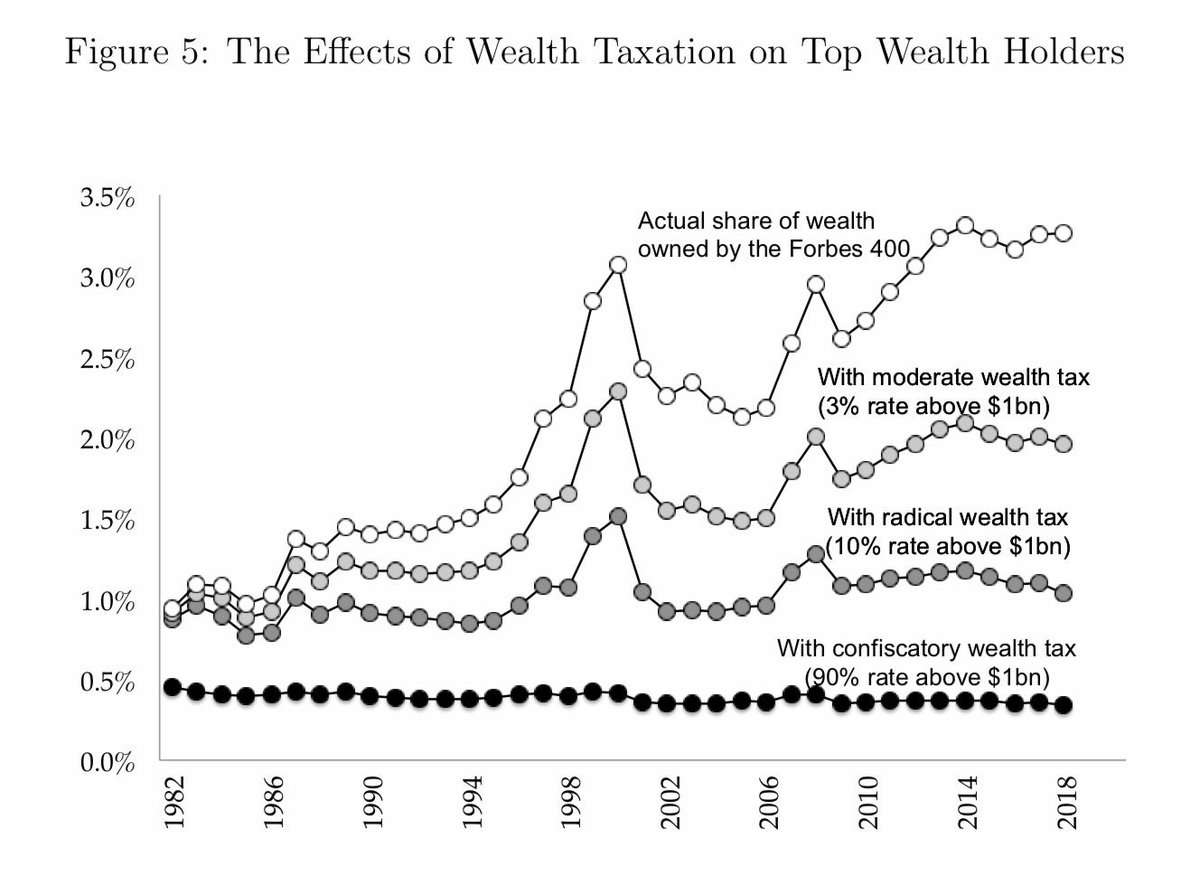

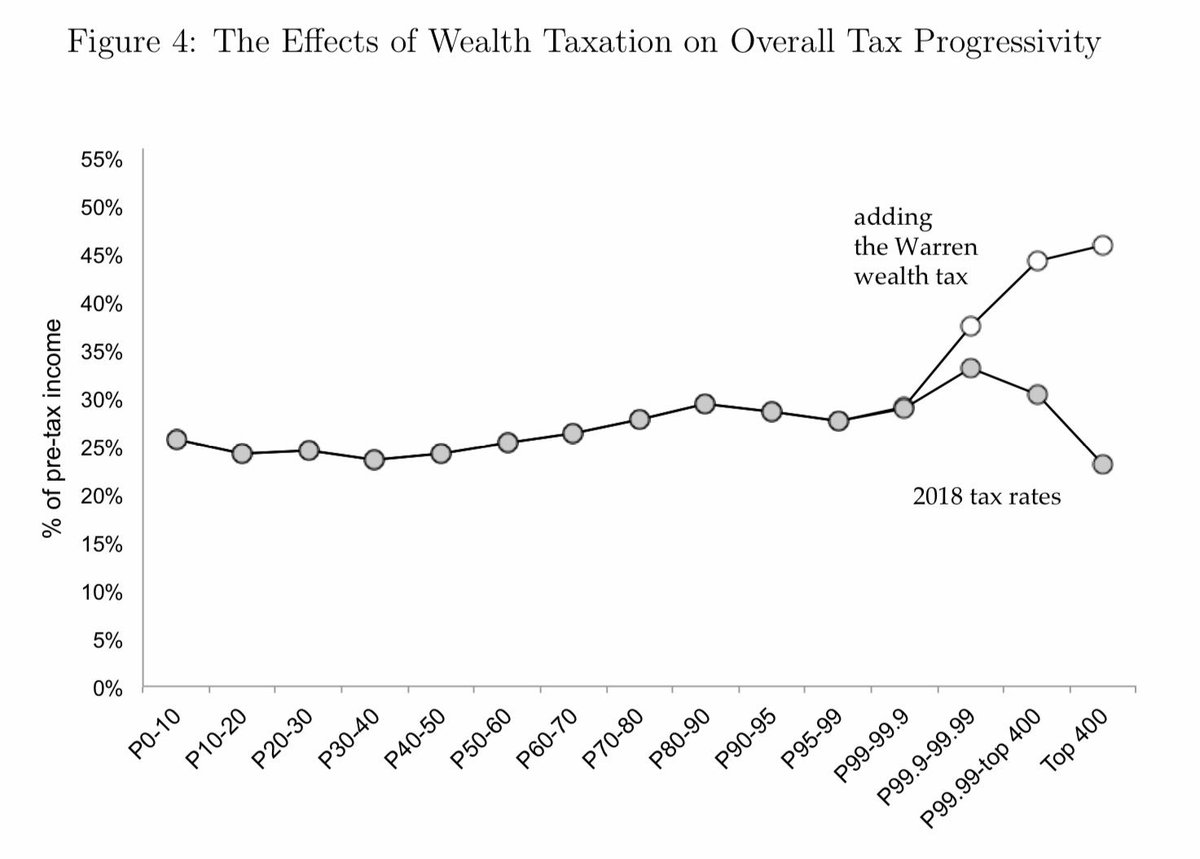

Important study by two leading experts, E. Saez and @gabriel_zucman , which is relevant for the current debate in Germany.

