If you don't have a BitMEX account yet please use this link to register and get 10% off commissions:

bitmex.com/register/WGhKhX

Signup for the first fully decentralized ALT coin exchange:

altcoin.io/?kid=KAVYG

A: Mostly BTC, but will trade ALTs when there are opportunities

A: Yes

A: Cross

A: Stop market. Never stop limit. Your limit might not get filled in a fast moving market. Stop is to make sure you preserve your capital. You can put the stop even before your limit order is filled.

A: CEST (GMT+2). I travel a lot and times will change in the future.

A: I did consider that, but will stick with XBTUSD for now since funding is not that bad yet. Futures sometimes over shoot on fast movements and you get your stop taken out way lower.

A: Only 20 years

A: Cross will use all available funds in your account when it comes to calculating the liquidation price. You can lose everything on the trade. If you set it to 100x, 10x etc. it will only use some of the margin.

A: Last price for trigger

A: That is what leverage allows you to do. Read more about it here: bitmex.com/app/isolatedMa…

A: Yes, the stop market is to buy the same amount of contracts that was sold/shorted

A: Yes, put an order to buy long. You can hit close position at market if the market is moving fast as well.

A: Yes you can. If you link the accounts you don't even have to pay fees. You can only link accounts if your main account has more than 5 BTC. Otherwise you can move the funds and wait for 12:00 UTC when transfers are done.

A: I try to enter and exit with a limit order. Only if the stop is hit the taker fee is paid. Also I try to enter a trade on setups that will return a good profit where the fees will not matter. Doesn't always work.

A: It's a technical indicator for buyers/sellers exhaustion. It indicates where a reversal might occur.

A: The difference is if my stop triggers before the limit buy happens the reduce only order will be canceled. That will make sure you don't have your stop taken out and then go long with the limit buy.

A: There is no system. If someone tells you that trading is easy and they have a system don't believe them. There are some rules I follow: steemit.com/cryptocurrency…

A: I look at the chart as well as my pain threshold. Usually I would change the stop after it moves in my direction.

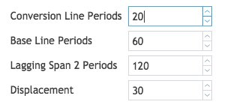

A: MACD, RSI, Bollinger Bands, TD Indicator, Candle Sticks patterns, Ichimoku Could. The most important for me are horizontal lines of support/resistance that I add based on previous highs/lows or areas where price stayed for extended period of time

A: I don't like liquidations as they are way more expensive than a stop. High leverage only gives you the illusion of making more money because you are risking less. Stops manage the risk.

A: 15 min and 1 hour for short term trades. 4 hour and daily for medium term trades.

A: I do pay fees, but my stop not executing is way more costly. The market can moves a few hundred dollars in minutes and I don't want to get caught. I do try to enter or exit with limit when possible.

A: I don't use the contracts for ALTs to chart them. I use the spot price charts. Only for Bitcoin I have a chart for XBTUSD as well as a few exchanges for BTCUSD.

A: One very common use is when it breaks all moving averages and then comes back to retest them. The short term MA need to be bellow/above the long term depending on if we are bullish or bearish.

A: The one thing I hate the most in TA is Elliott Waves.Totally made up after the fact and so flexible that you can explain any count. I like horizontal support and resistance as well as some other TA indicators.

A: The reason I am using a tight stop here is because the trade is opposite the trend. If it was with the trend the stop can be wider to give the trade a chance before the trend resumes.

A: For Swap (XBTUSD) I always set stop at "last" price. Mark can be $50 away from last price. For futures mark price is better as liquidity is bad and you can have a move that will take you out.

A: 5% margin based on the balance of the account.