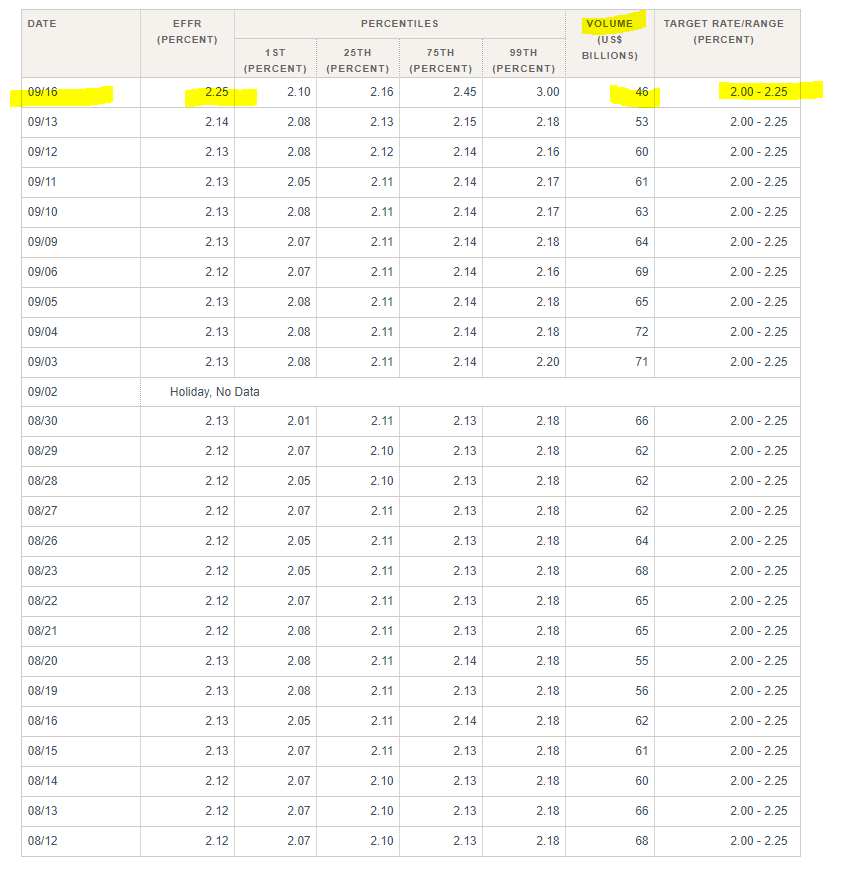

When this reaches the top end, it means demand for $ is strong👈🏻

Means demand for USD up👈🏻

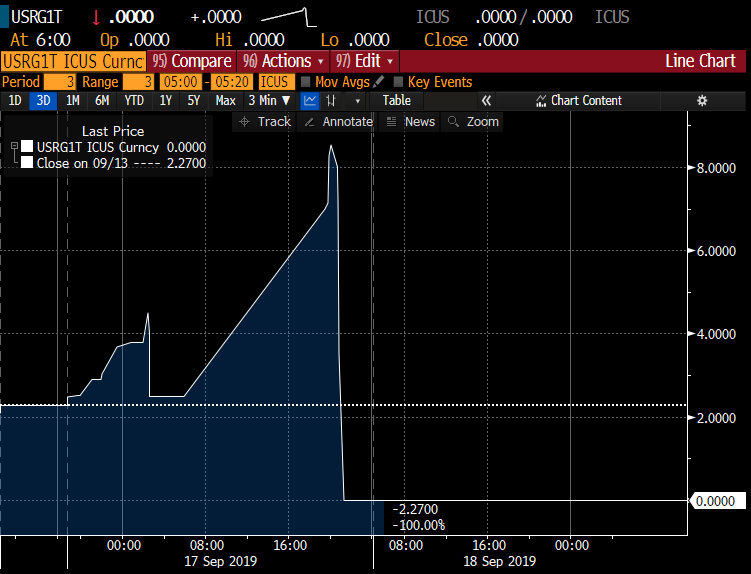

Overnight repo did that 👇🏻(demand for $high). The FEd steps in

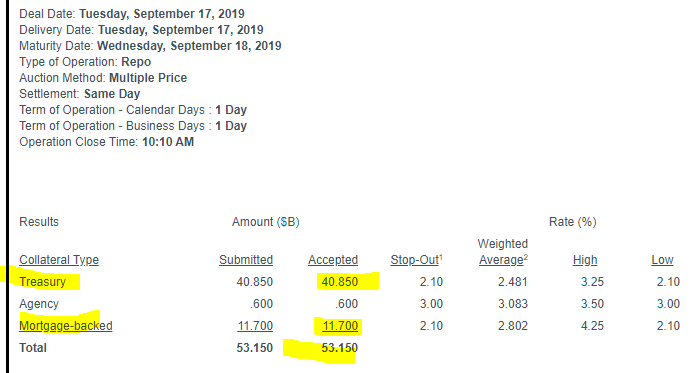

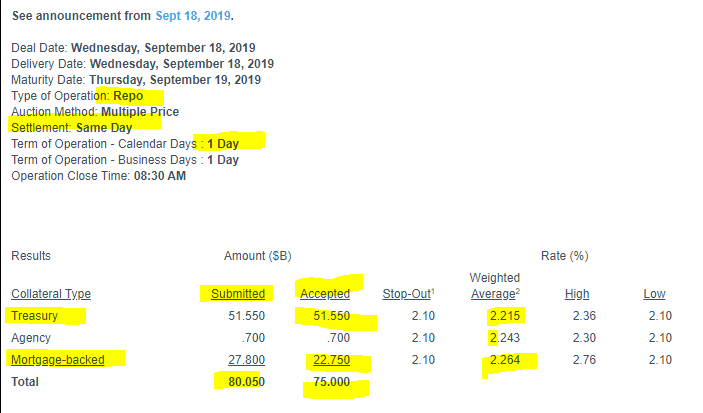