brookings.edu/wp-content/upl…

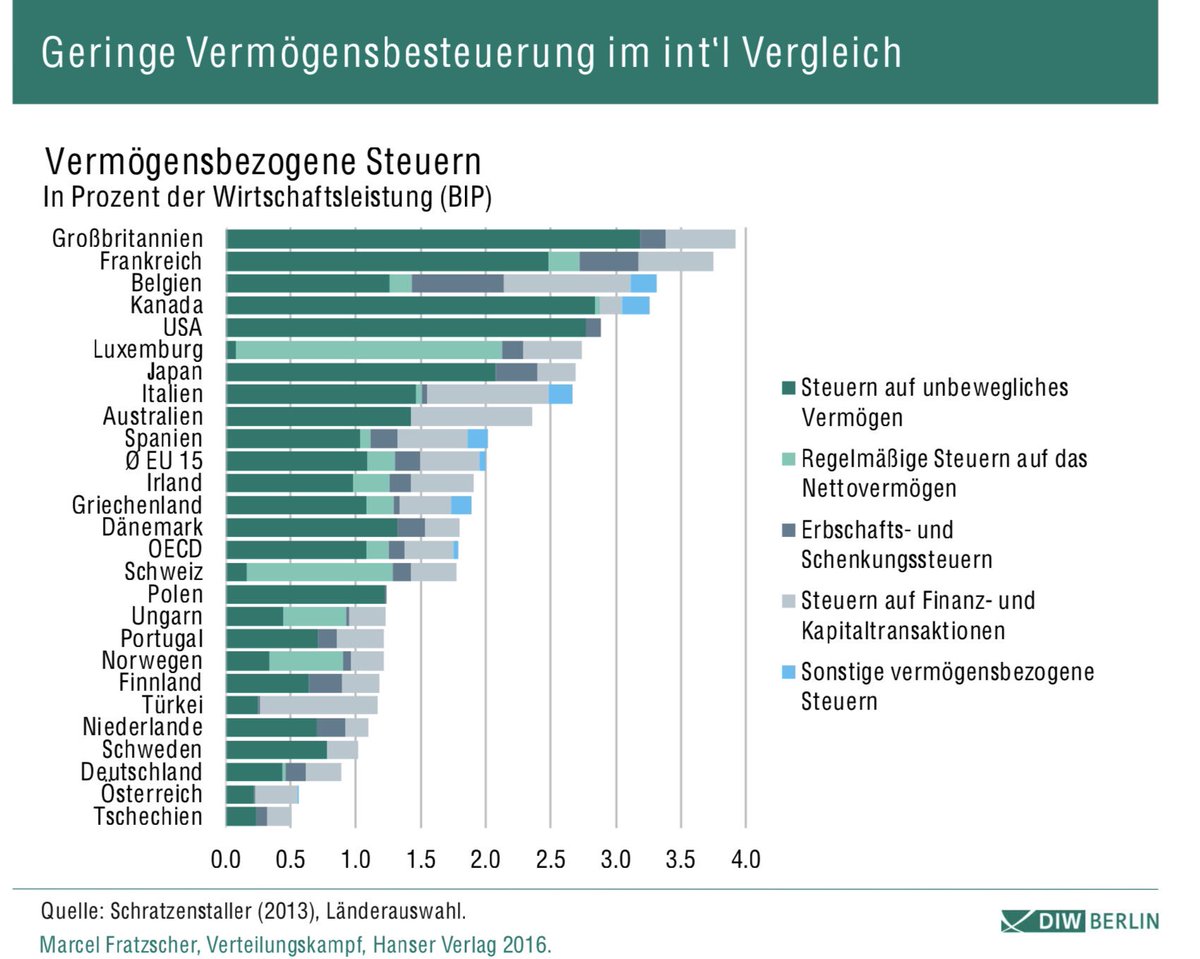

