Here are some highlights from the Voices of Tomorrow Bangalore Chapter! (1/n)

#VoicesofTomorrow #VoT2023 #ithoughtVoT #ithoughtVoT2023

#VoicesofTomorrow #VoT2023 #ithoughtVoT #ithoughtVoT2023

Session #01

ithought Way – The Journey by Mr Shyam Sekhar

Mr @shyamsek answers the question, ‘What pain points does ithought address & solve?’ (2/n)

#ithought #portfoliomanagement #financialplanning

ithought Way – The Journey by Mr Shyam Sekhar

Mr @shyamsek answers the question, ‘What pain points does ithought address & solve?’ (2/n)

#ithought #portfoliomanagement #financialplanning

“We want to make Millennials as $ Millionaires – a well-managed wealth corpus for the 90’s born.” - @shyamsek on what ithought wants to accomplish.

Watch Mr Shyam Sekhar’s talk ‘ithought Way – The Journey’ here youtube.com/live/Gyg3D2djS… (3/n)

#investors #investearly

Watch Mr Shyam Sekhar’s talk ‘ithought Way – The Journey’ here youtube.com/live/Gyg3D2djS… (3/n)

#investors #investearly

Session #02

Budget & International Investing by Mr Kalpen Parekh

@KalpenParekh starts with a question - "If you were an alien from Mars, how would you invest on earth?" @dspmf (4/n)

#UnionBudget2023 #globalinvesting #DSPMutualFund

Budget & International Investing by Mr Kalpen Parekh

@KalpenParekh starts with a question - "If you were an alien from Mars, how would you invest on earth?" @dspmf (4/n)

#UnionBudget2023 #globalinvesting #DSPMutualFund

No country ‘always’ stays at the top!

Watch Mr @KalpenParkeh’s talk ‘Budget & International Investing’ here - youtube.com/live/Gyg3D2djS… @dspmf (5/n)

#Budget2023 #investments #DSPMutualFund

Watch Mr @KalpenParkeh’s talk ‘Budget & International Investing’ here - youtube.com/live/Gyg3D2djS… @dspmf (5/n)