The NYFed says it will LEND 75bn for those that qualify & the kind of collateral it'll accept (treasury, agency, MBS).

This happened👇🏻& 53.15bn lent

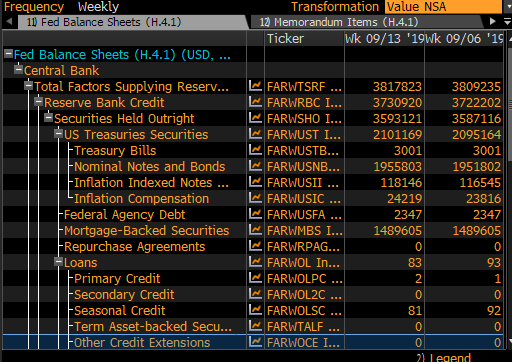

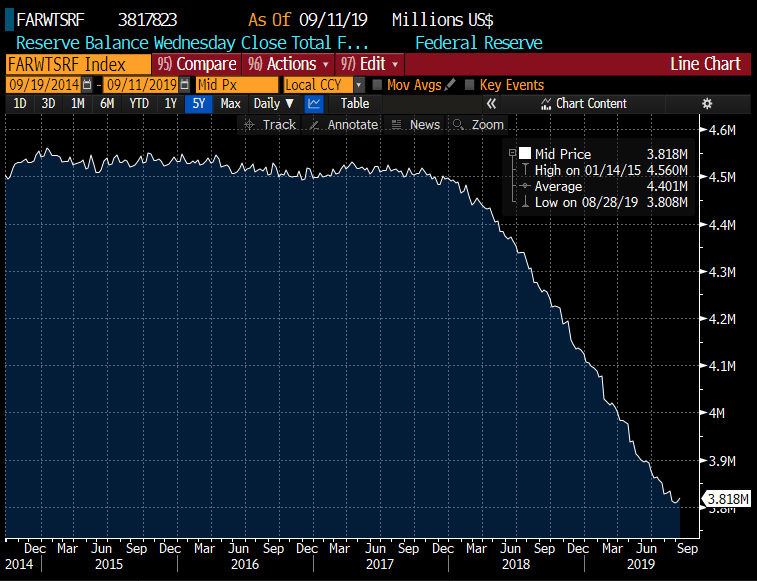

Let's zoom out a bit to talk beyond the short-term liquidity squeeze & focus on Fed balance sheet, which is 3.817trn down from peak of 4.56trn or -743bn

