1/n

economictimes.indiatimes.com/industry/banki…

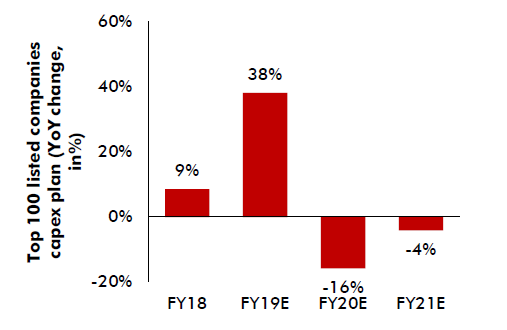

a. Both consumption & investment growth to remain muted in FY20.

b. Suggests an "extremely defensive strategy"

c. Sell on "high end" & "rural consumption" plays

d. Buy on "low and mid-ticket consumption plays"

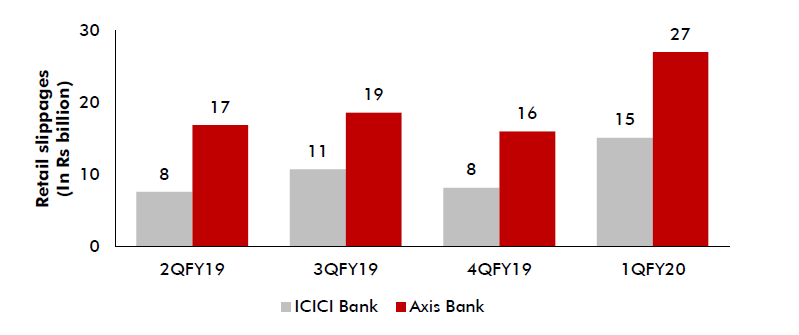

e. +ive on Corp focused Banks & Insurance