#Budget2023 #investments #DSPMutualFund

Session #03

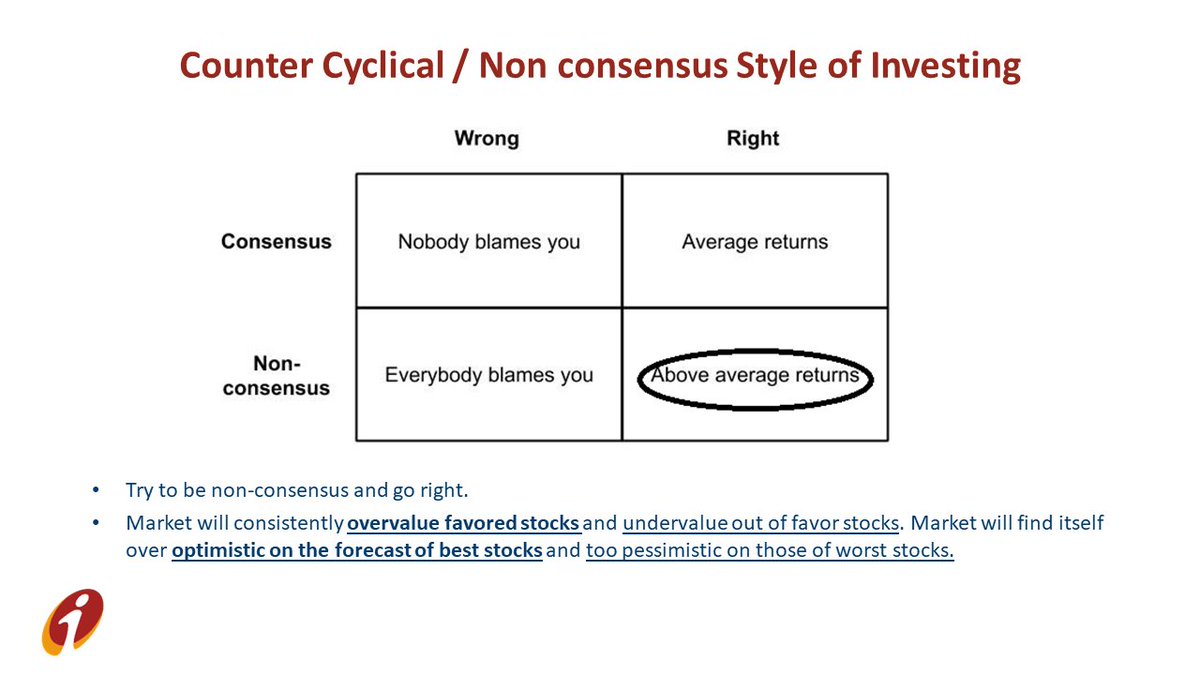

The Indian Equity Opportunity by Mr @Ihabdalwai @ICICIPruMF (6/n)

#stockmarket #equity #investing #ICICIMutualFund

The Indian Equity Opportunity by Mr @Ihabdalwai @ICICIPruMF (6/n)

#stockmarket #equity #investing #ICICIMutualFund

“Try to be non-consensus and go right. Market will consistently overvalue favoured stocks and undervalue out of favour stocks. Market will find itself over optimistic on forecast of best stocks and too pessimistic on those of worst stocks.”, @Ihabdalwai (7/n)

#stockmarket

#stockmarket

“Trick is to avoid investing in sectors or markets, where investment spending is unduly elevated & competition is fierce, and to put one’s money to work where capital expenditure is depressed, competitive conditions are more favourable. (8/n)

#investing #wealth #NIFTY

#investing #wealth #NIFTY

As a result, prospective returns are higher.”, Mr @Ihabdalwai, @ICICIPruMF

Watch Mr @Ihabdalwai’s talk ‘The Indian Equity Opportunity’ here - youtube.com/live/Gyg3D2djS… (9/n)

#equity #opportunity #NIFTY

Watch Mr @Ihabdalwai’s talk ‘The Indian Equity Opportunity’ here - youtube.com/live/Gyg3D2djS… (9/n)

#equity #opportunity #NIFTY

Session #04

The Indian Fixed Income Opportunity by Mr Anupam Joshi, @hdfcmf (10/n)

#FixedIncome #Debt #inflation #interestrates #HDFCMutualFund

The Indian Fixed Income Opportunity by Mr Anupam Joshi, @hdfcmf (10/n)

#FixedIncome #Debt #inflation #interestrates #HDFCMutualFund

“Long-duration debt should be at the core of asset allocation.”

“How long you stay invested for will likely be the single most important factor determining how well you do at investing”- Morgan Housel (11/n)

#fixeddeposits #interestrates

“How long you stay invested for will likely be the single most important factor determining how well you do at investing”- Morgan Housel (11/n)

#fixeddeposits #interestrates

Interest rates fall as countries move up the economic ladder. Despite the recent increases, overall yields have shown a downtrend for growing economies. (12/n)

#interestrates #inflation #indianeconomy

#interestrates #inflation #indianeconomy

Watch Mr Anupam Joshi’s talk ‘The Indian Fixed Income Opportunity’ here youtube.com/live/Gyg3D2djS…

@hdfcmf (13/n)

#FixedIncome #Debt

@hdfcmf (13/n)