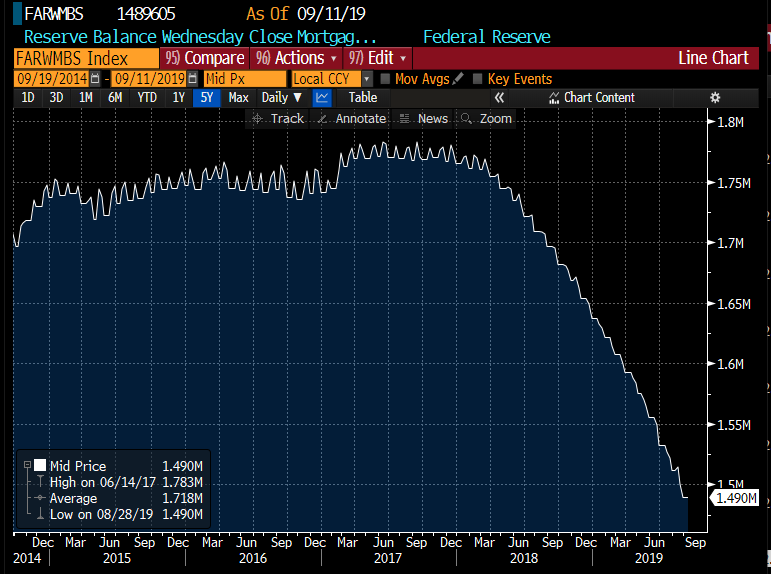

Fed has lots of USTs & MBS & reserves 👇🏻👇🏻

This is the reverse of what it did last night - by selling assets to the market, it takes $ from the system. How much? Well -743bn 👇🏻👇🏻