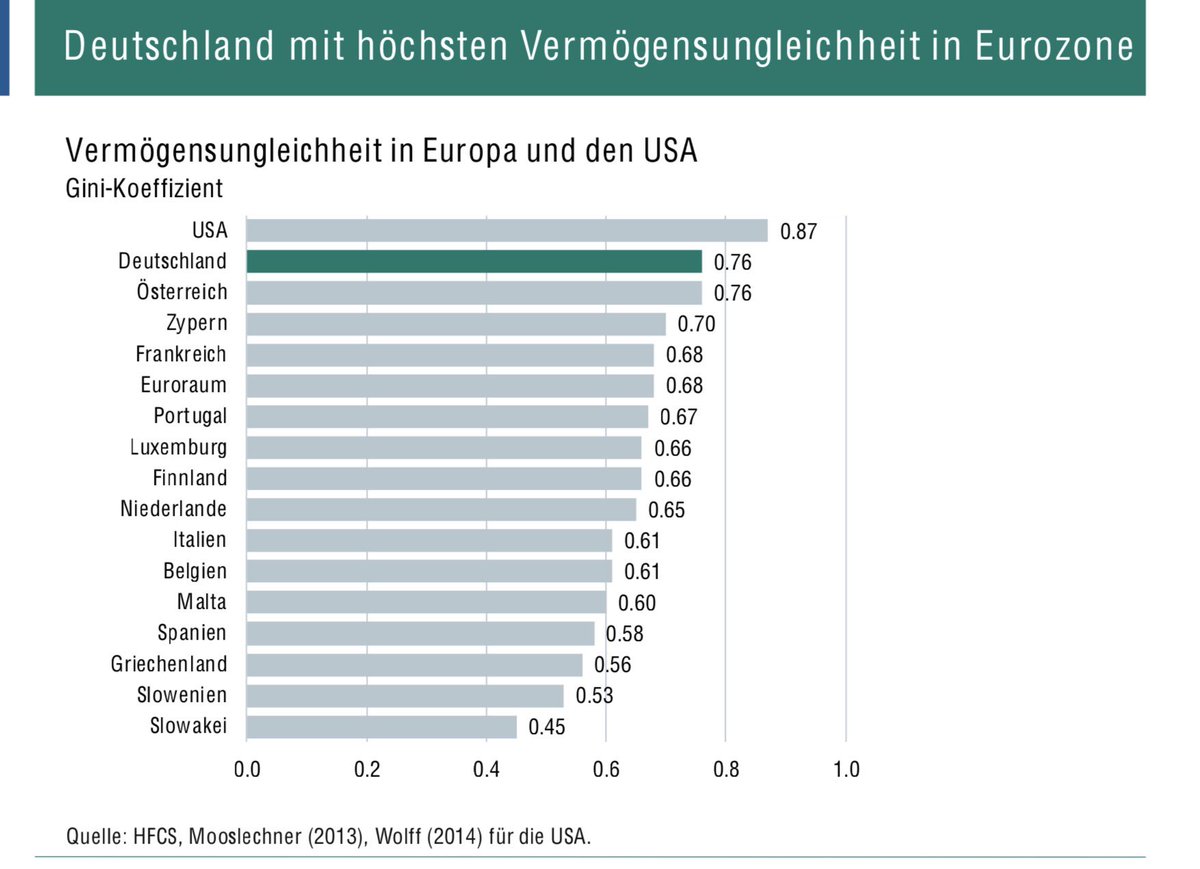

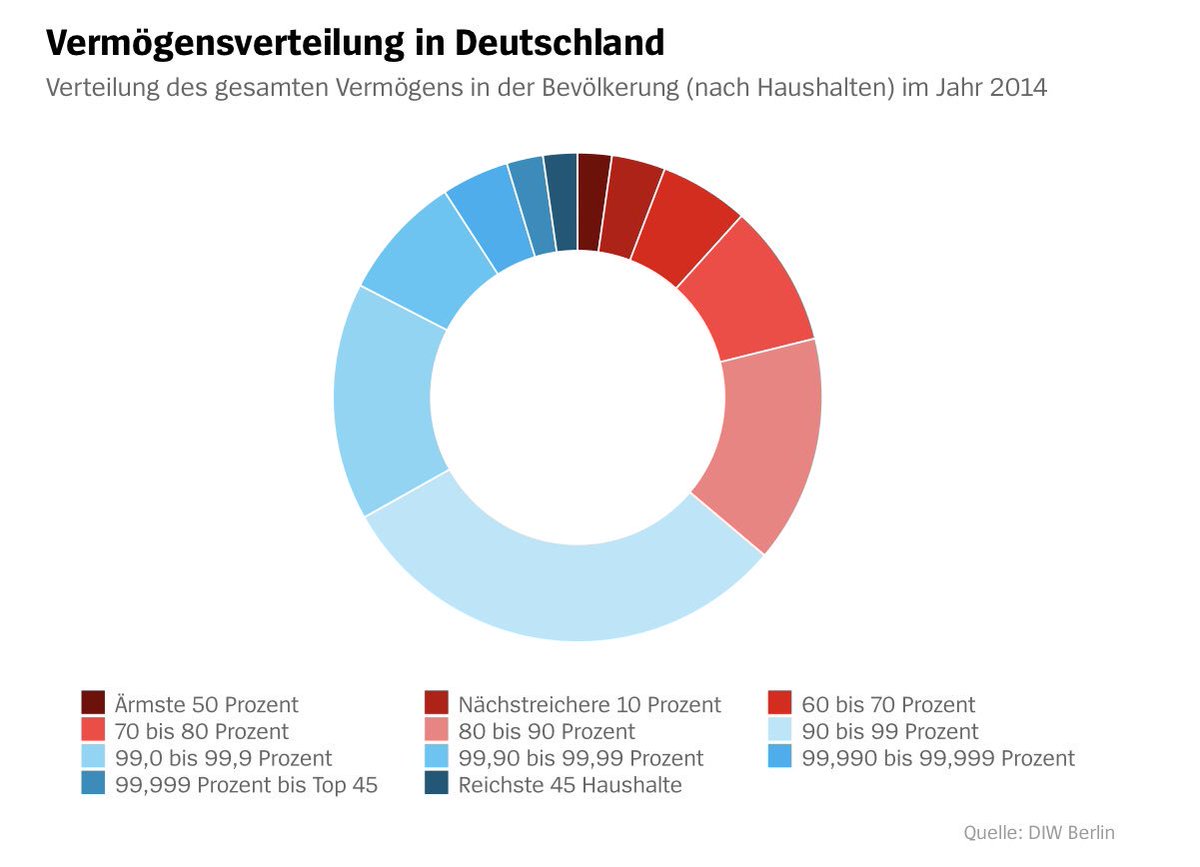

