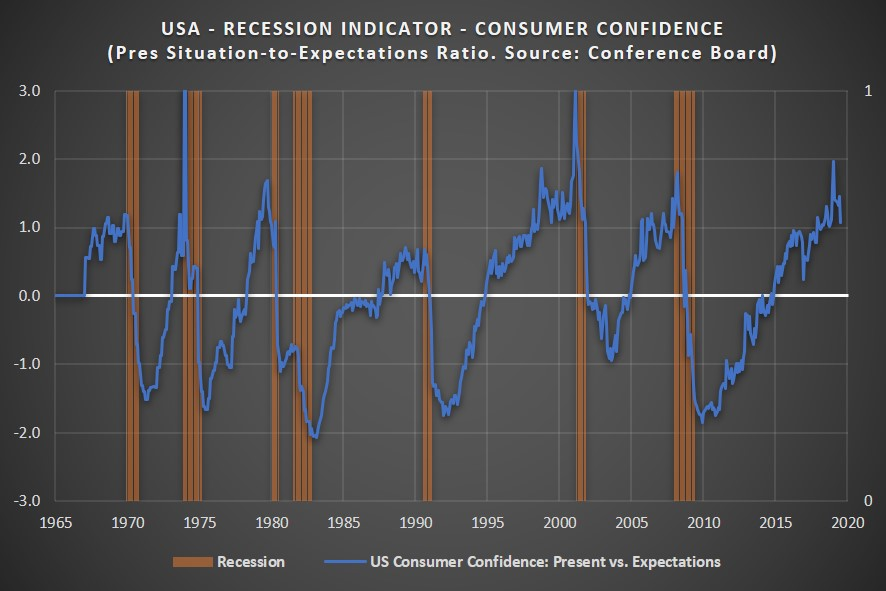

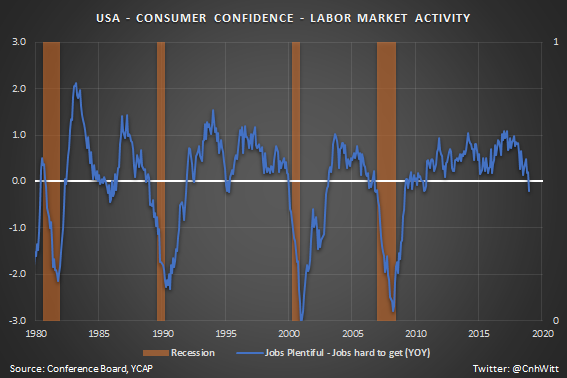

cc @Conferenceboard

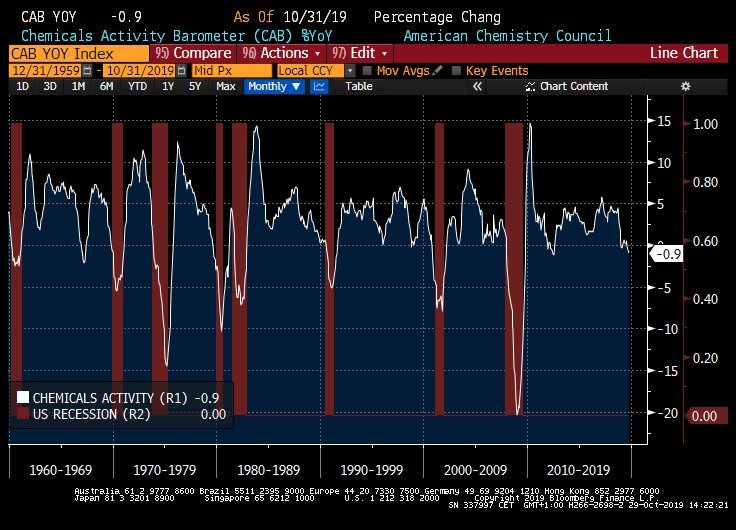

cc @DrTKSwift

cc @EconguyRosie

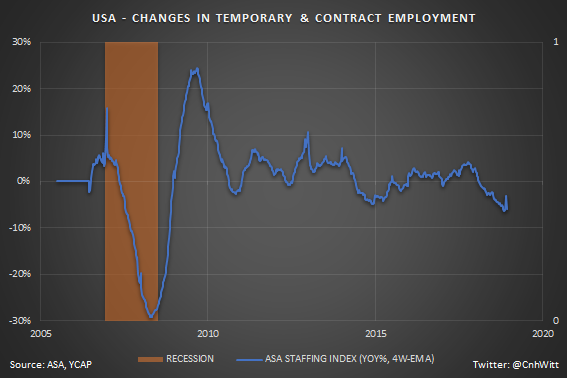

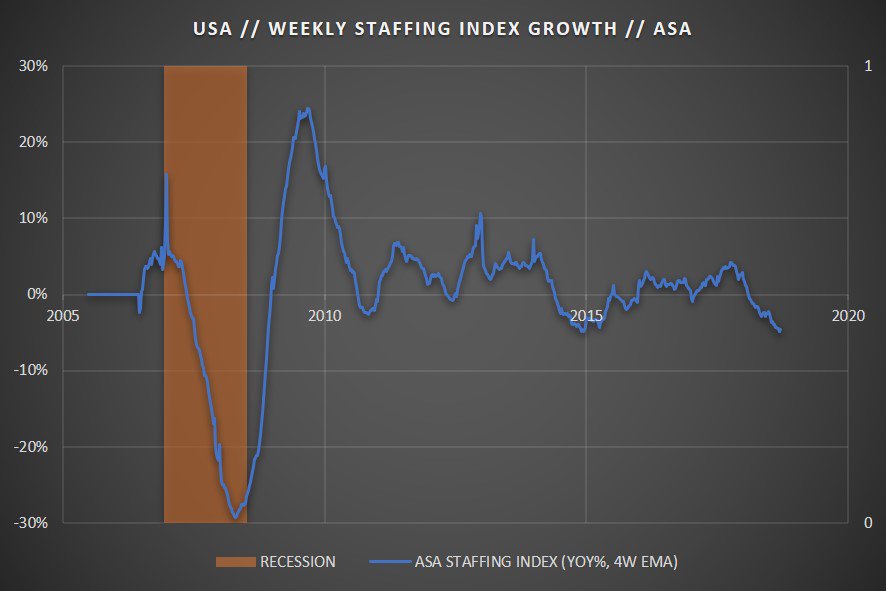