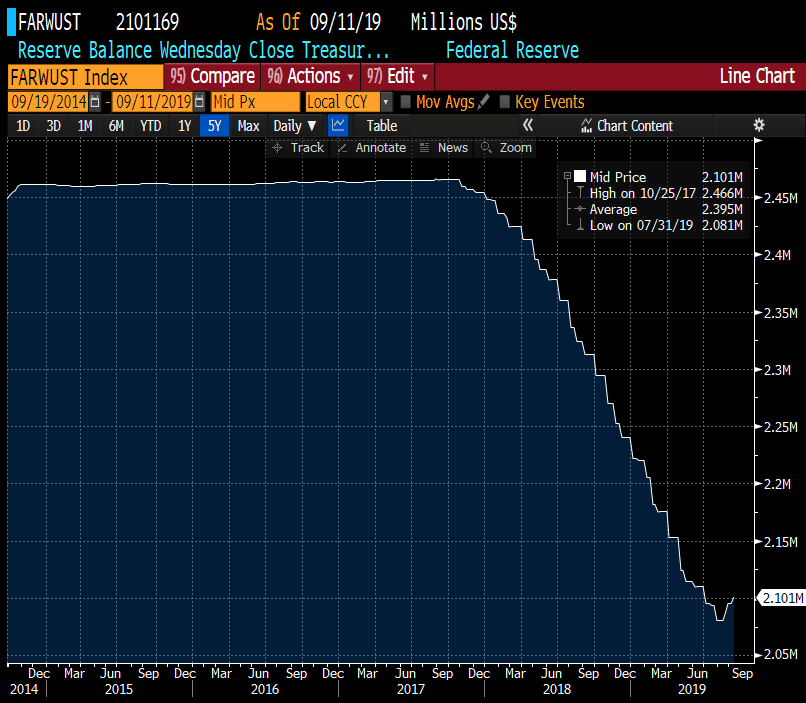

In terms of UST, reduced owning -365bn 👇🏻👇🏻👇🏻

👇🏻👇🏻👇🏻

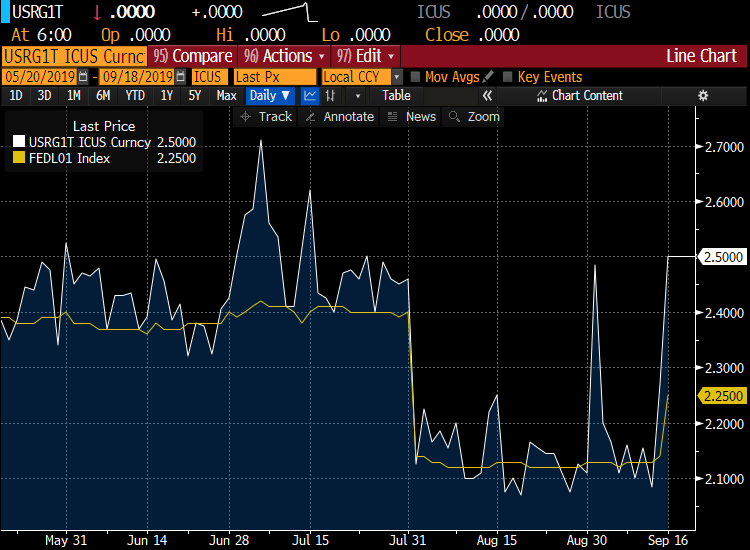

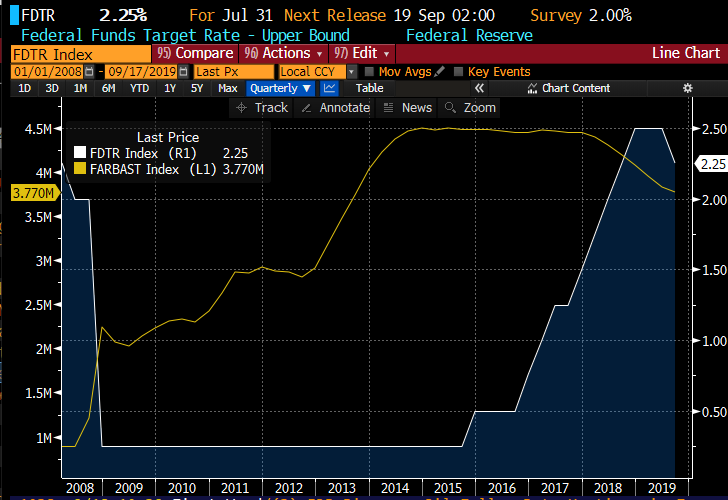

After the financial crisis, the Fed LOWERED RATES TO ZERO (white line show upper bound at 0.25% & lower bound 0%).

And it also BOUGHT ASSETS through what we call QUANTITATIVE EASING 👇🏻👇🏻

Notice that President Obama had easy money both his terms.

JYEL raised rates 25bps in 2015, 25bps 16, 75bps 17

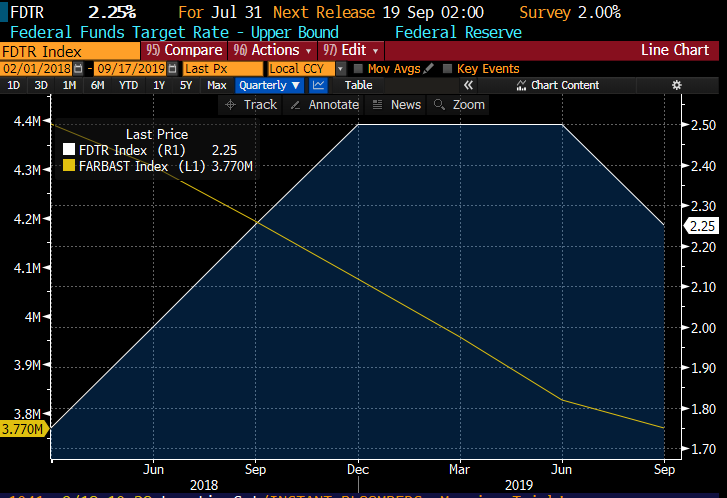

So the -743bn of reduction & also rates going 1.75% to 2.5% & now 2.25% happened mostly during 2018 & H1 2019👇🏻

Markets expect the Fed to cut rates by 25bps & also more in December by 25bps. This takes the upper bound to 2% tomorrow & 1.75% end 2019.

Why? Many reasons. But let me quickly name them...

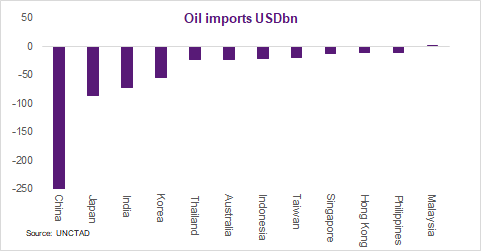

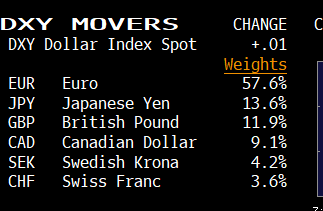

*Price of USD (rates at 2.25%) HIGHER than other econs as they CUT RATES & so demand for USD strong too

*USD too strong so global lending 📉(risk taking📉)

*US govie issuance 📈further squeezes liquidity

So what?

