It's weekend and it's the end of the month. The #markets are closed.

So there is the perfect time to analyze the #momentum & relative #strength of the markets.

This information is relevant for all #investors, but especially for #trend #followers 📈📈📈

#marketresearch

🧵

So there is the perfect time to analyze the #momentum & relative #strength of the markets.

This information is relevant for all #investors, but especially for #trend #followers 📈📈📈

#marketresearch

🧵

The #momentum of the markets are one of the most powerful forces in the evolution of the #asset #prices.

The #reversion to the mean is the opposite force, which is equally powerful. Momentum works on a short and medium term (up to 3 to 5 years).

The #reversion to the mean is the opposite force, which is equally powerful. Momentum works on a short and medium term (up to 3 to 5 years).

There is a ton of academic research related to the momentum and the benefits of using it and relative strength. But presenting it this is not the purpose of this #thread.

Relative strength is actually a comparison between the #momentum of two or more #markets.

Relative strength is actually a comparison between the #momentum of two or more #markets.

For an important part of my portfolio I use the momentum and the relative strength in order to determine the markets the I want to stay in.

This part of the portfolio is called #Trend #Following.

The other part #Buy&#Hold.

Those two parts are completing each other very well

This part of the portfolio is called #Trend #Following.

The other part #Buy&#Hold.

Those two parts are completing each other very well

I'm an #European investor, so I do not have direct access to #US listed #ETFs (although I can buy them using #options assignment).

So I will refer to especially to European #UCITS ETFs, but the information is equally relevant for all #investors, irrespective of their residence.

So I will refer to especially to European #UCITS ETFs, but the information is equally relevant for all #investors, irrespective of their residence.

If we were to deviate from a low-cost #global market-cap #ETF, we have to do it according to a certain plan, which increases our chances to get a better risk-adjusted #return.

That's why, in this case, I use the #momentum of the markets.

But now, let's see some simple tables ⬇️

That's why, in this case, I use the #momentum of the markets.

But now, let's see some simple tables ⬇️

Part of my investor heart definitely belongs to #value

I like the idea of buying something cheap and the academic research proves that value usually delivers #Alpha over the long term

But I like #cheap #markets when they are going up!

I like the idea of buying something cheap and the academic research proves that value usually delivers #Alpha over the long term

But I like #cheap #markets when they are going up!

So I made a ranking with different #Value #ETFs and sorted them by the #average obtained (average of the 3M, 6M and 12M).

I know that @MebFaber is also a huge fan of the cheap markets that are going up!

I know that @MebFaber is also a huge fan of the cheap markets that are going up!

@MebFaber Few conclusions related to the momentum of the #value ETFs:

1⃣ US Small Cap Value remains the leader (I make this ranking at the last weekend of every month)

2⃣ #Momentum & #trend really works. I stay invested only if the trend of the leader is positive.

1⃣ US Small Cap Value remains the leader (I make this ranking at the last weekend of every month)

2⃣ #Momentum & #trend really works. I stay invested only if the trend of the leader is positive.

3⃣ Over time, using momentum and trend "force" you to stay away from the lagging / downtrend markets and protects your capital. @jvogs02 wrote a lot about that.

4⃣ Combining #value and #momentum may boost your #returns over time

4⃣ Combining #value and #momentum may boost your #returns over time

@jvogs02 5⃣ US small cap value weighted ETF ($ZPRV) brings another layer of diversification in a portfolio where the benchmark is the All Country World Index ($ACWI). They are not so correlated and this helps a lot.

@jvogs02 6⃣ Using this kind of ranking helps you to avoid home country bias and makes you a better investor, because you choose to have exposure to the markets with the best relative strength.

7⃣ Over time, this creates a difference in returns ↗️

7⃣ Over time, this creates a difference in returns ↗️

@jvogs02 8⃣Once the relative strength of a #Market A is exceeded by the relative strength of the Market B, you are free to move you #exposure to Market B. Trend followers have no loyalty to the markets. This implies transaction and tax costs that need to be taken into account.

@jvogs02 But now let's analyze the geographical momentum (how different countries / regions performed in the last 12 M).

According to @GaryAntonacci's research, momentum works best when comparing different geographic markets. His book, "Dual Momentum" is exceptional and helped me a lot.

According to @GaryAntonacci's research, momentum works best when comparing different geographic markets. His book, "Dual Momentum" is exceptional and helped me a lot.

I will make a #pause and I will revert to this thread 😉

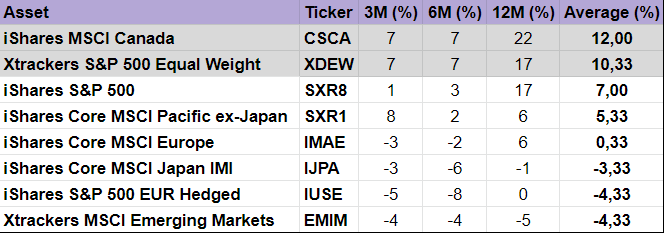

So here are the return of different geographical markets over the last 3M, 6M and 12M. I sorted them by the average of those returns. My aim is to identify the markets with the strongest momentum.

All returns are in EUR with dividends included.

All returns are in EUR with dividends included.

So #MSCI #Canada #Index 🇨🇦 (or $EWC for our fellow American investors) was the best performing geographical index (among those analyzed above).

The great exposure to #energy and #materials sectors & the evolution of #Canadian #Dollar definitely helped a lot.

The great exposure to #energy and #materials sectors & the evolution of #Canadian #Dollar definitely helped a lot.

The nice thing is that #Canada #ETF is in top 2 ETFs from the list for more than one year.