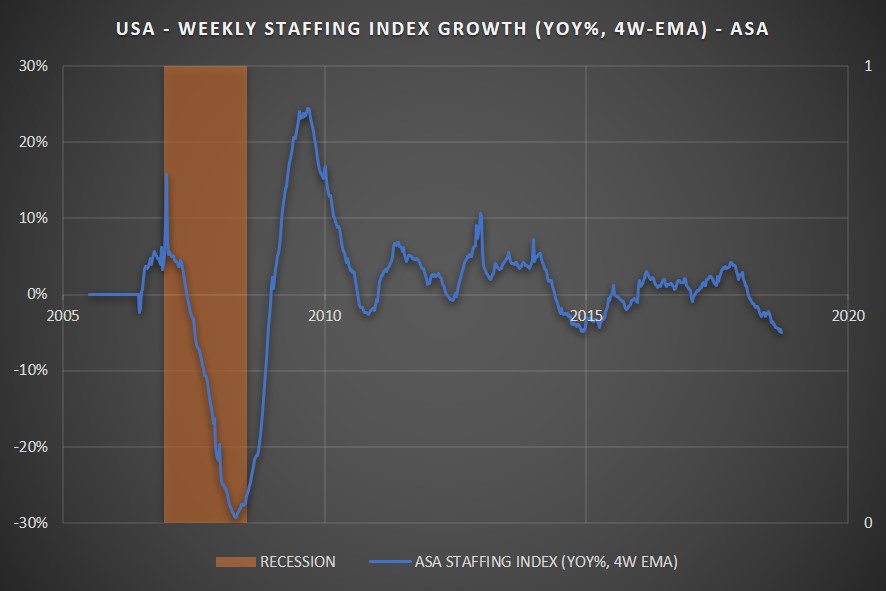

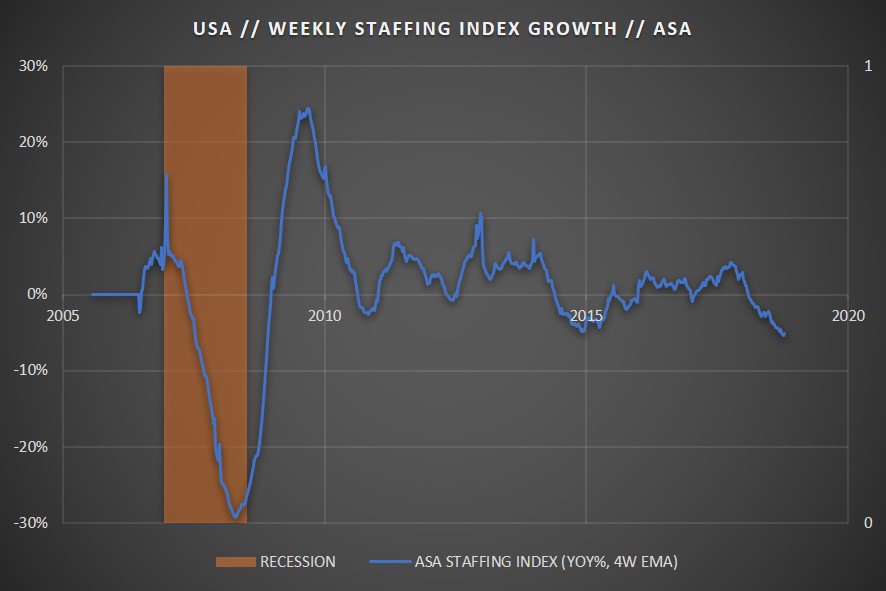

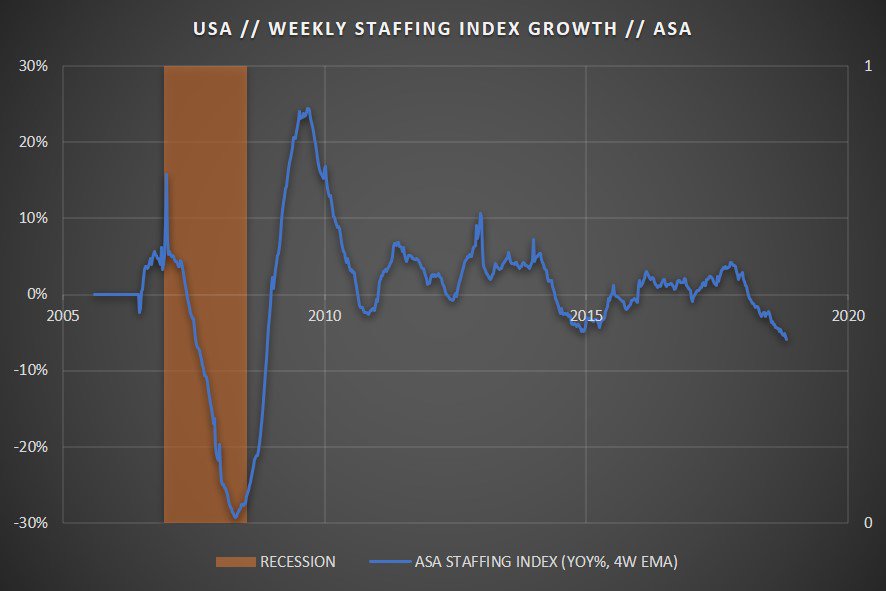

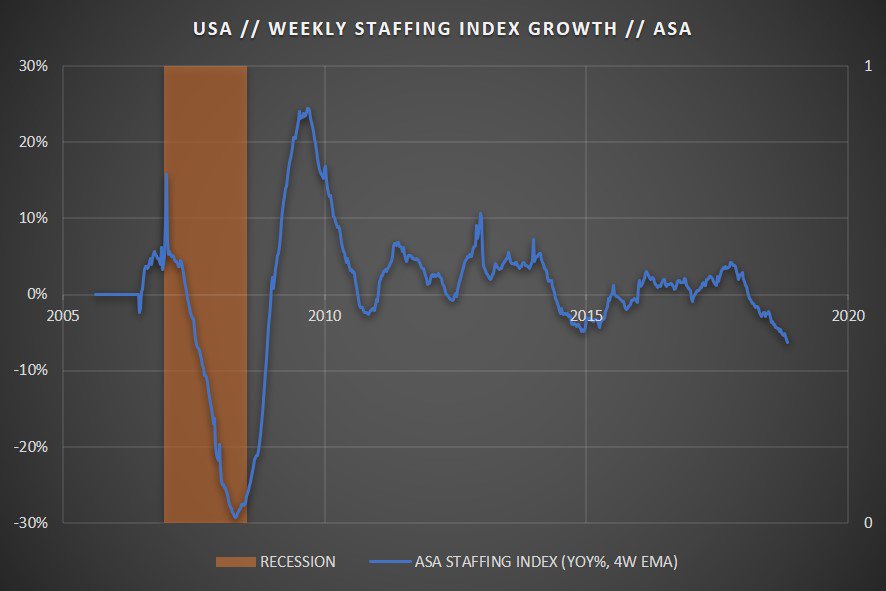

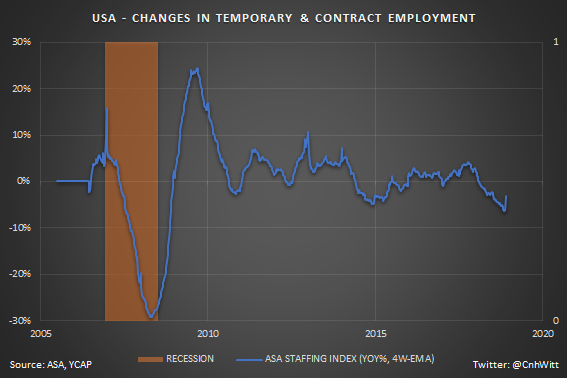

CC @StaffingData

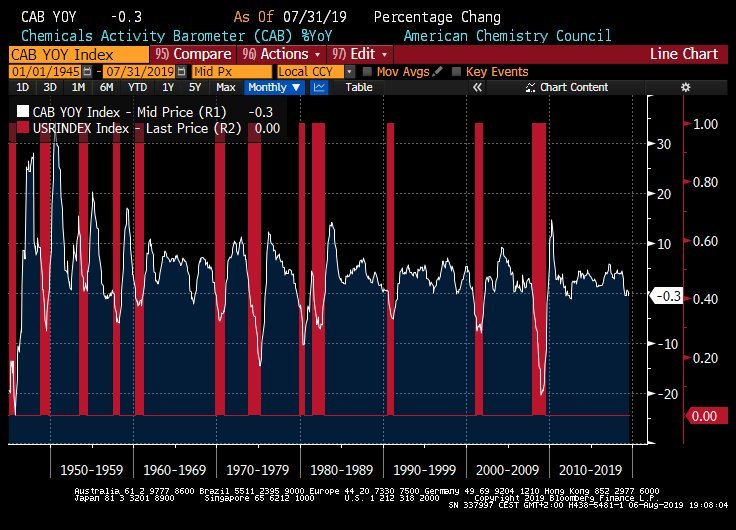

CC @AmChemistry @DrTKSwift

cc @StaffingData

cc @StaffingData

cc @StaffingData

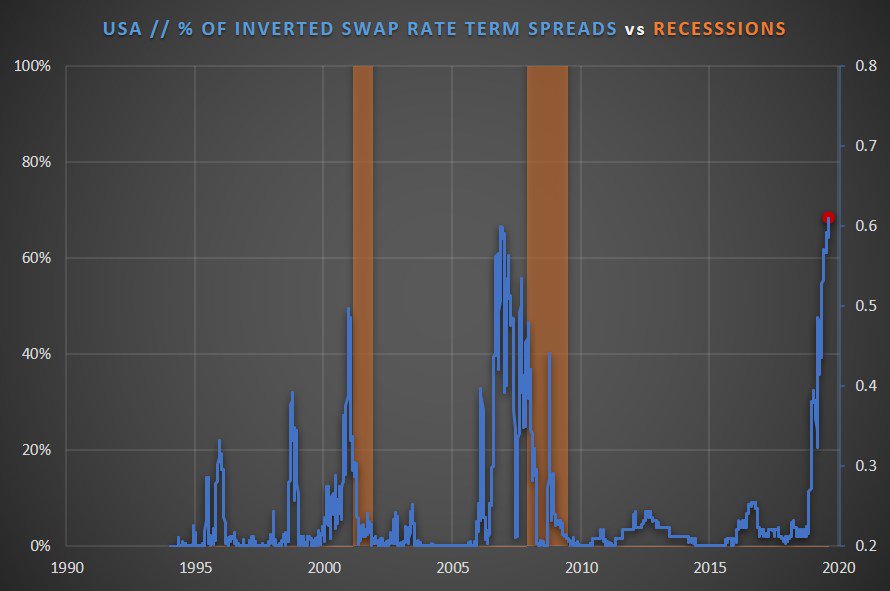

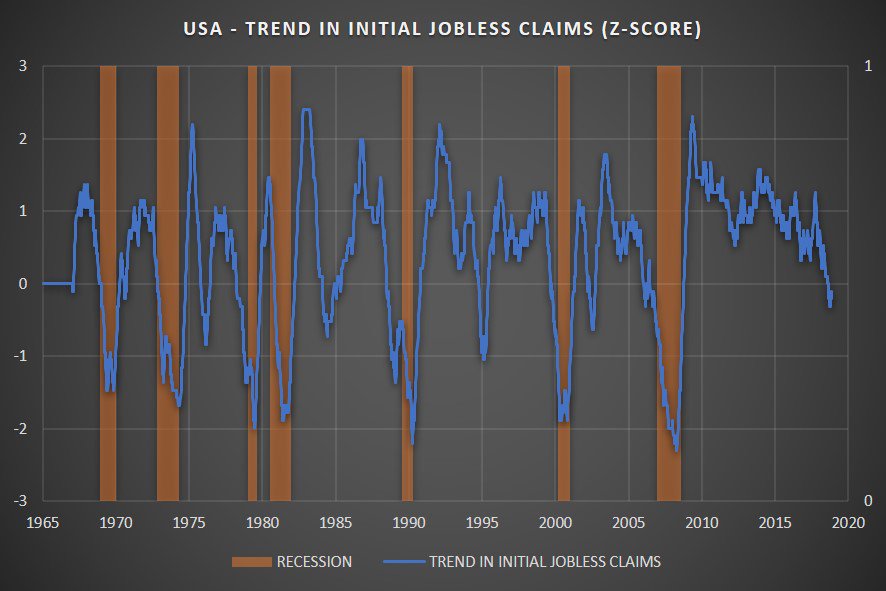

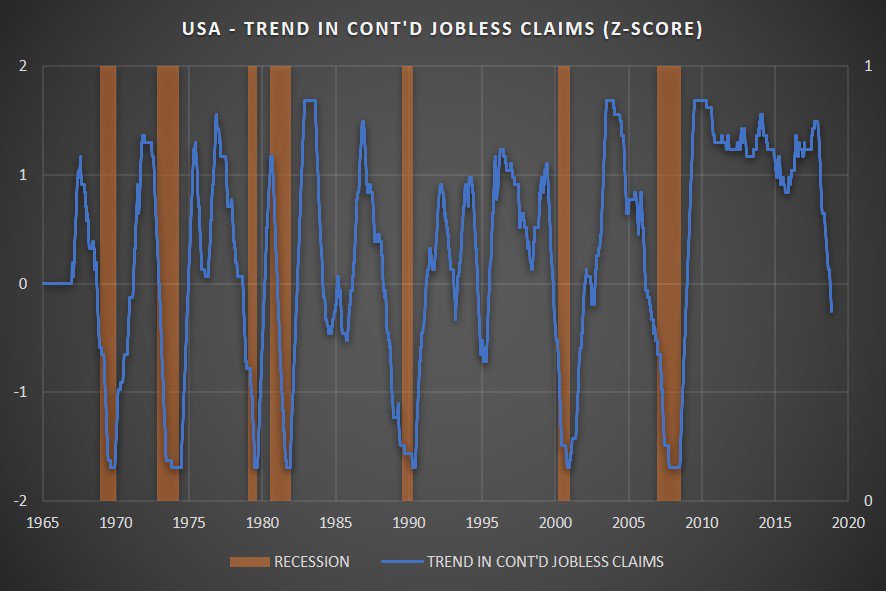

