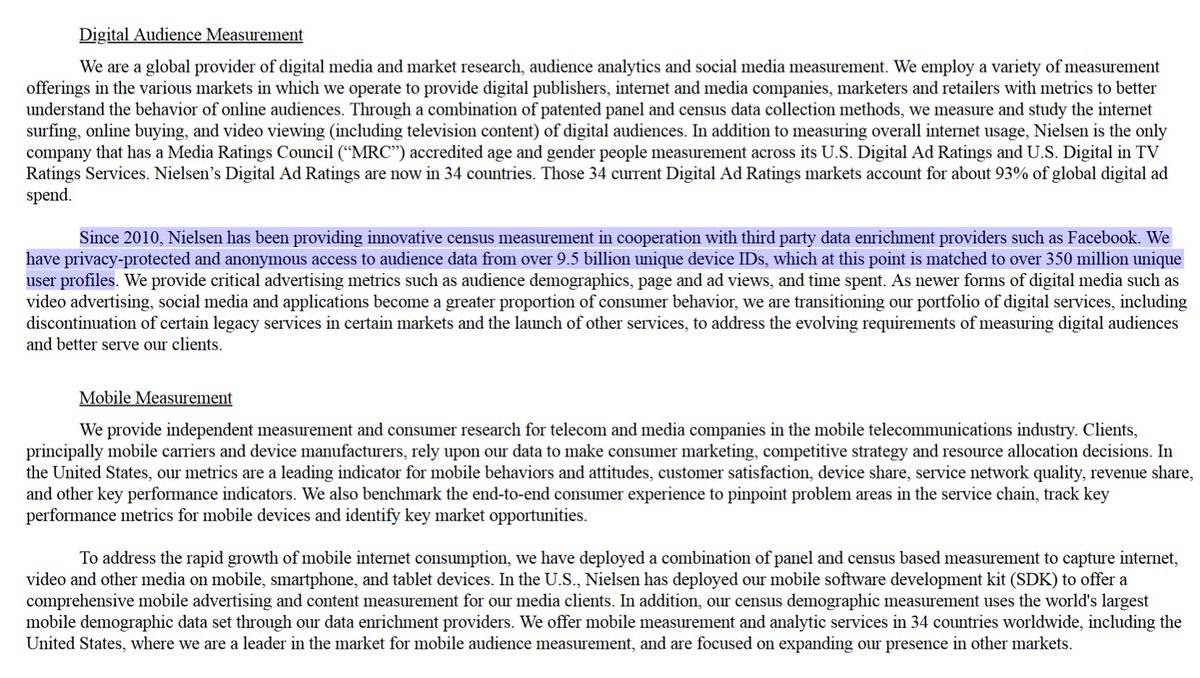

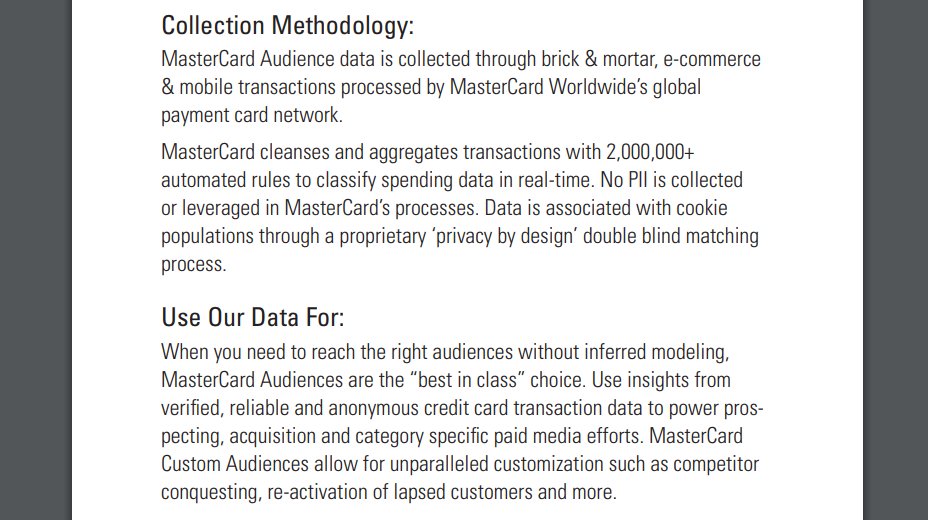

My take: exploiting knowledge based on combining/matching *individual-level* data = systems of consumer mass surveillance, whether 'double-blind encryption' or not bloomberg.com/news/articles/…

This was an open question since Google stated that they take advantage of "third-party partnerships, which capture approximately 70% of credit and debit card transactions" in the US in May 2017: adwords.googleblog.com/2017/05/poweri…

And in the case of MasterCard and Google I'm sure it goes strongly against all expectations of a majority of consumers.

crackedlabs.org/dl/Christl_Spi…

crackedlabs.org/dl/CrackedLabs…

oracle.com/us/solutions/c…

And btw. then there's this (even more) evil twin of pervasive marketing surveillance - data sharing and profiling for fraud analytics:

Another txt by @jennysurane on Cardlytics, which "analyzed $1.5tn in purchase data from 2,000 financial institutions" last year: bloomberg.com/news/articles/…

Blog by Tom Noyes from 2017, who markets his data company Commerce Signals (see above), but also provides some interesting insights:

blog.starpointllp.com/blog/?p=4659

"Google has 'access' to 70% of US transaction data through Mastercard, 1-2 participating processors, a bank data aggregator, and retailers sending data to Google" (blog.starpointllp.com/blog/?p=4805)

"...most banks have NO IDEA of how their data is being used. Banks give out raw data to the [credit] bureaus, and their marketing teams have given “anonymized” data to many other entities (ie Argus, Affinity, Cardlytics, …etc)"

blog.starpointllp.com/blog/?p=4695

"The bank/mastercard issue is NOTHING compared to retailer sharing of SKU level info with Google/FB. Most top 50 retailers send Goog/FB near real time SKU level data" ()

Blog: blog.starpointllp.com/blog/?p=4791

Both, but yes.

gizmodo.com/google-reporte…