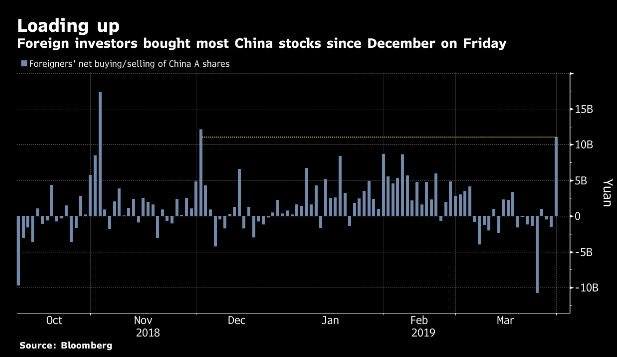

Meaning, if u're invested 100 end 2017, u're still down today on 1 April '19. That said, if u bought end 2019, good job! 🤗

Q: Will retail investors chase this & push it higher? @HAOHONG_CFA

Q: Wut happened in 2015?

@HAOHONG_CFA

If fundamentals deteriorate yet markets rally on hope, what’ll sustain the rally? More believers, well, until they don’t. Buyers tend trickle in slowly but dash to exit. High reward=high risk. True story

1) Retail sales tonight

2) ISM

3) Durable goods order

4) Jobs (ADP & NFP)