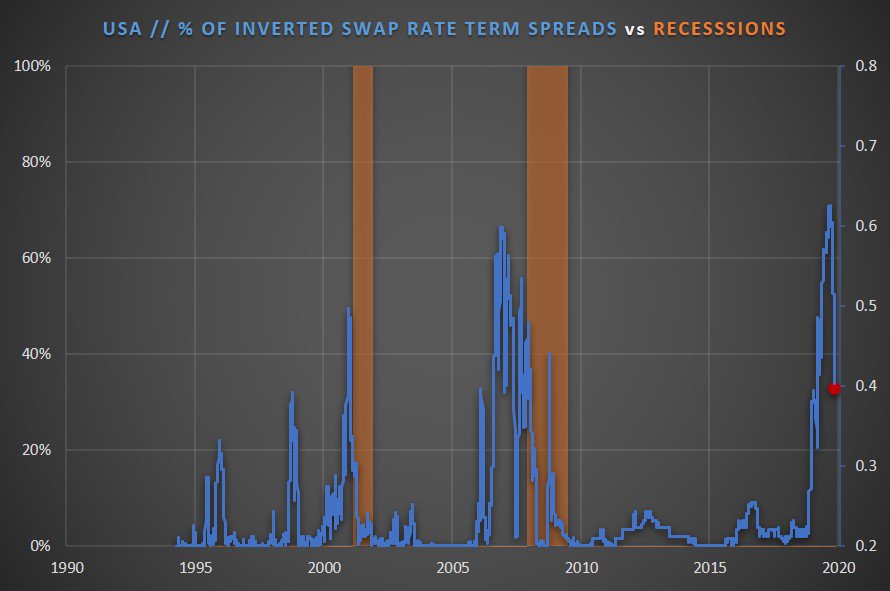

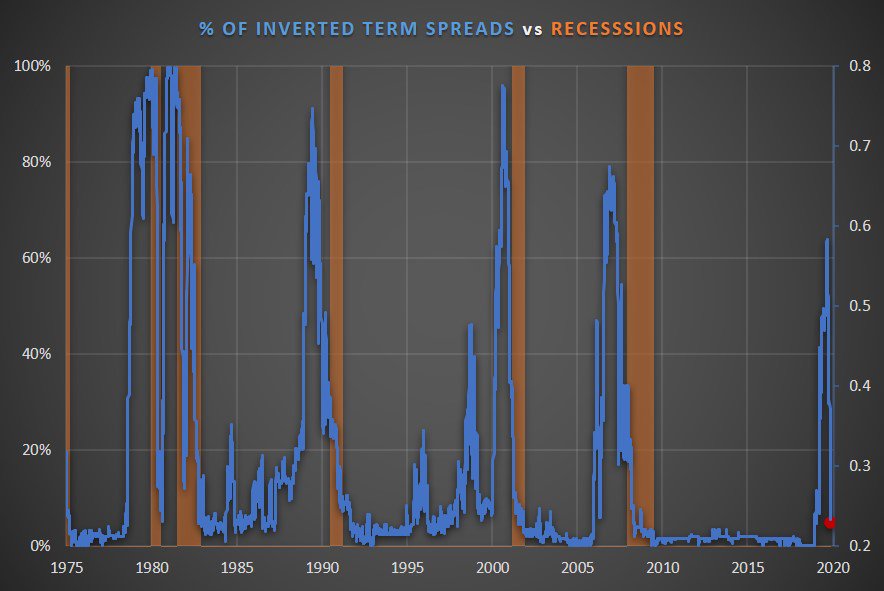

cc @economics

cc @StaffingData

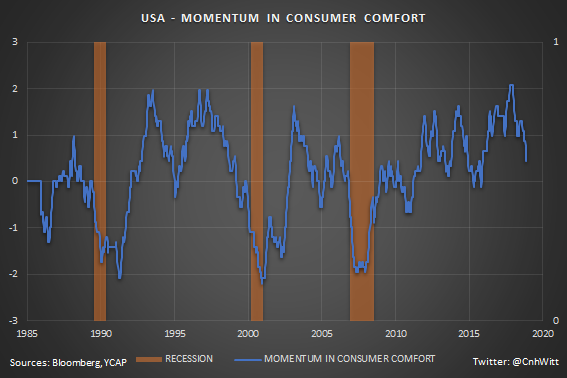

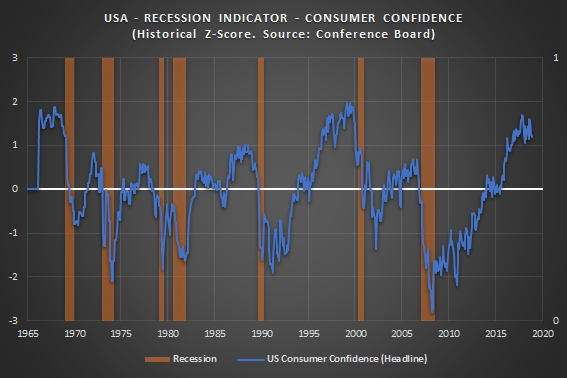

1) Headline consumer confidence 📉