Let's talk about this!

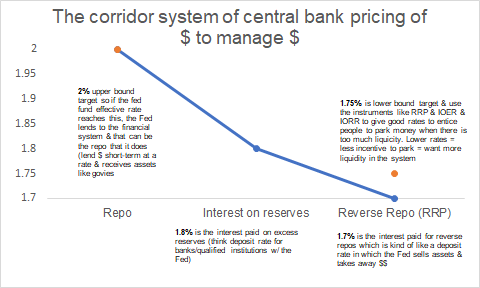

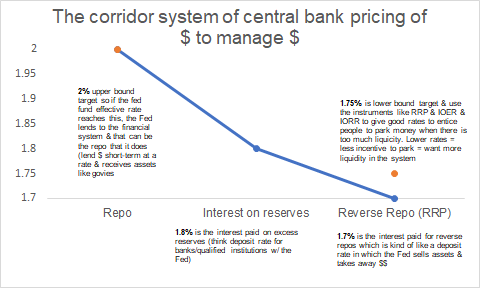

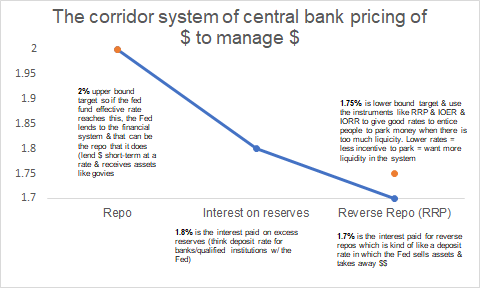

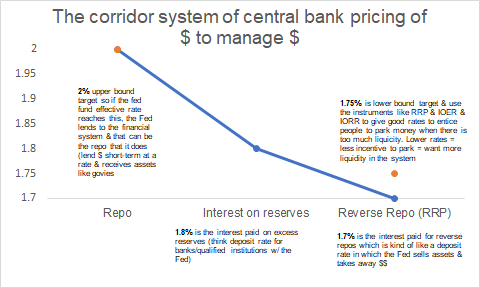

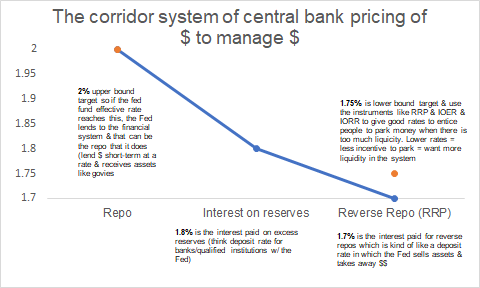

Talked about repo, which is short-term collateralized lending (days). Meaning, the Fed GIVES MONEY & takes ASSETS at a rate. Upper bound =lending

This is an equivalent of WITHDRAWING MONEY or DEPOSIT RATE for qualifying institutions.

RRP is 1.7% so dropped by 30bps last night 👇🏻

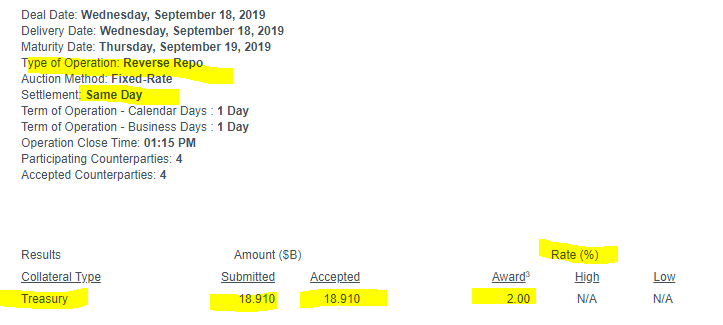

OK, for reverse repo or otherwise as collateralized DEPOSITS was USD18.9bn (treasury) & rate was 2% (will be lowered by 30bps to 1.7%)

The repo, or lending rate, was higher at 2.2% for Treasury👇🏻

This is different than quantitative easing (QE) because the Fed outright buys assets (treasury, mortgage backed securities) & to influence LONGER-TERM RATES. Key