#FixedIncome #Debt

Session #05

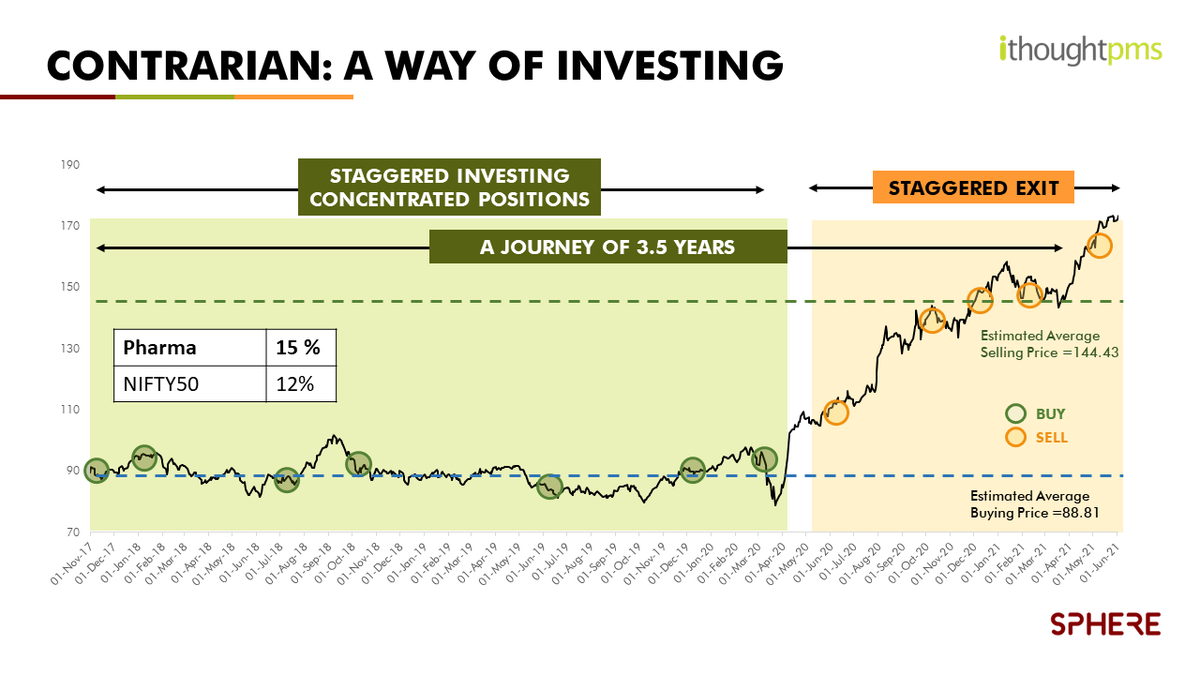

Multi-Asset Investing – The SPHERE Way by Mr @theninjax, @ithoughtpms (14/n)

#Multiasset #assetallocation

Multi-Asset Investing – The SPHERE Way by Mr @theninjax, @ithoughtpms (14/n)

#Multiasset #assetallocation

Winners can quickly become losers, and vice versa. Government Securities were at the top in 2016 and the bottom in 2017. Gold rose from the bottom of the pile in 2021 to be the leader in 2022.

@theninjax, @ithoughtpms (15/n)

#governmentsecurities #gold #bonds

@theninjax, @ithoughtpms (15/n)

#governmentsecurities #gold #bonds

What can SPHERE do for you?

Watch Mr @theninjax talk ‘Multi-Asset Investing – The SPHERE Way’ here youtube.com/live/Gyg3D2djS… (17/n)

#SPHEREPMS #portfoliomanagement

Watch Mr @theninjax talk ‘Multi-Asset Investing – The SPHERE Way’ here youtube.com/live/Gyg3D2djS… (17/n)