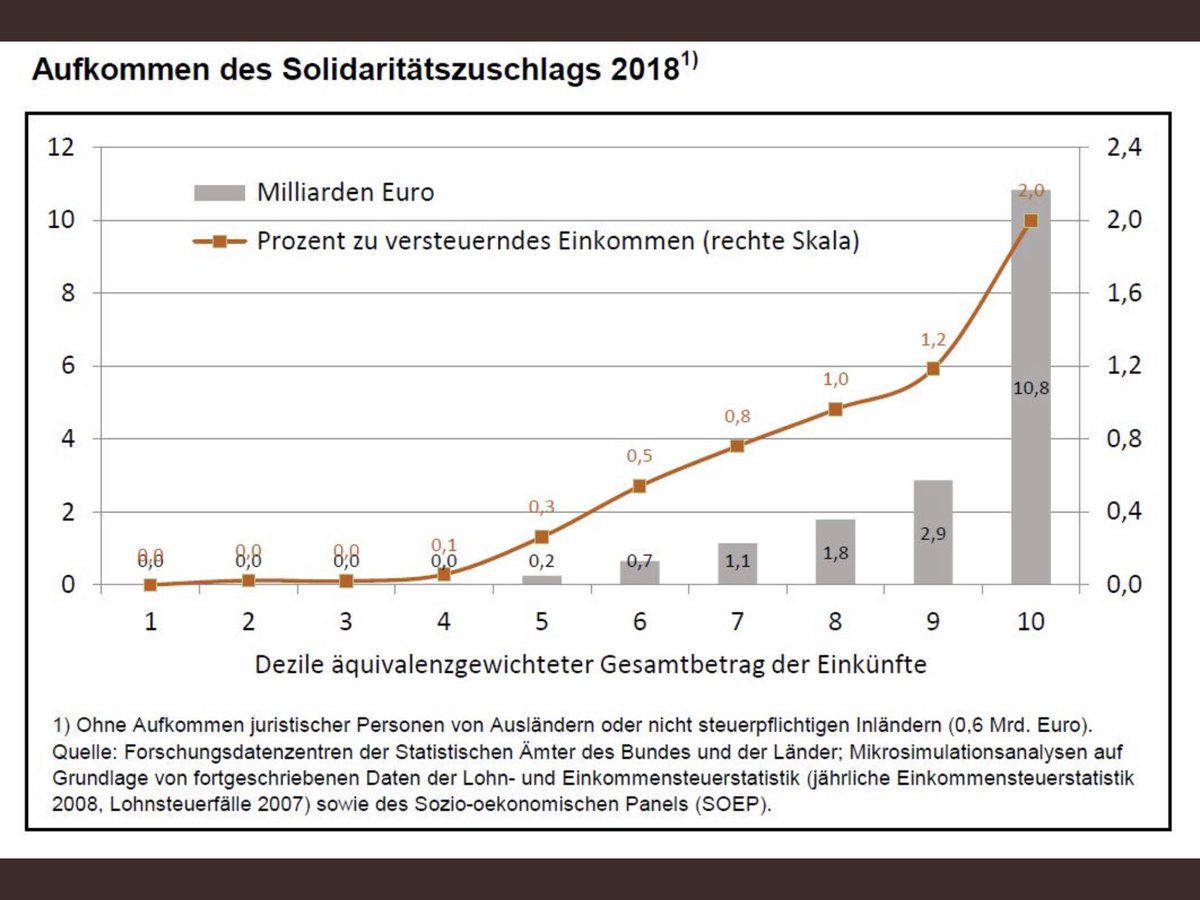

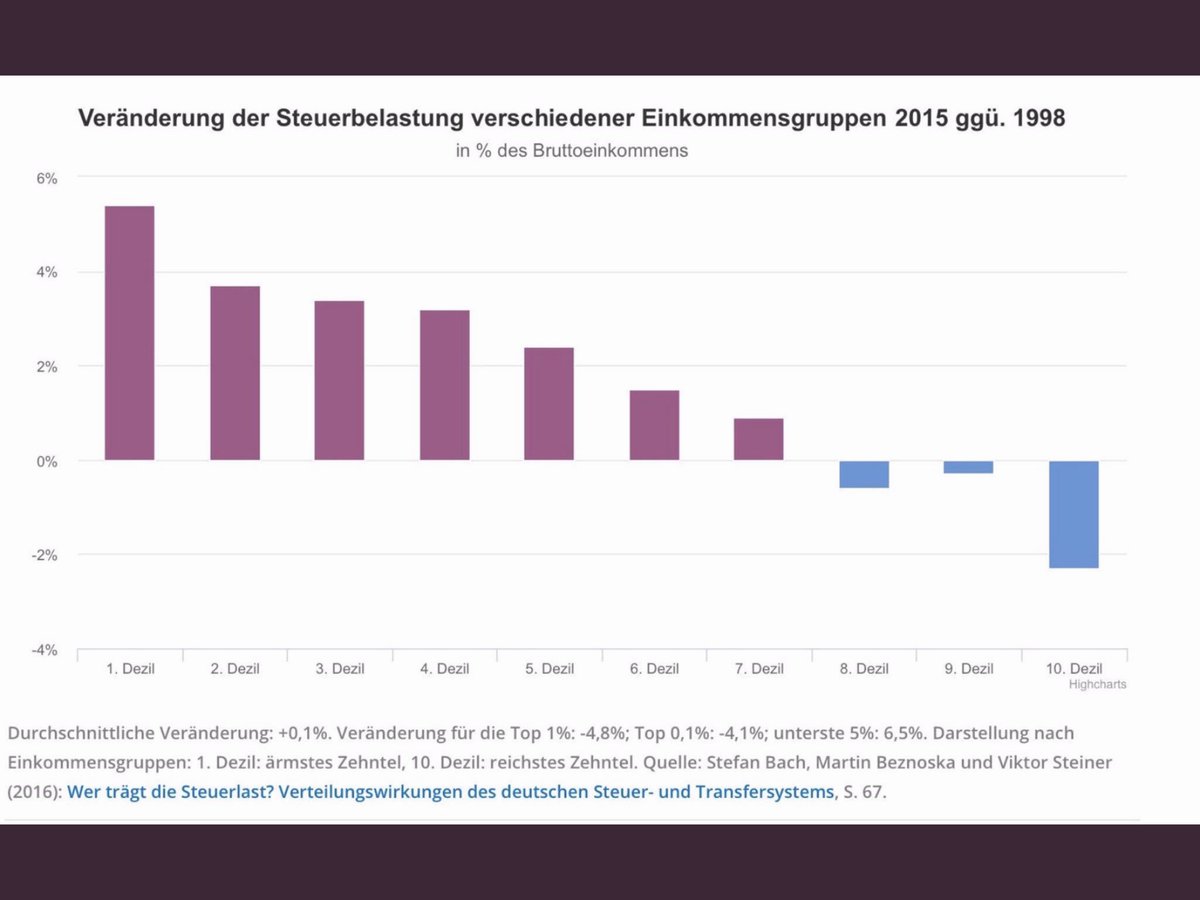