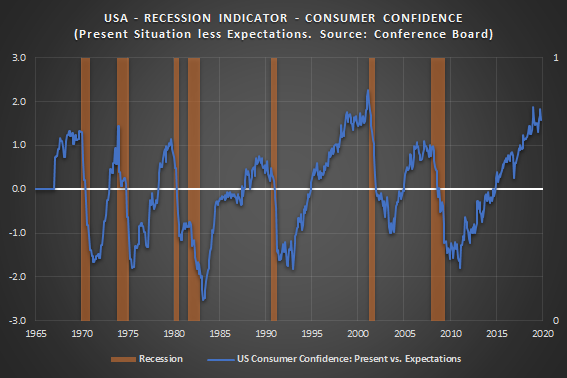

2) Ratio of current situation to expectations 📉

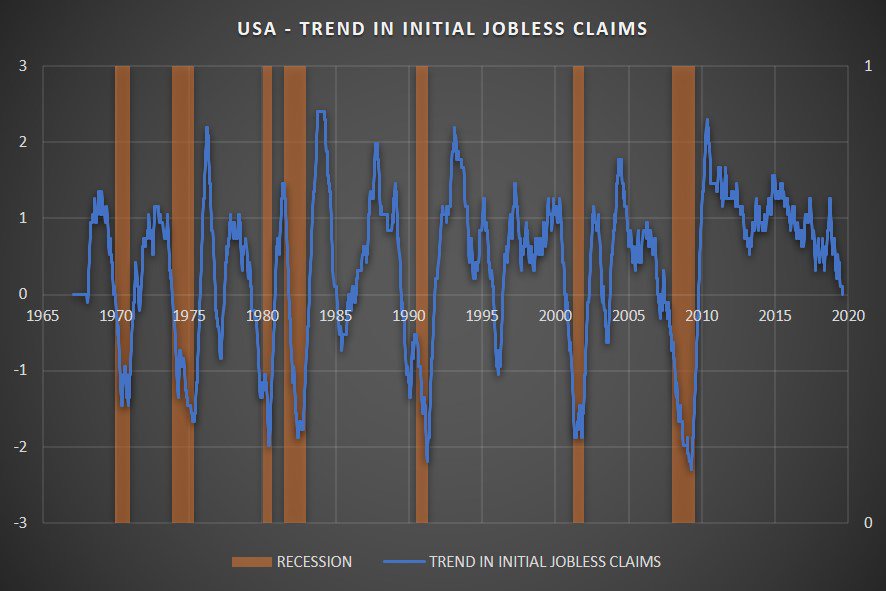

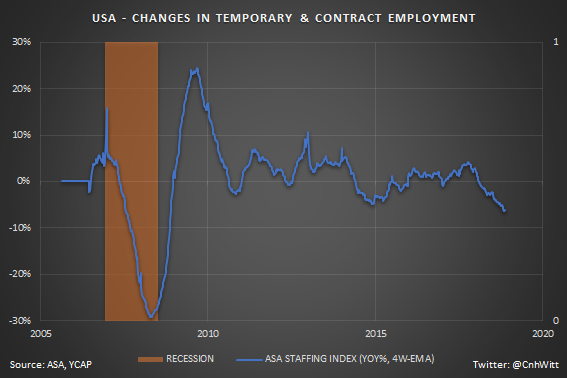

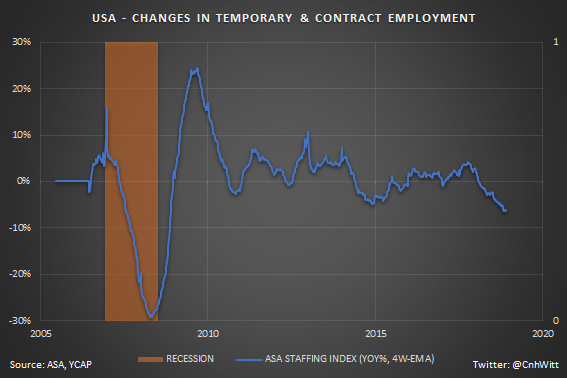

3) Labor market activity fading 📉