So, such #exposure would have been very beneficial for the investors 😉

So, such #exposure would have been very beneficial for the investors 😉

What really amazes me is the difference of #return over la last 12M between the best & the worst performing #market:

#MSCI #Canada 🇨🇦: +22%

MSCI #Emerging #Markets 🇨🇳 🇹🇼 🇮🇳 🇰🇷 🇧🇷: -5%

Although the equity markets are correlated, geographical diversification still works!

#MSCI #Canada 🇨🇦: +22%

MSCI #Emerging #Markets 🇨🇳 🇹🇼 🇮🇳 🇰🇷 🇧🇷: -5%

Although the equity markets are correlated, geographical diversification still works!

This does not look great at all for the Emerging Markets (orange line) especially in comparison with Canada (blue line).

Emerging markets are indeed cheap today. Maybe there are reasons for this. And what is cheap it may also get cheaper 📉📉📉

Emerging markets are indeed cheap today. Maybe there are reasons for this. And what is cheap it may also get cheaper 📉📉📉

The second best performing #ETF from my list was the one tracking S&P 500 #Equal #Weight (blue)

It outperformed the classic #market-cap weighted ETF (orange) in the last 3 months

This is due to underperformance in 2022 of the large-growth stocks relative to the rest of the mkt

It outperformed the classic #market-cap weighted ETF (orange) in the last 3 months

This is due to underperformance in 2022 of the large-growth stocks relative to the rest of the mkt

I tweeted about this S&P 500 Equal Weight ETF:

It is an interesting way of constructing your portfolio, by reducing the exposure to large + growth and increasing your exposure to mid/small and value

@CliffordAsness also referred to that in the past

https://twitter.com/sense4investors/status/1518841837124997121

It is an interesting way of constructing your portfolio, by reducing the exposure to large + growth and increasing your exposure to mid/small and value

@CliffordAsness also referred to that in the past

@CliffordAsness Although S&P 500 #Equally #Weight ETF and S&P 500 #Market-cap Weighted had the same return over the last 12M, S&P 500 Equally Weight has a better relative #strength, because it performed better on a short term basis (3M and 6M).

Another really interesting finding is that both #SXR8 and #IUSE #ETFs (that are tradeable in EUR and are tracking the same index: S&P 500) had very different return profiles (+17 vs 0)

This is bc IUSE is #EUR-hedged and the EUR massively underperformed to #USD in the last year

This is bc IUSE is #EUR-hedged and the EUR massively underperformed to #USD in the last year

By using #momentum, #trend and relative #strength, you would have avoided the exposure to #Emerging #Markets in the last year.

Although are cheap, emerging markets are not going up. So I opted to avoid exposure there. $EEM, #EMIM

Although are cheap, emerging markets are not going up. So I opted to avoid exposure there. $EEM, #EMIM

In the next tweet, we will analyze the #evolution of certain #sectors of the #StockMarket

Stay tuned 😉

Stay tuned 😉

So here is the ranking of the returns generated by different #sectors of the #MSCI #World #Index

#Energy #Sector is the best performing sector in the last year, with an amazing return of 69% (in EUR, with dividends reinvested). $XLE

#Energy #Sector is the best performing sector in the last year, with an amazing return of 69% (in EUR, with dividends reinvested). $XLE

And the nice thing about #momentum & #trend si that it allows you to get on the good train (in the case, #energy #

sector) EARLY!

sector) EARLY!

The trends are clear now: commodity drives sectors (#Energy, #agriculture, #gold, #materials) are in an uptrend. Defensive sectors (#utilities and #consumer #staples) are also up.

These trends may last more than we expect (especially considering the valuations).

These trends may last more than we expect (especially considering the valuations).

On the other hand, #tech, #consumer #discretionary and #communication services are in an downtrend.

Those trends may also continue more than we expect, considering the performance of those #sectors in the last 10 years and the force of mean #reversion. #markets

Those trends may also continue more than we expect, considering the performance of those #sectors in the last 10 years and the force of mean #reversion. #markets

I like not to anticipate, but just to participate in the big long-term trends.

That's why I've been allocating to #energy and #agriculture for almost an year ago.

The method and indicators may be tweaked, but the principle remains the same. $XLE #XDW0

That's why I've been allocating to #energy and #agriculture for almost an year ago.

The method and indicators may be tweaked, but the principle remains the same. $XLE #XDW0

How about #real #assets (#gold / #commodities / real estate)?

How this they perform in the last year?

Are they in an uptrend, protecting the holders from inflation?

Well, let's see 👇

How this they perform in the last year?

Are they in an uptrend, protecting the holders from inflation?

Well, let's see 👇

So here is the performance of the real assets.

Commodities performed best and offered protection against inflation.

#Commodities and #Gold also offer a real #diversification to #Equities.

Do you have commodities exposure?

Commodities performed best and offered protection against inflation.

#Commodities and #Gold also offer a real #diversification to #Equities.

Do you have commodities exposure?

I'm glad that #trend following rules "obliged" me to have exposure to #commodities and not have any exposure to #cryptocurrencies.

Don't anticipate, just participate! 😉

Don't anticipate, just participate! 😉

Momentum and #trend also kept me away from #cryptocurrencies this year.

I avoided all these #losses, staying on the sidelines while other are losing their accounts.

Once again, it is confirmed that it is an excellent #strategy for preserving and grow your #wealth.

End of 🧵

I avoided all these #losses, staying on the sidelines while other are losing their accounts.

Once again, it is confirmed that it is an excellent #strategy for preserving and grow your #wealth.

End of 🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh