(Warning: This will be a long thread, grab a cuppa coffee)

Most people are familiar with Warren Buffet's saying "Only when the tide goes out do you discover who's been swimming naked."

I believe it may be EXACTLY what lies beneath the

Now, I've always

So when I saw an article yesterday from @BetterDwelling about Cdn Helocs,

betterdwelling.com/canadians-used…

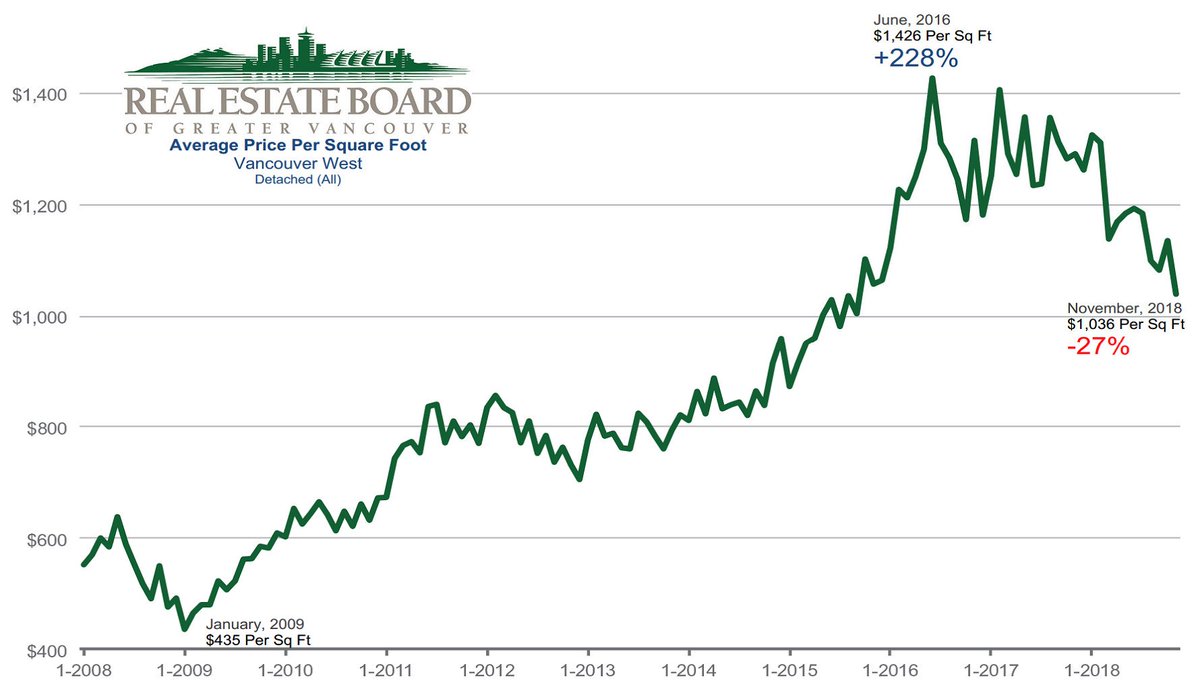

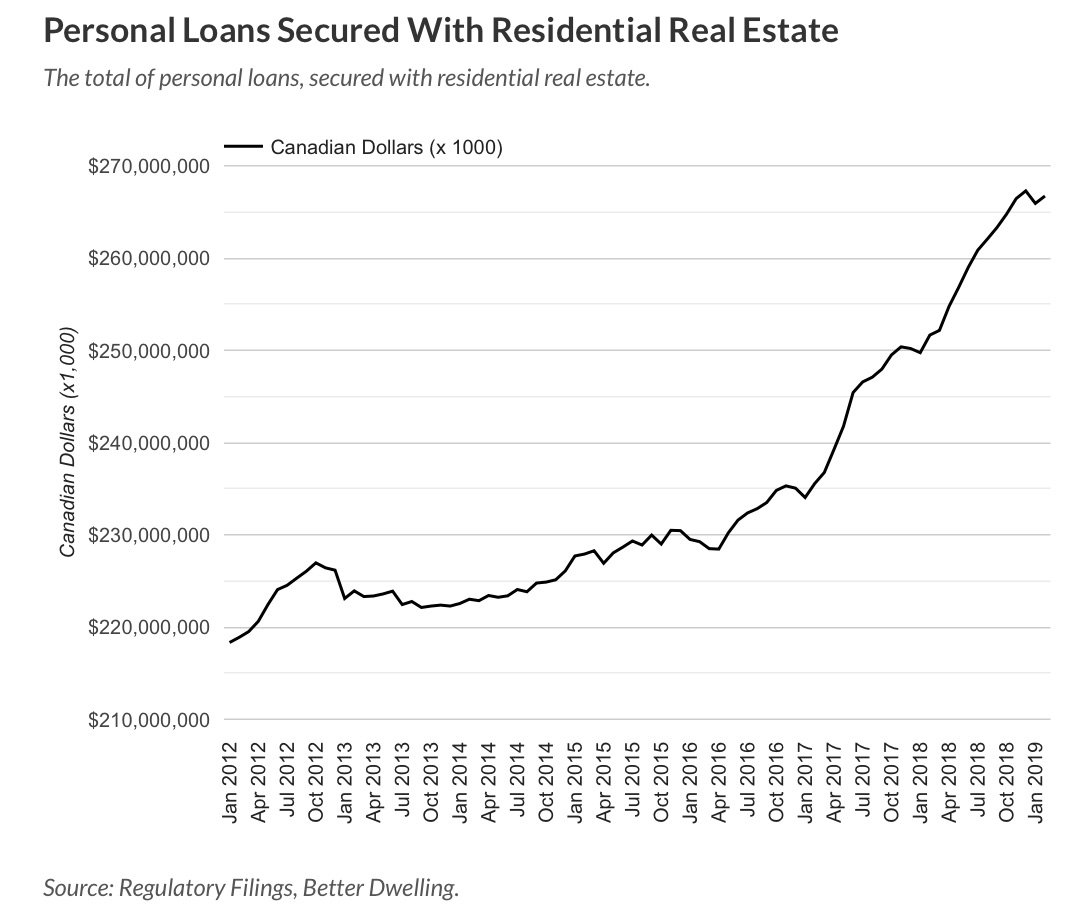

Take a look at the two charts below.

The fist is the "Price per Sq Ft for West Side

The second is from the BetterDwelling article and show "Personal Loans Secured With Residential Real Estate in Canada" from the beginning of 2012 to the beginning of 2019. (I am sure that if we had a similar chart

Not surprisingly, as prices rise, so does the amount of loans secured by real estate.

Also not surprising is that as prices peaked in 2016/2017 and have cratered since, the amount of loans outstanding has

That money is likely spent and gone.

In other words, the amount of loans secured by real estate WILL NOT FALL until forced by bankruptcy and the liquidation of the assets securing them.

As anecdotal "proof" of my

He writes about a #Vancouver teacher who bought a $700,000 home in 2002 which then proceeded to inflate to a value of $3.5M I'm going to assume this home is on the West Side as East Side homes

At this point in time, they have a total of 4 MORTGAGES on the home TOTALLING $3.37M!!!

Now this may be an extreme example, but how many other #Vanre homeowners are in similar, if not less precarious financial situations?

Might they

Add to that "crowd" the following type of West Side homeowner.

I also suspect that there are a second group who have followed

Let's say that teacher (not a great example because teacher's have great pensions) had not leveraged up her/his home, but figured,

In the meantime let's live it up. Beemers and Range Rovers, and multiple trips per year and... don't worry our house will

Well, that $3.5M house (peak value) is now worth $2.275M

BOOM!

That $2.8M retirement nest egg is now $1.575M… and falling.

If/when this market continues DOWN, there will be a "holy shit honey" moment where they panic and try desperately to sell their home

And WHEN we reach the panic stage of this collapse is when we will see these two types of local owners/sellers start pouring

Thanks for reading!

#vanre #tore #vancouverrealestate #torontore #yjjre #westvanre #northvanre #richmondre #burnabyre #vanpoli #bcpoli