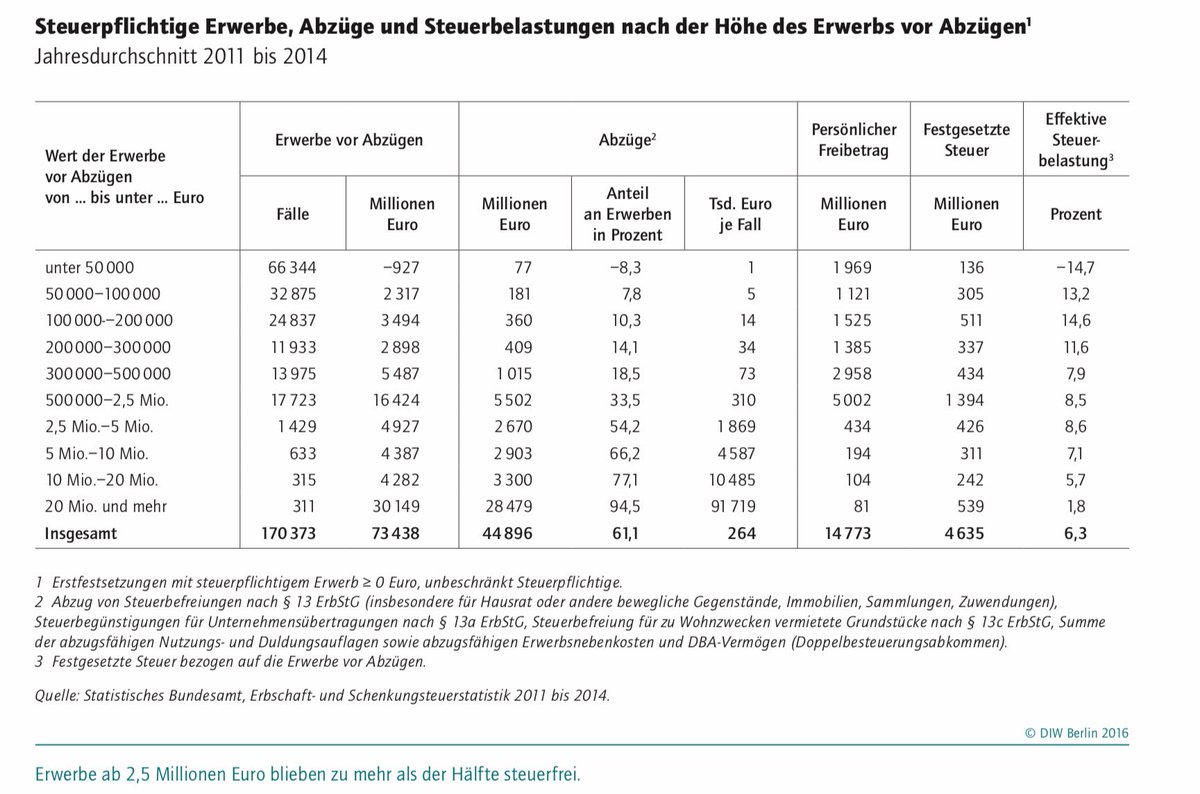

Our study at DIW Berlin (in German):

diw.de/documents/publ…

Our study at @DIW_Berlin_en :

