #market #volatility pounded investors with repeated #bearmarkets and economic #recessions. By the end in 1974 valuations were 7x earnings.

realinvestmentadvice.com/paul-volker-an…

realinvestmentadvice.com/paul-volker-an…

Even if the #Fed does “pause,” such is far different than cutting rates to zero and restarting QE. Those actions would occur given an increase in financial instability, suggesting much lower asset prices in the process.

Maybe 1974 has something to tell us?

realinvestmentadvice.com/paul-volker-an…

Maybe 1974 has something to tell us?

realinvestmentadvice.com/paul-volker-an…

• • •

Missing some Tweet in this thread? You can try to

force a refresh