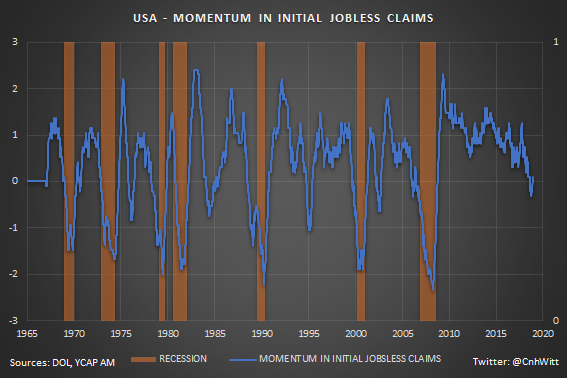

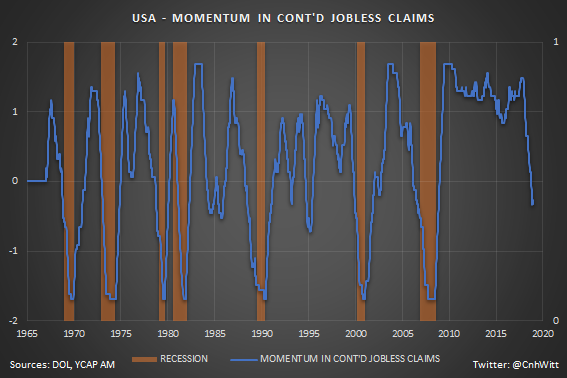

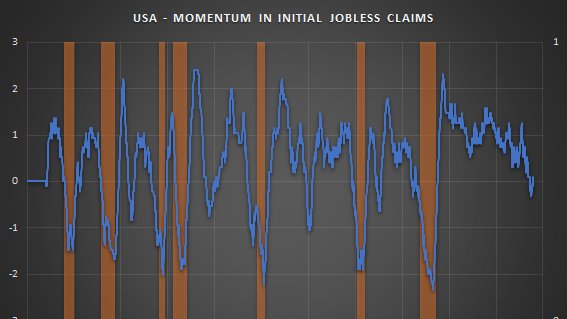

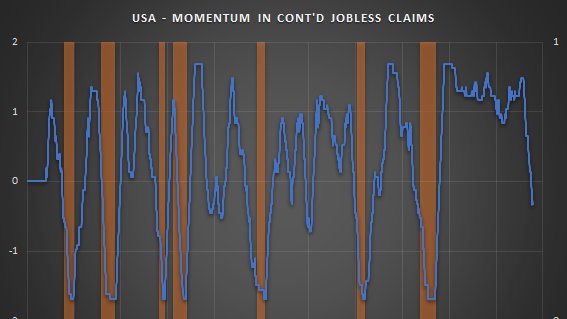

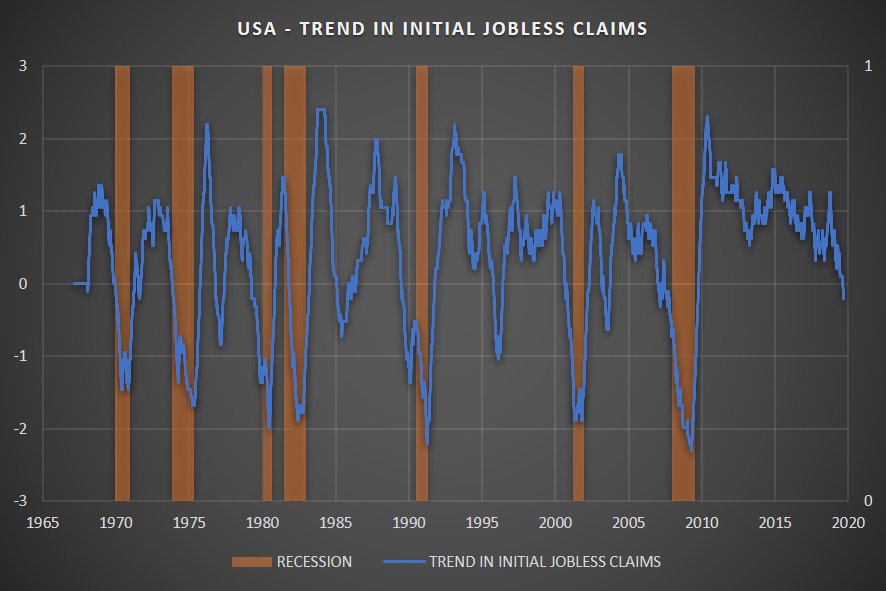

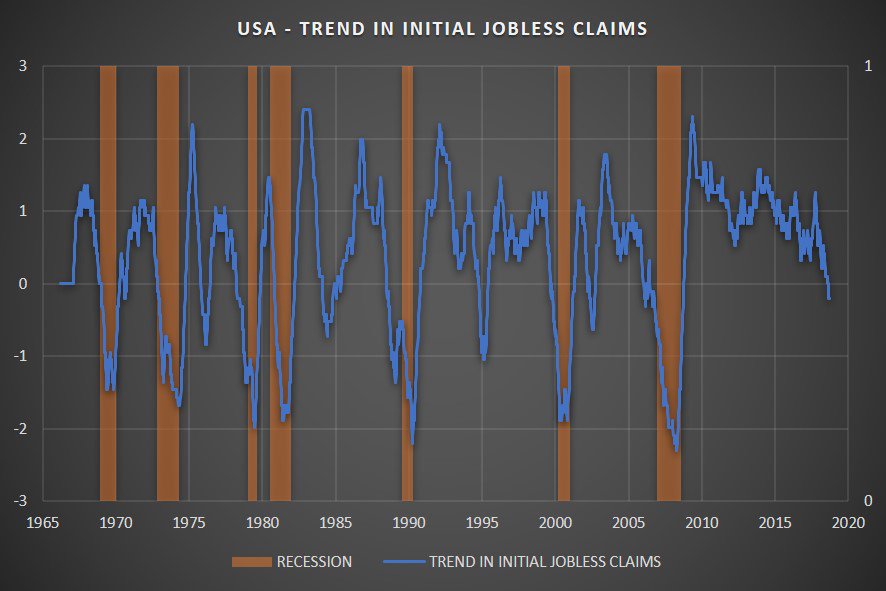