#SPHEREPMS #portfoliomanagement

Session #06

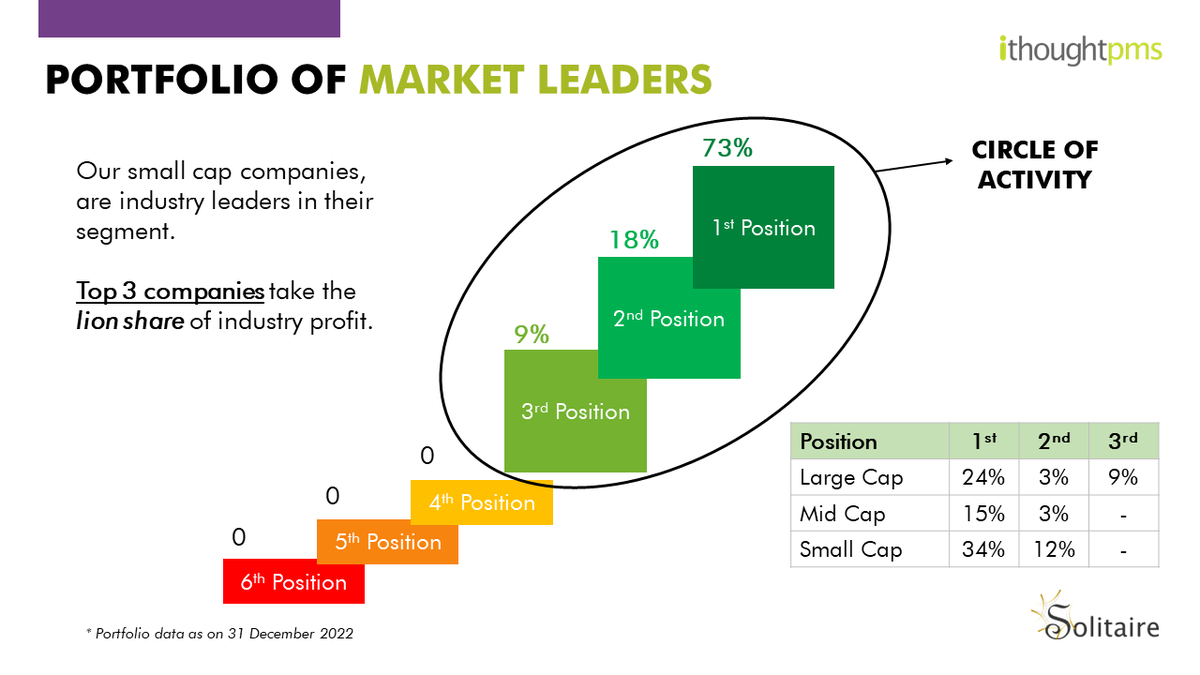

The Art & Science of Investing – The Solitaire Way by Mr @balajispice, @ithoughtpms (18/n)

#portfoliomanagement #SolitairePMS

The Art & Science of Investing – The Solitaire Way by Mr @balajispice, @ithoughtpms (18/n)

#portfoliomanagement #SolitairePMS

“GREAT INVESTMENT = STRONG FUNDAMENTALS + ATTRACTIVE VALUATIONS”, @balajispice (19/n)

#investments #valuations

#investments #valuations

#SolitairePMS Investing Framework

- Patience is a good virtue!

- Investing is counter-intuitive

- Seek long-term performance!

- Valuation matters! Can’t overpay even for a great business. (21/n)

#portfoliomanagement #Nifty #stockmarket

- Patience is a good virtue!

- Investing is counter-intuitive

- Seek long-term performance!

- Valuation matters! Can’t overpay even for a great business. (21/n)

#portfoliomanagement #Nifty #stockmarket

Proof of the Pudding!

Watch Mr @balajispice, @ithoughtpms talk ‘The Art & Science of Investing – The Solitaire Way’ here youtube.com/live/Gyg3D2djS… (22/n)

#SolitairePMS #investments

Watch Mr @balajispice, @ithoughtpms talk ‘The Art & Science of Investing – The Solitaire Way’ here youtube.com/live/Gyg3D2djS… (22/n)

#SolitairePMS #investments

Session #07

Is The Time Ripe To Unearth Hidden Gems – The VRDDHI Way by Mr @rohitkrishnan, @ithoughtpms (23/n)

#VRDDHIPMS

Is The Time Ripe To Unearth Hidden Gems – The VRDDHI Way by Mr @rohitkrishnan, @ithoughtpms (23/n)

#VRDDHIPMS

Resilient portfolios! #VRDDHIPMS falls less than the market. (25/n)

#stockmarket #smallcapfund #activefunds

#stockmarket #smallcapfund #activefunds

“We are very close to investing zone with a view of 3 - 5 years. Small cap is down 18% from peak.” (26/n)

#smallcapinvesting

#smallcapinvesting

Watch Mr @rohitkrishnan, @ithoughtpms talk ‘Is The Time Ripe To Unearth Hidden Gems – The VRDDHI Way’ here youtube.com/live/Gyg3D2djS… (27/n)

#VRDDHIPMS #portfoliomanagement

#VRDDHIPMS #portfoliomanagement

• • •

Missing some Tweet in this thread? You can try to

force a refresh