In the 2021's first issue of #Cantillon Effects, we discussed the #inflation which now pervades our lives: not just the narrow, disputed one relating to goods prices, but the inflation of rhetoric, passions, tribalism & despotism.

Over this thread, we'll present our case:-

1/x

Over this thread, we'll present our case:-

1/x

Replacing the "public square" with the "cyber swarm" has not been conducive to reason or civility, for all that it has opened up new possibilities of disseminating news and opinion.

2/x

2/x

The #stakeholder capitalism being built while we're confined to quarters is a world where, we're glibly assured, " you will (truly) own nothing - the #centralbank will ensure your fake asset's notional price is misleadingly high - and you'll be happy!" Really?

3/x

3/x

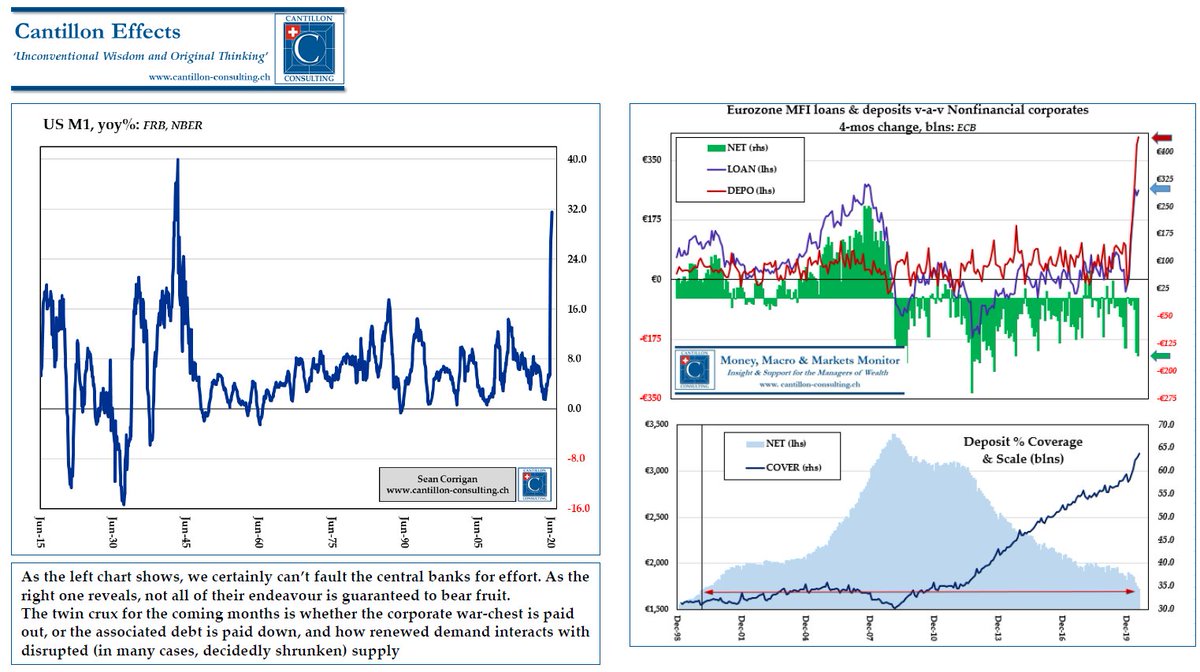

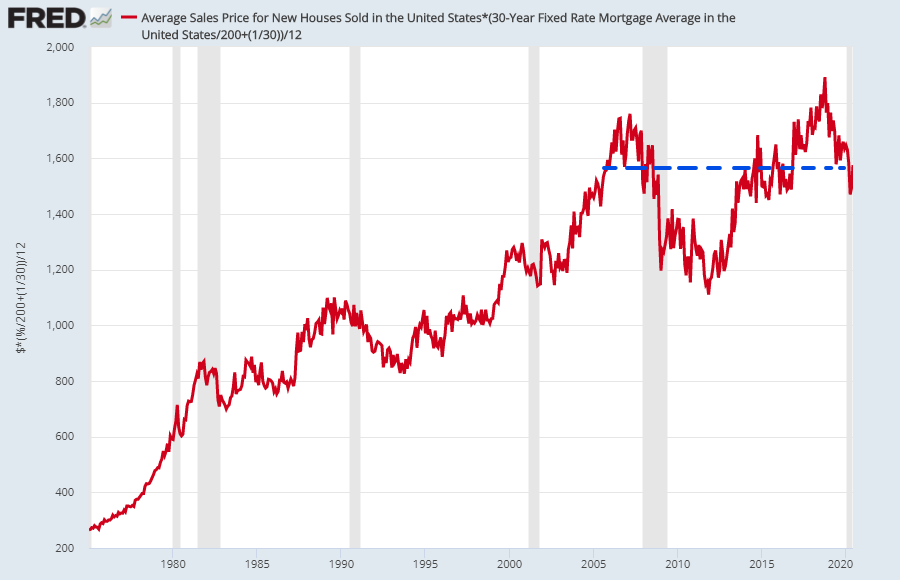

Why #inflation has been slow to make its presence felt and why that may be about to change. Once the gates of our prison are finally throw open, fiscal-#monetary overkill could produce a veritable conflagration.

4/x

4/x

Does the "Suits"' recent endorsement of #crypto constitute a genuine loss of faith in central bank monies or is it just a predictable bandwagon effect? Either way, it only hastens that Dies Irae when #CBDC-s are introduced. 6/x

Once these are in use, the present, dreadful trend of #sinification will be complete. Nothing will be private; our money will have variable value not just in general but in its specifics; stick and carrot will be inescapable. Brave New World! 7/x

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh