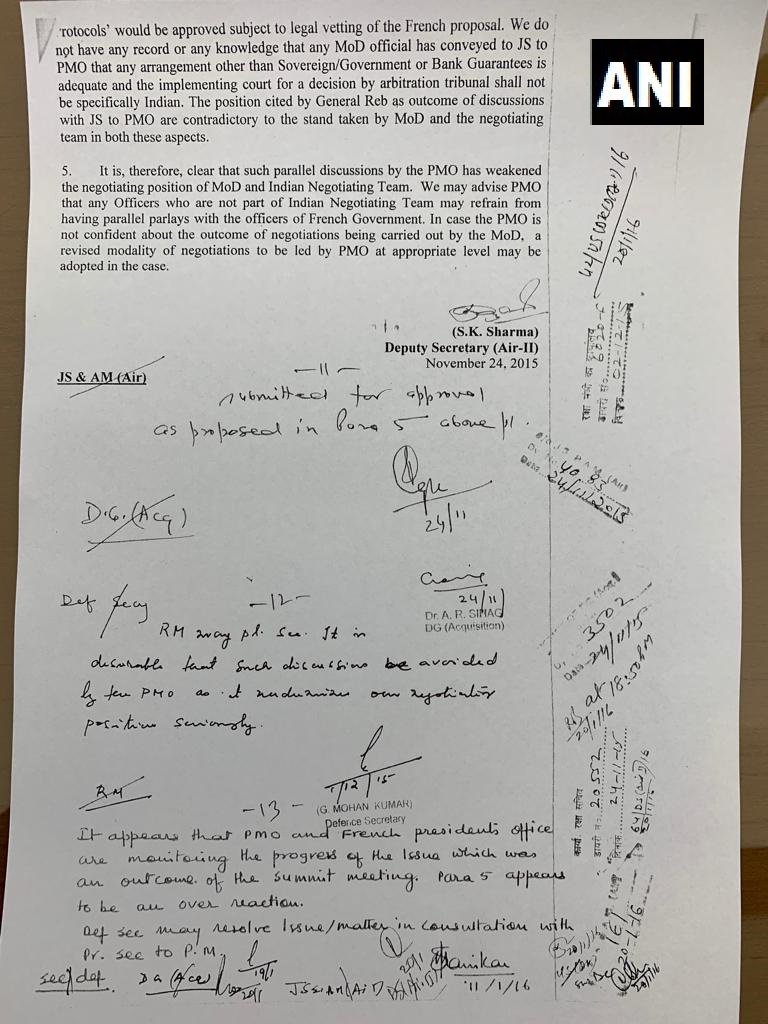

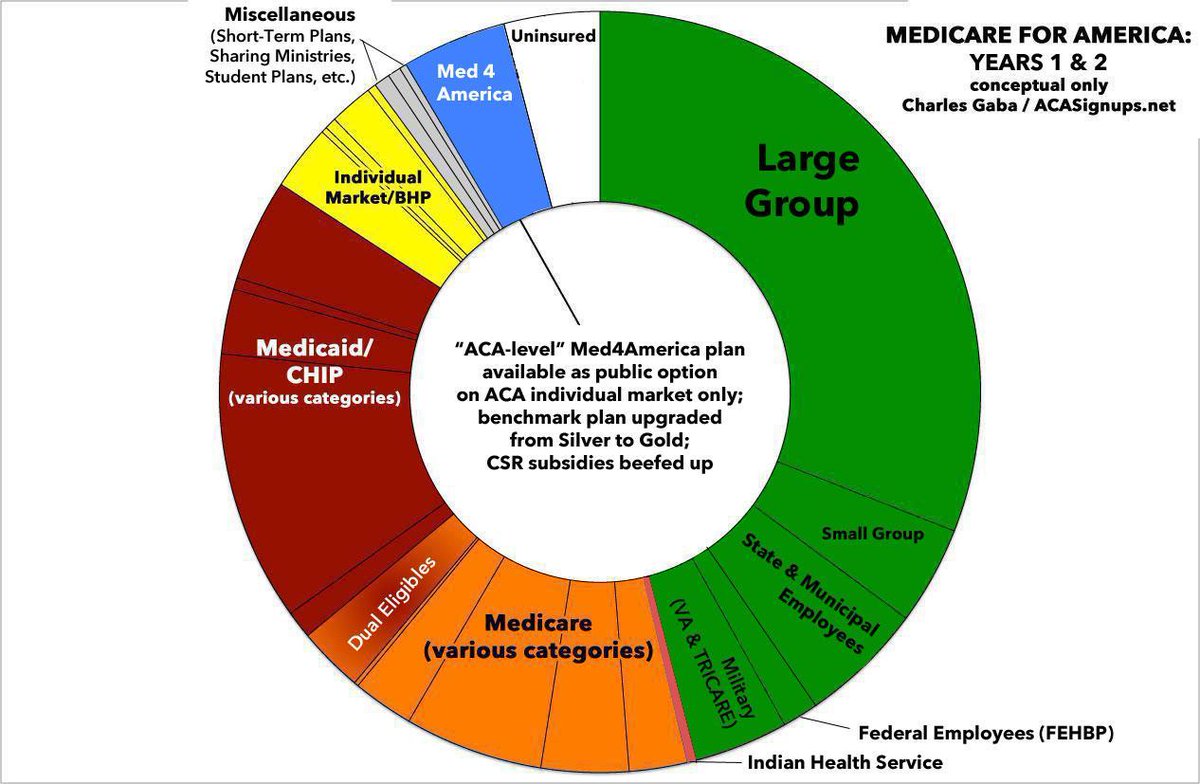

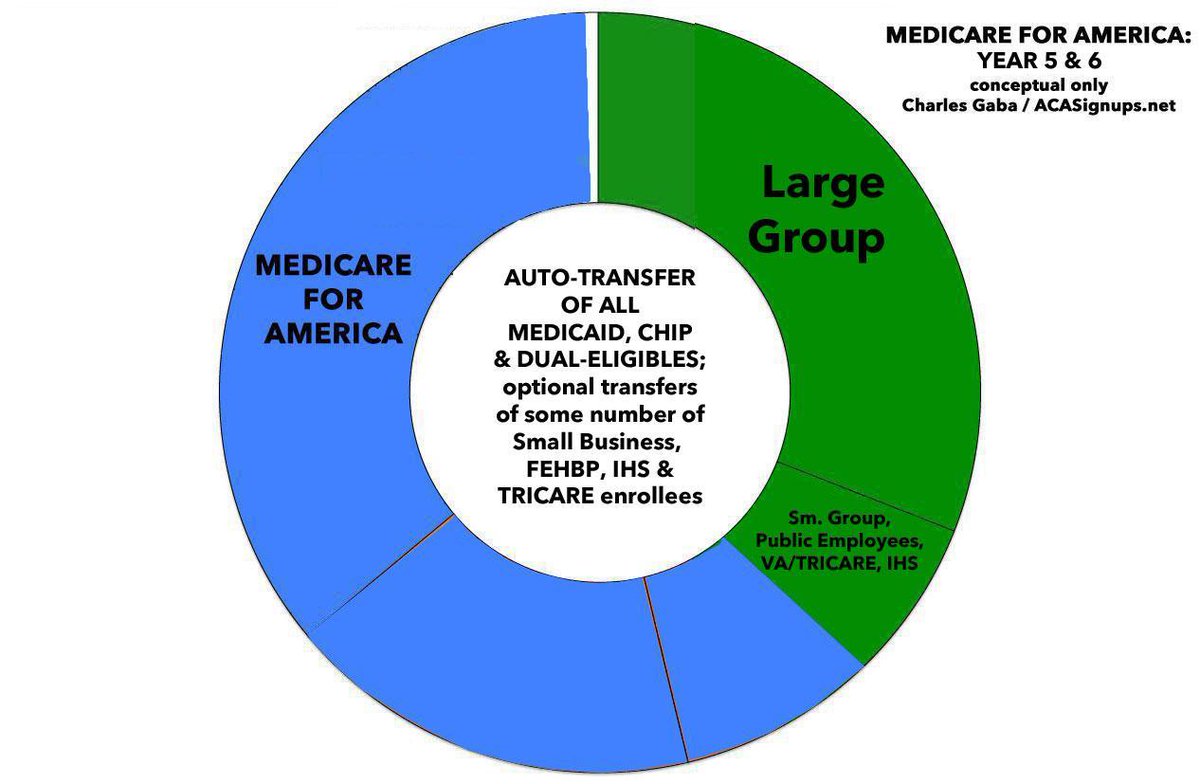

A Really Deep Dive into #MedicareForAmerica: acasignups.net/19/05/02/reall…

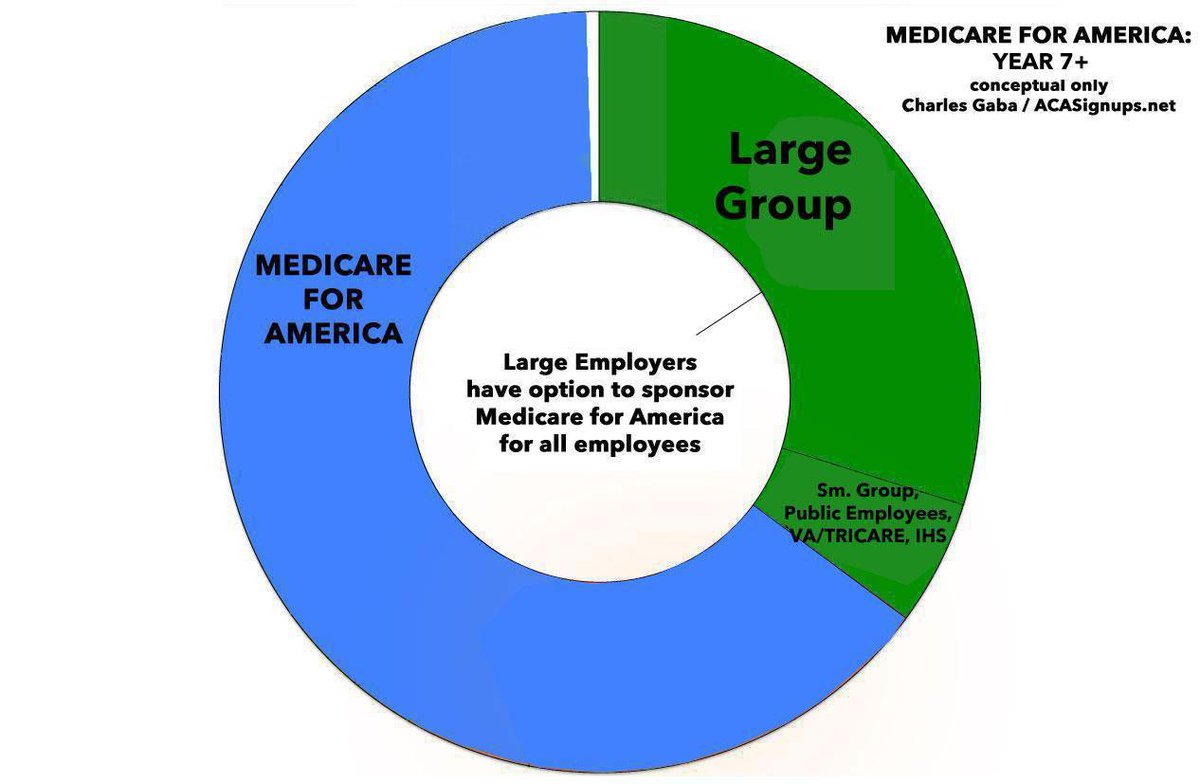

It’d be mandatory for the 1/2 of the country least likely to have a problem with it being mandatory…and optional for the 1/2 of the country most likely to want it to be optional. 4/

Let's say you're single and earn $30,000/year. That's around 240% FPL.

Your premiums would be around 1% of your income, or $25/month. NO deductible. Maximum out of pocket costs likely around $400. Worst-case scenario: $700 for the year.

--repeal GOP tax bill

--5% surtax on income > $500K

--increase Medicare payroll tax on income > $200K

20/

--increase excise taxes on tobacco, alcohol & sugary drinks.

Notice that only 2 of these bullets impact anyone earning less than $200K at all: Repeal of the GOP tax bill and the tobacco/alcohol/sugary drink taxes. 21/

acasignups.net/19/05/02/reall…