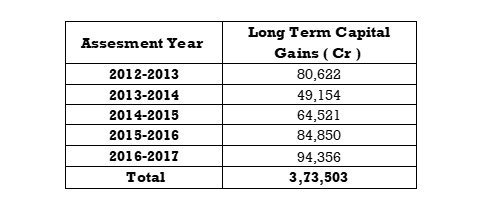

3.67 Lakh Crores of Exempted #LTCG Tax in A Y 2017-2018 and 20k crores expected in tax revenue in 2019 and 40k crores in 2020.

incometaxindia.gov.in/Pages/Direct-T…

Looks like 5 years data added as per Income Tax Website.

All Tax Payers – Range of Long Term Capital Gains Tax

The data on Income Tax India website for LTCG is only for other asset classes.

Or the budget used a cumulative data of 5 years?

Or the data used in the budget for #LTCG for Equity is from the Income Tax and other agencies but not available on any public website

Expects 6-10% of Equity of Indian Markets to change hands!! The Public holding is less than 10% and another 6% through MF

As per us a practical estimate is if we grow Equities at 12-15% as per GDP and a starting market capitalization of 150 lakh crores and 2-4% of equity changing hands the government can barely get 3000-5000 cr of LTCG Tax annually. This is the best and linear case.

The broader markets have corrected 40% since the budget.Even if new investments become profitable there will be a lot of set-offs available for LTCG Loss for many years. LTCG revenues could become significant only after a decade of compounding.

Now if we consider 100% profit the Value of Trade becomes 7-8 lakh crores which would be 30% of all delivery volumes.