This was a real “battle lines for the soul of crypto” kinda week.

+Will big players leech attention or inspire new adoption? +Where will we draw the line with ethical business practices?

+Oh, and, uh..who gets to print money?

Thread 👇

The beauty of markets is that, just as Coinbase is free to buy who they wish, we’re free to exert as much pressure as we wish to make that a bad financial decision.

Great way to raise funds, nearly limitless potential for abuse, or both?!?

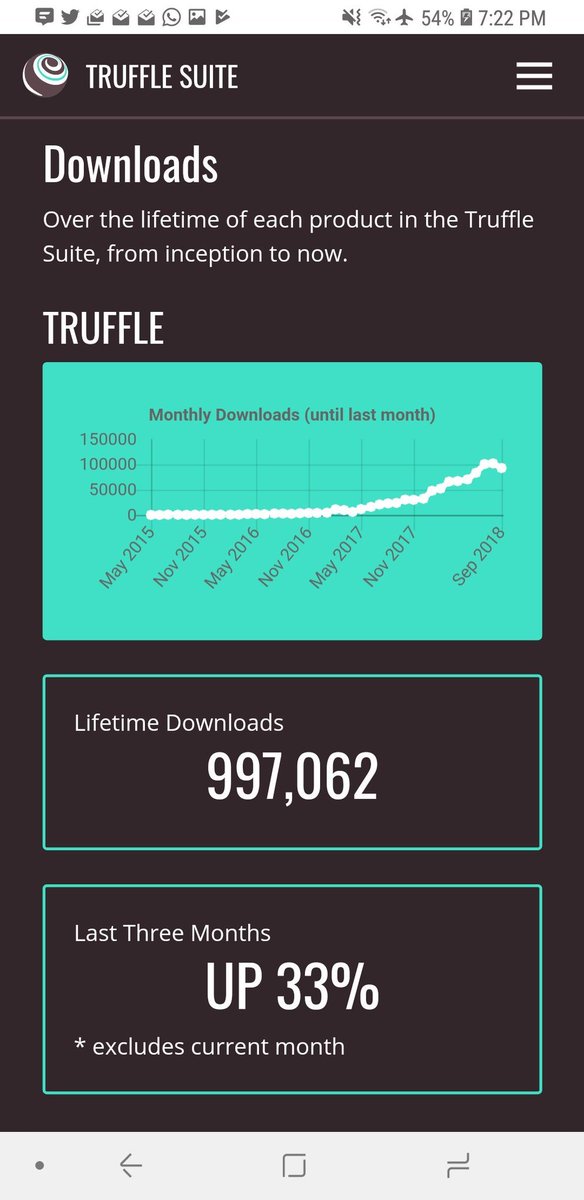

Like, heyyo, we’ve got an Ethereum Constantinople hard fork/upgrade complete!

...while Kraken is incentivizing the sleuths