diw.de/documents/publ…

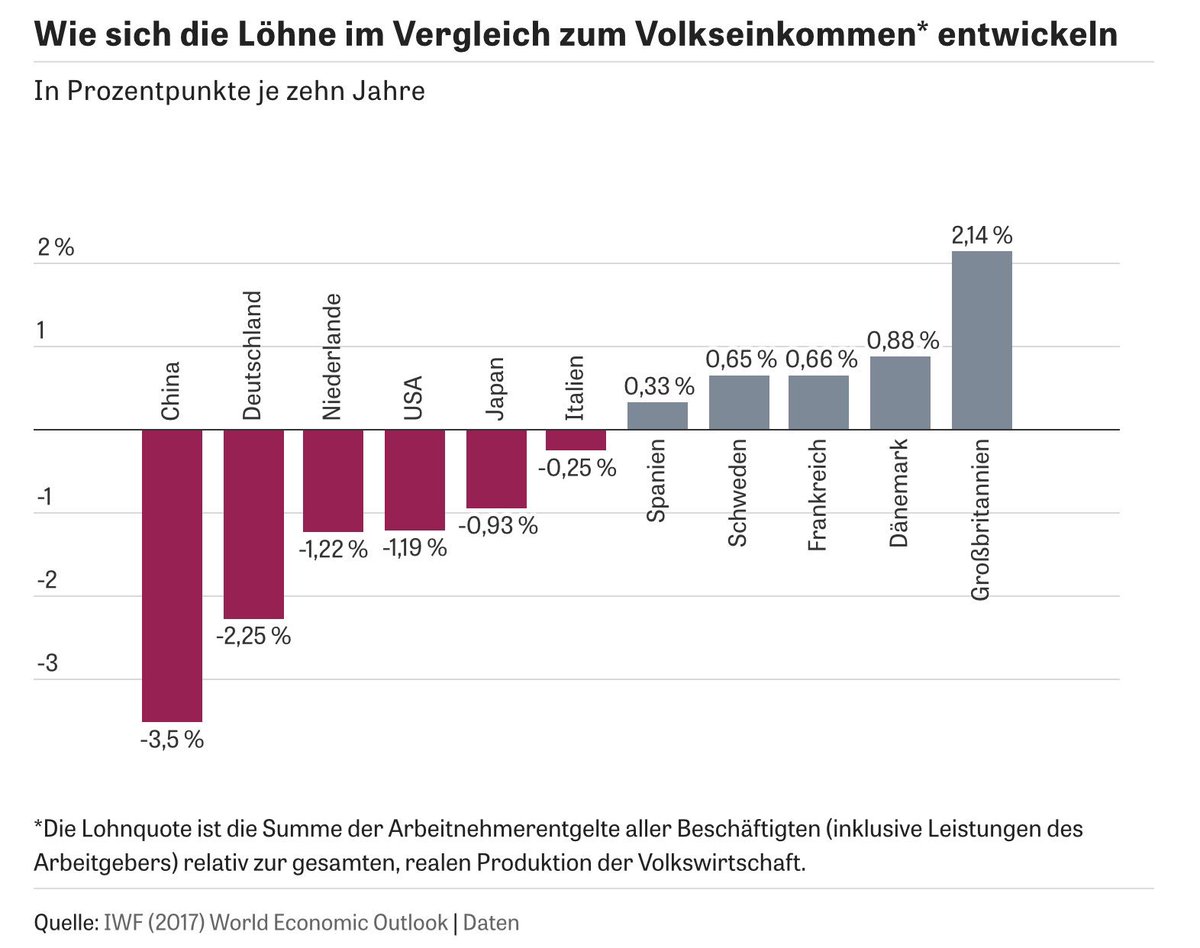

