$VALUA

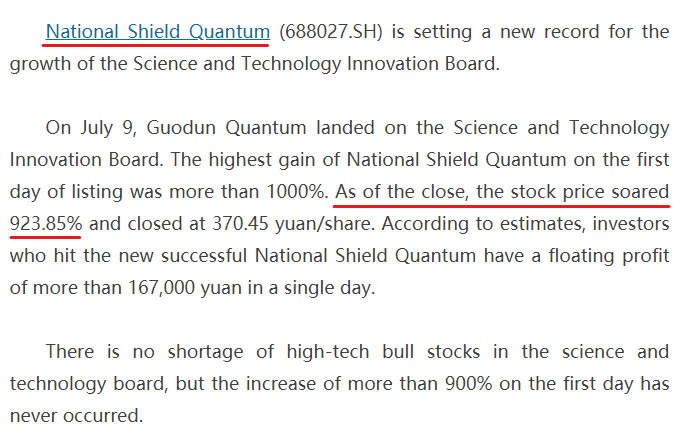

National Quantum #IPO briefy jumps to a 10-fold gain on first day of listing beating last week's record-breaker Tinavi Med-Tech - a poor relation on Tuesday with just 614% and leaving Geovis Technology Co's 438% Wed debut eating dust

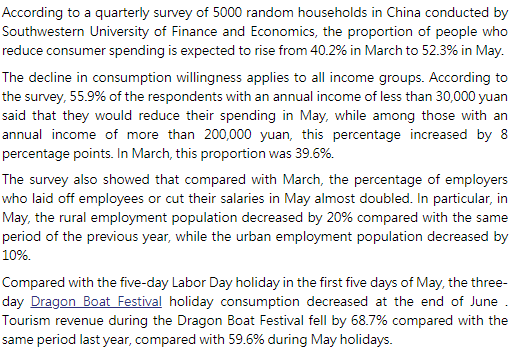

Additionally, local cynics say even foreign trade is largely viable because of the associated tax rebates (often heavily gamed, of course). No such scope exists in the home market

#China #stockbubble