Let me try to describe the basic idea. 2/

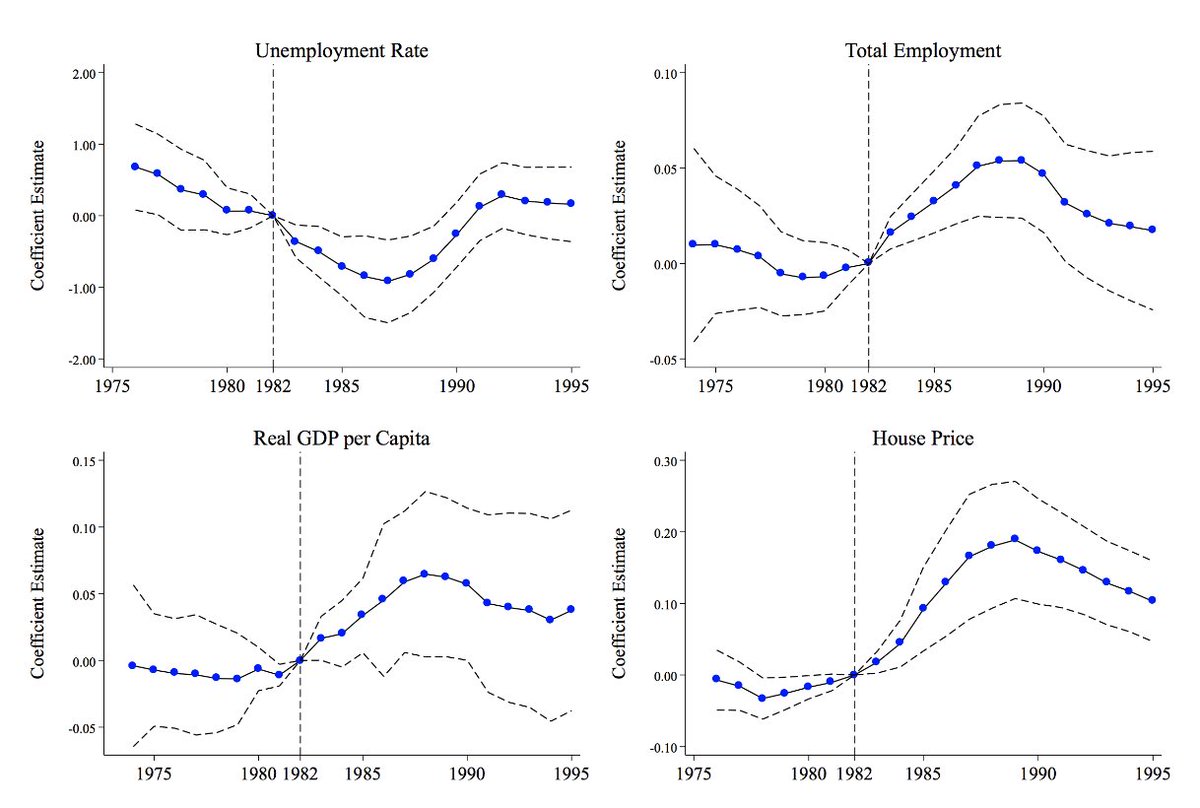

However, we find that the household demand channel played an important role in this episode. 9/

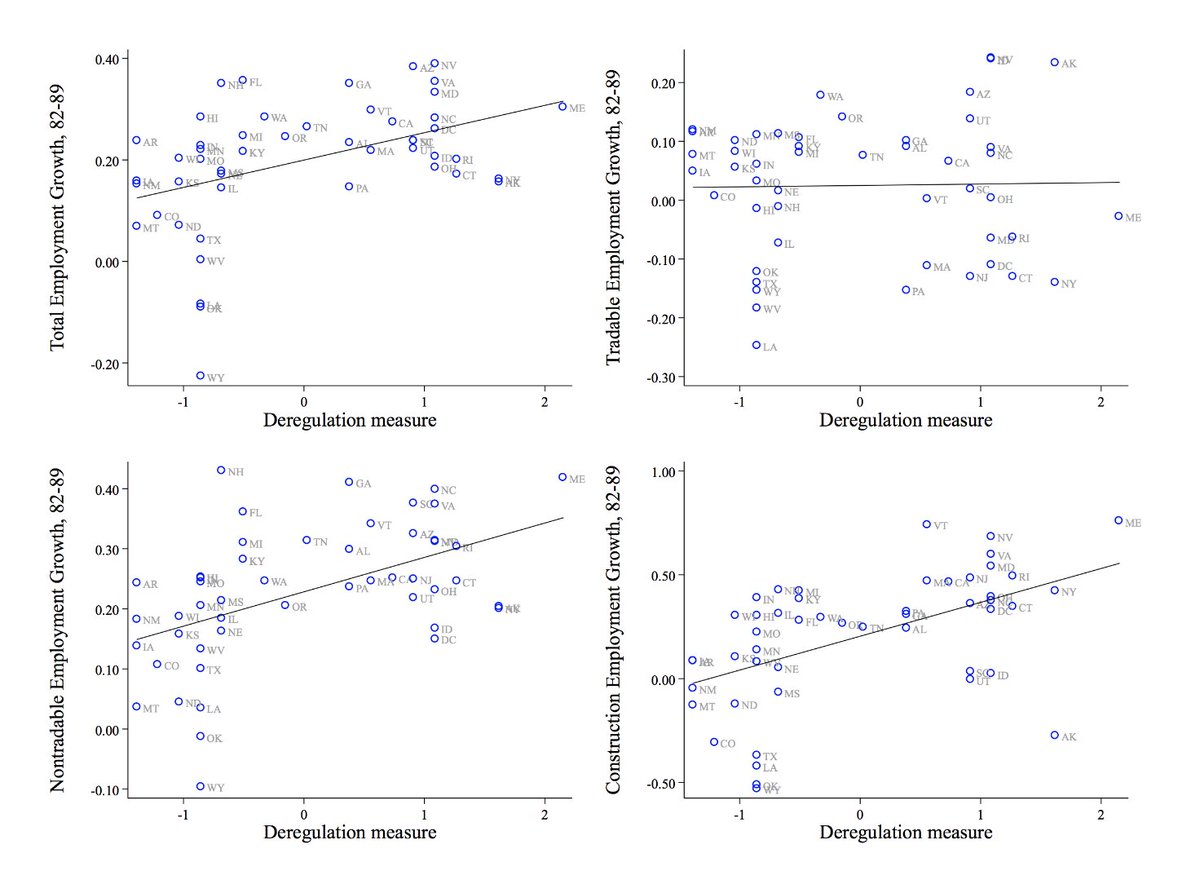

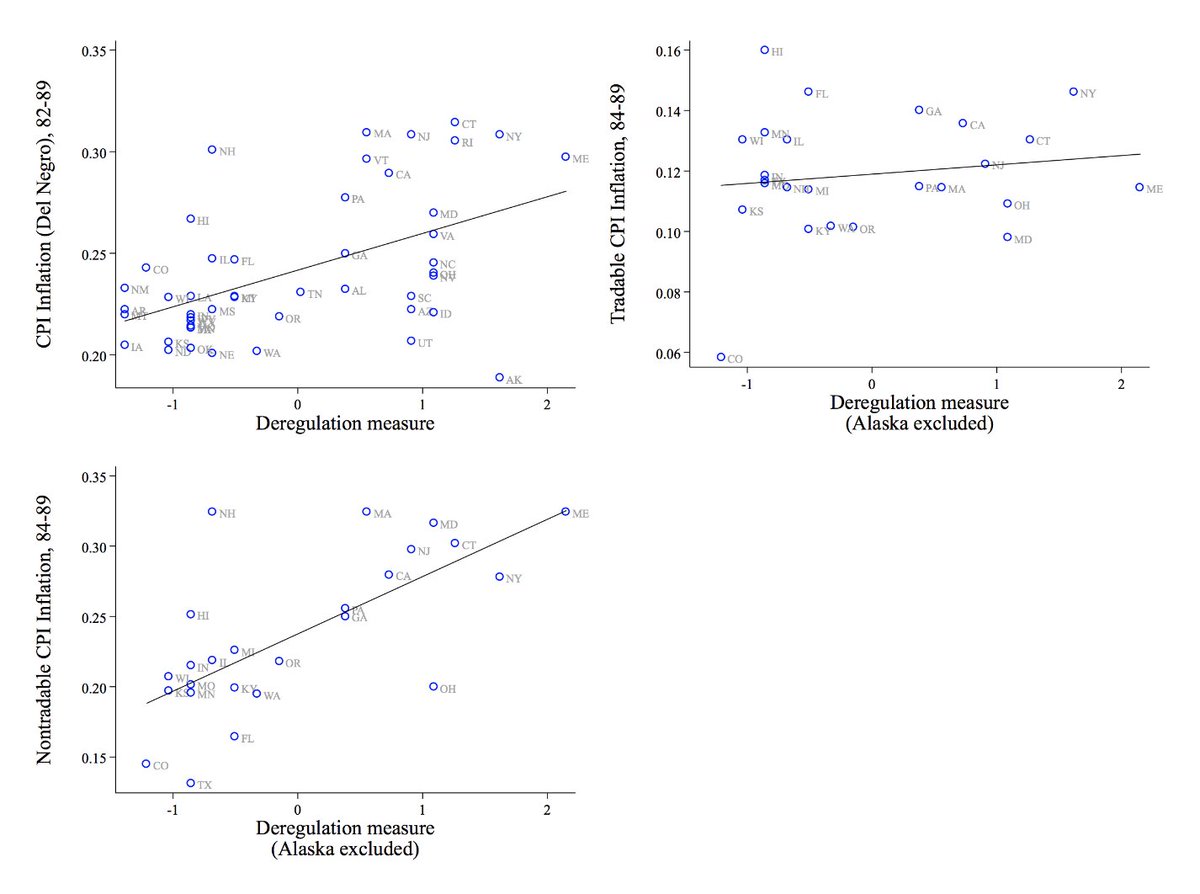

The reallocation to non-tradables and the increased scarcity of non-tradables suggests that a deregulation-induced credit expansion fueled a demand boom. 11/

The early deregulation states that saw a stronger credit boom in the 1980s also witnessed a *more severe downturn* during the 1990/91 recession. 12/

In US and international data, these credit-supply-induced demand booms are also likely to lead to busts down the road. end/