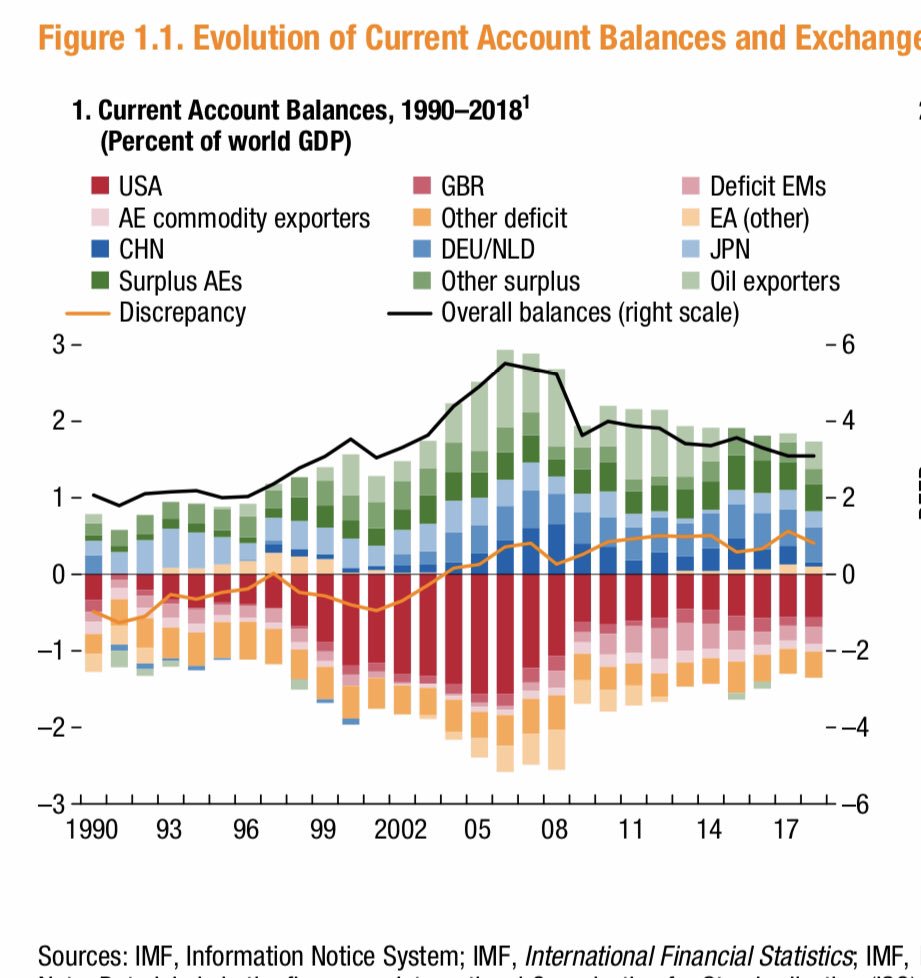

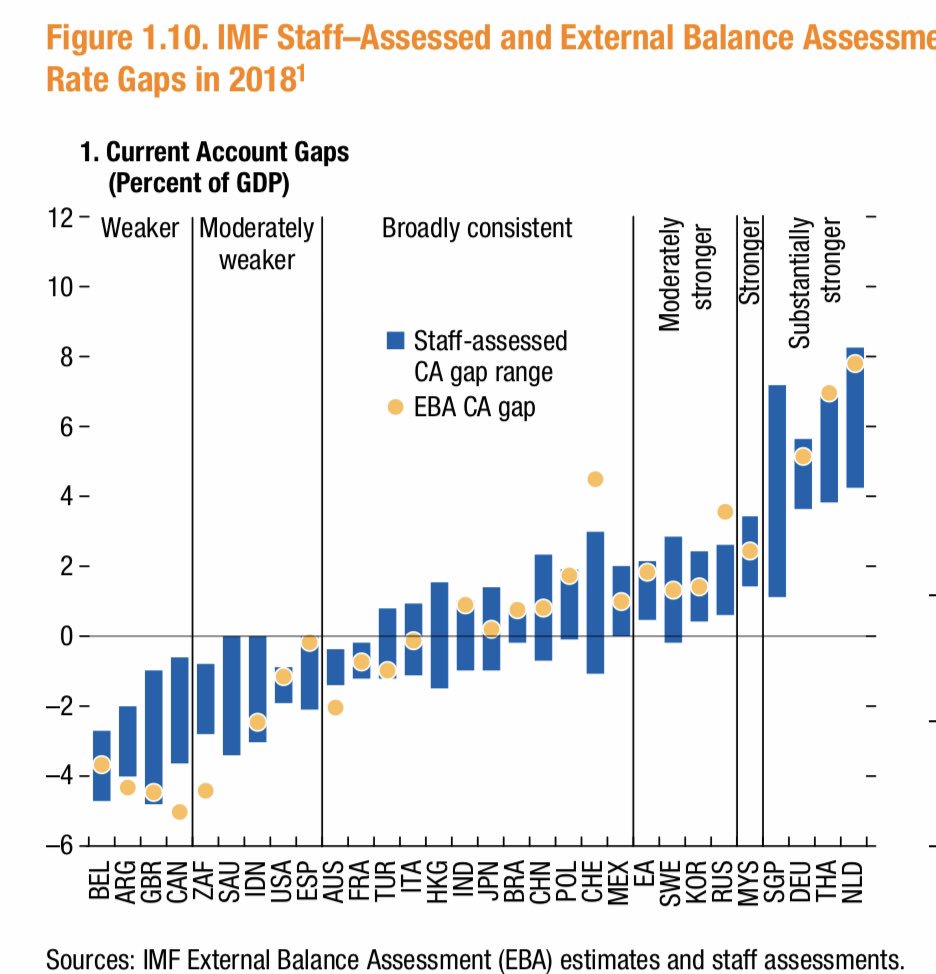

imf.org/~/media/Files/…