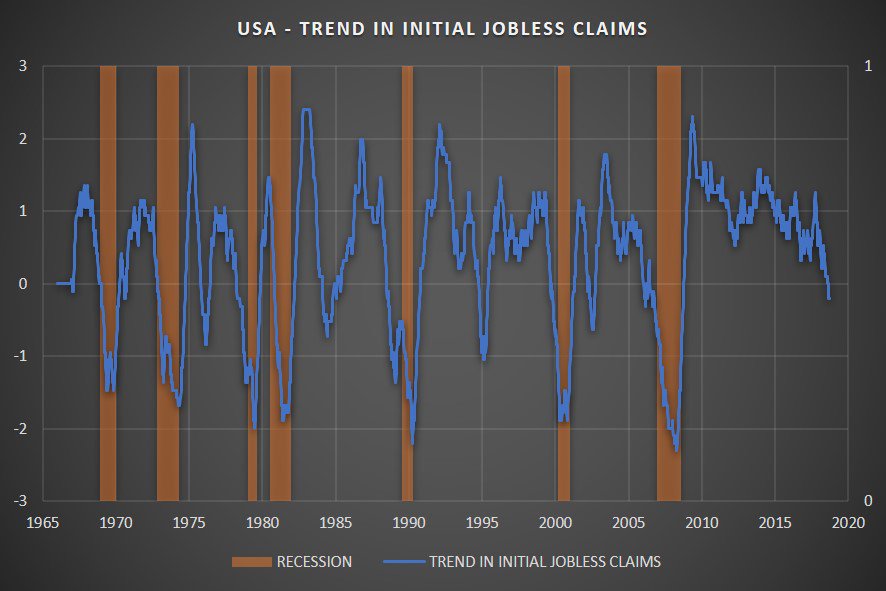

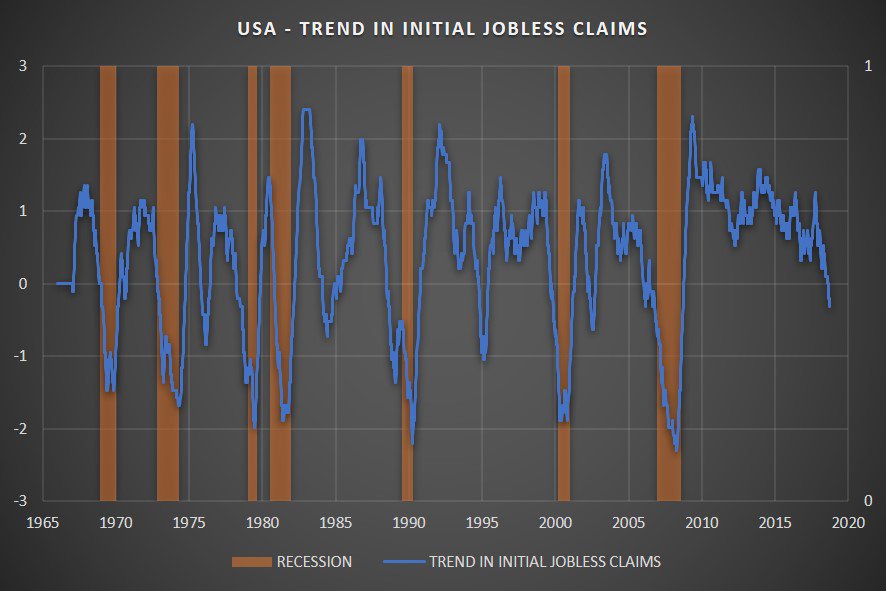

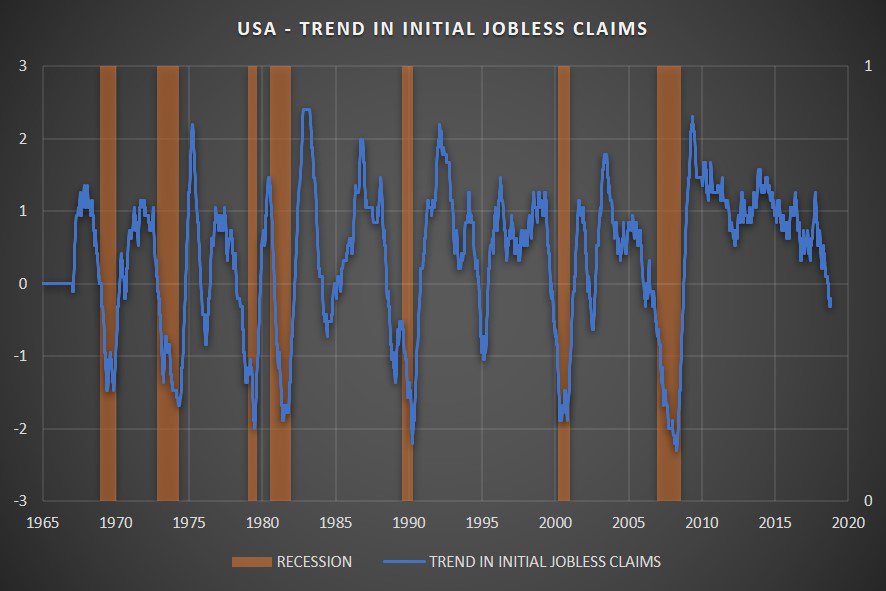

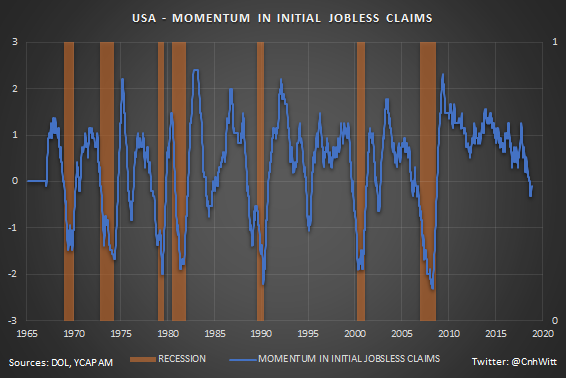

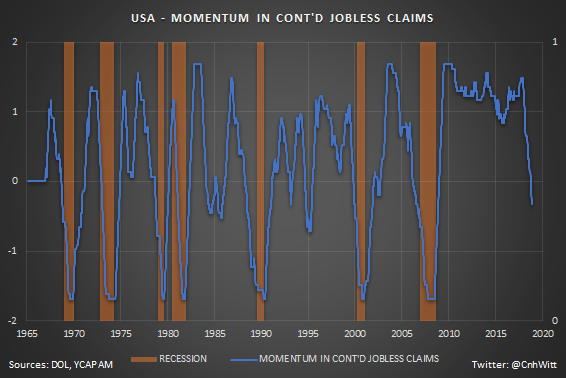

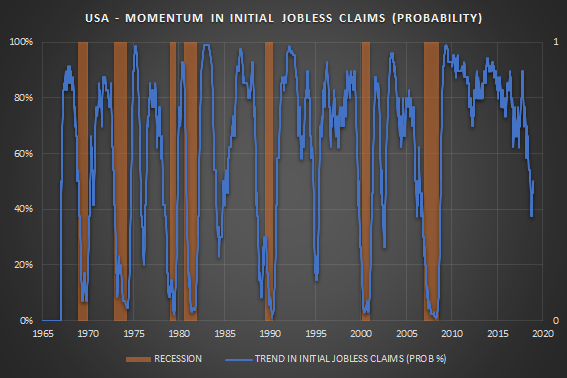

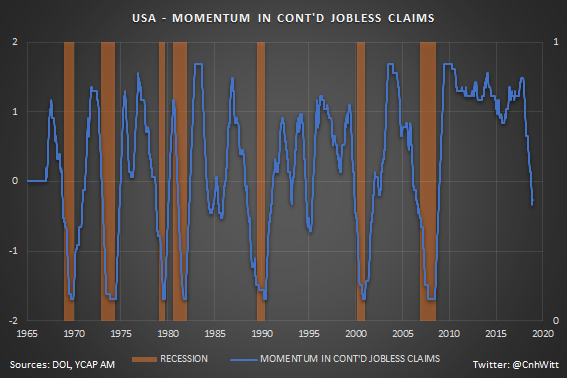

Initial jobless claims have so far been immune to the weakness in labor market conditions that surveys are showing (e.g. Conference Board consumer confidence, NFIB).

cc @StaffingData

cc @StaffingData