*Link: bit.ly/2lC4p0I

bloomberg.com/news/articles/…

*March statement: bit.ly/2kSoO1j

*Link: bloom.bg/2mlGbYT

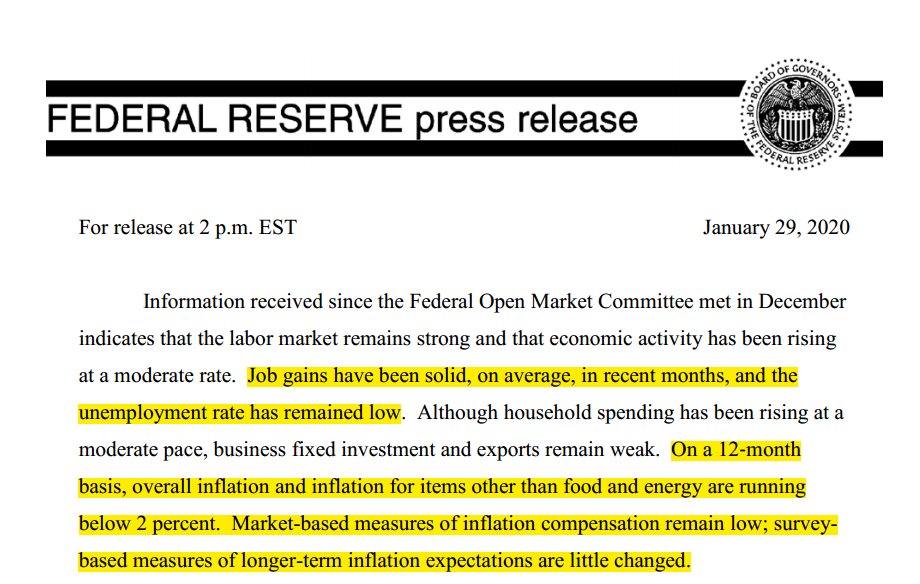

*FED: GEORGE, ROSENGREN DISSENT FOR NO CUT, BULLARD SEEKS 50 BPS

*The dot plot of rate forecasts shows a split over the need for more easing.

*There are slight upgrades in GDP growth expectations (2019 and 2021).

*Esther George and Eric Rosengren again dissent in favor of no cut.

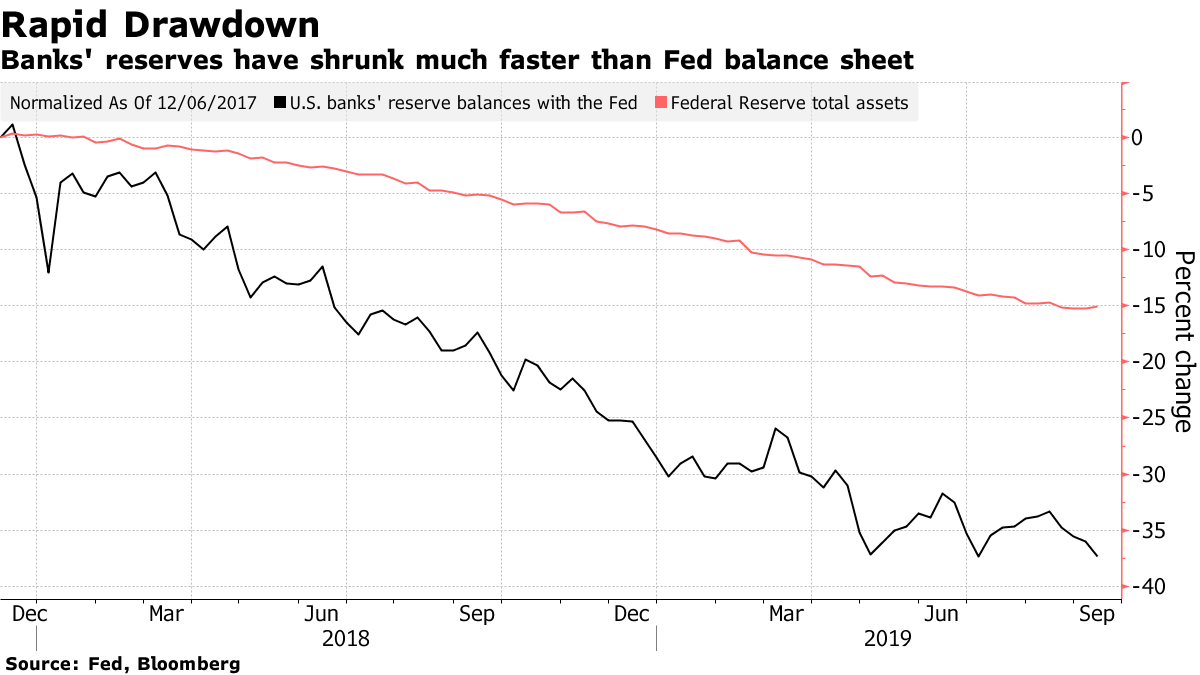

*No announcement of small round of asset purchases in order to solve the problem of dollar scarcity.

*POWELL CITES CORPORATE TAX PAYMENTS, TREASURY SETTLEMENTS