What do they buy?

a) FOOD (yes, trade-war retaliation hurts food supply)-> this explains higher food prices in China as can't offset Swine disease w/ imports

b) AlCOHOL (mostly 🍷)

c) MOST MANU 😱

a) Fruits & vegies (yay! healthy!) & seafood (not so good for cholesterol & sea animals)

b) Vegie oil (yay for Malaysia 🇲🇾)

c) Iron ore (yay for Australia 🇦🇺) & copper (yay Mongolia 🇲🇳)

d) Oil & natural gas

A couple things for electronics are up though, like electric watches, medical products & things to purify air/water etc.

Health conscious👈🏻

Btw, food prices up in China so at some pt it needs to import more👈🏻

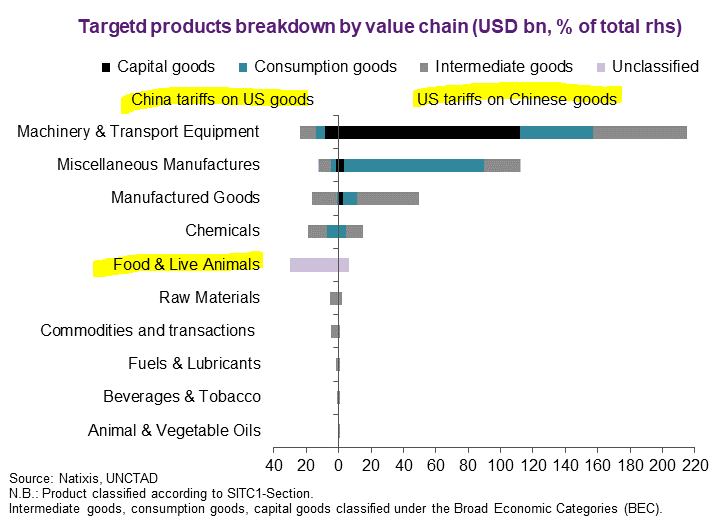

Why? ESSENTIALS VS DISCRETIONARY.

Look at China tariffs on US: What's the BIGGEST? FOOD & LIVE ANIMALS. Yep,🐷👈🏻

*Trade data is awesome 😍

* China imports matter b/c MASSIVE (yes, almost as big as the US & bigger than the Euro zone)

* Specifically China imports of high-tech + commodities

* Bad news - China imports DOWN & esp for manufacturing

* Not good for Asian exporters 😱👈🏻👈🏻