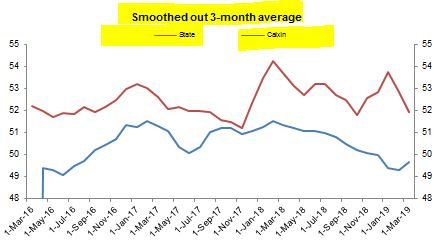

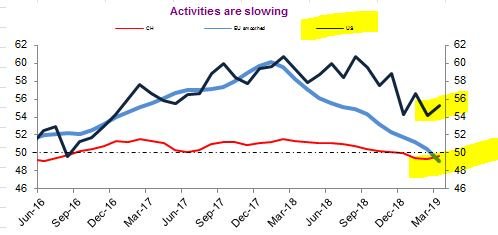

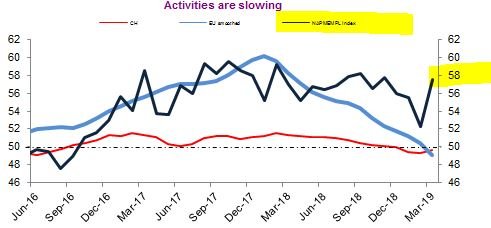

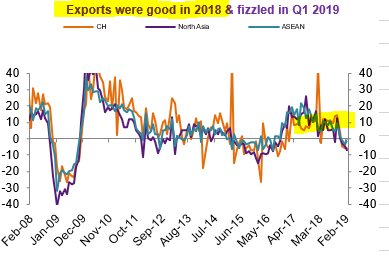

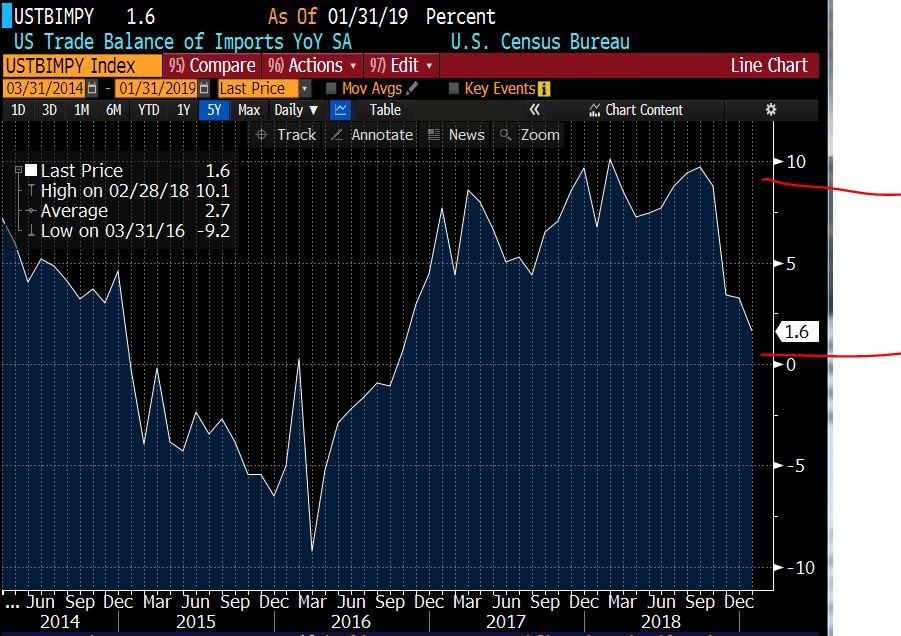

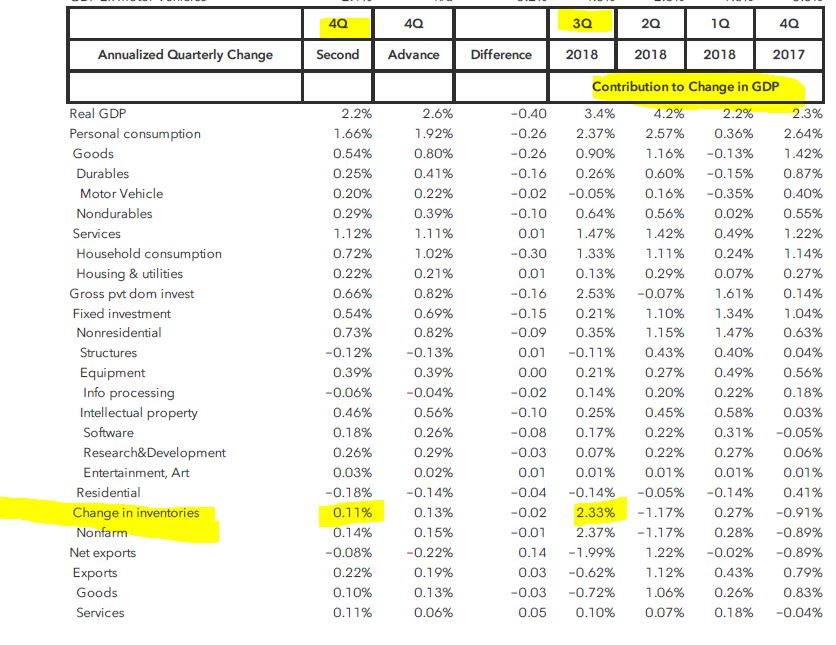

a) Further deterioration in Q2 expected

b) New orders falling at rate not seen since 2012

c) Job losses in Germany & Italy 🥶

d) France contracting too

e) Australia & Spain infected & slowing 😬

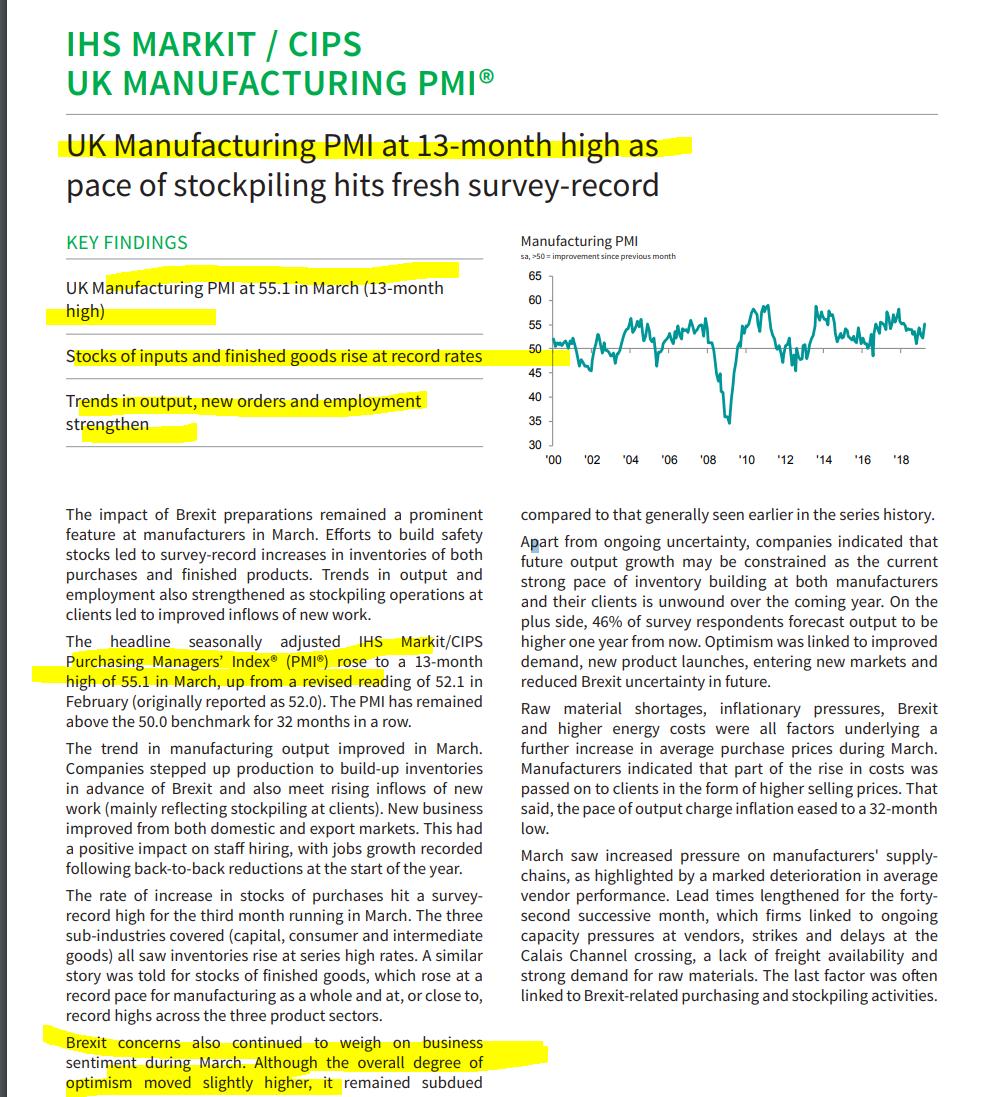

Perhaps an indication of stockpiling & prepping for Brexit so may have some payback but pretty 📈compared to Germany's