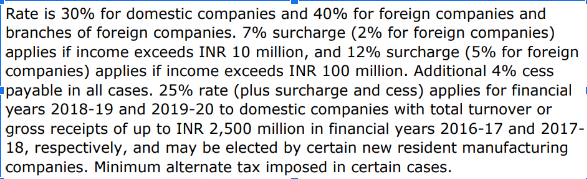

First the good news: FM @nsitharaman’s corporate tax cut is a clear sign that #ModiSarkar is worried about the state of the #Indian #Economy. That’s good because it means she acknowledges the scale of the #budget2019 cock-up.

1. The Corp gets to keep more of its profits. It may either retain the windfall as equity, re-invest it, or give it away in dividends to shareholders. But a windfall also has other effects:

b) Because of the agency problem coupled with poor corporate governance managers may simply pay themselves more.

c) Managers may not pass on the tax break in lower prices.

On the other hand:

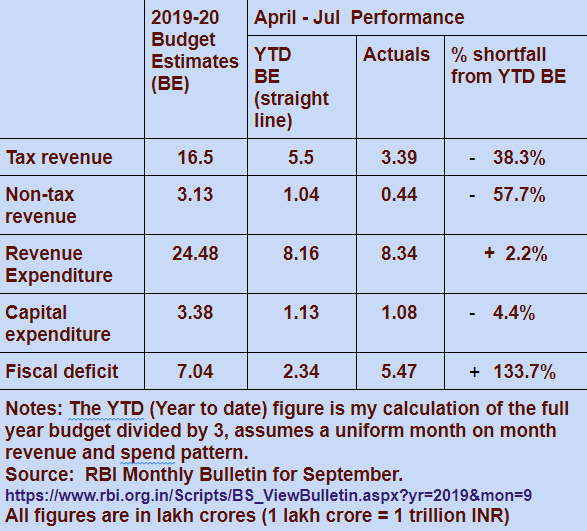

2. the Govt loses revenue that it had budgeted for.

See: www2.deloitte.com/content/dam/De…

I think that is unlikely. As a stimulus it is poorly targeted at the sector least likely to spend their windfall on consumption. Raghav Bahl puts it well: thequint.com/voices/opinion…

#AltSarkar does not support this knee jerk response that makes a drama out of a crisis. We can do better