-China is responsible for a significant amount of the global supply chain.

-China already restricting shipments & availability of goods.

-USA allegedly now energy independent.

-China controls significant gold & lithium reserves.

-China has been pumping their stock market.

-USA is also pumping their stock market.

-China probably survives #nCoV19 crisis due to massive manufacturing infrastructure.

-USA probably hurts more due to lack of access to China goods.

-USD probably survives as world reserve...

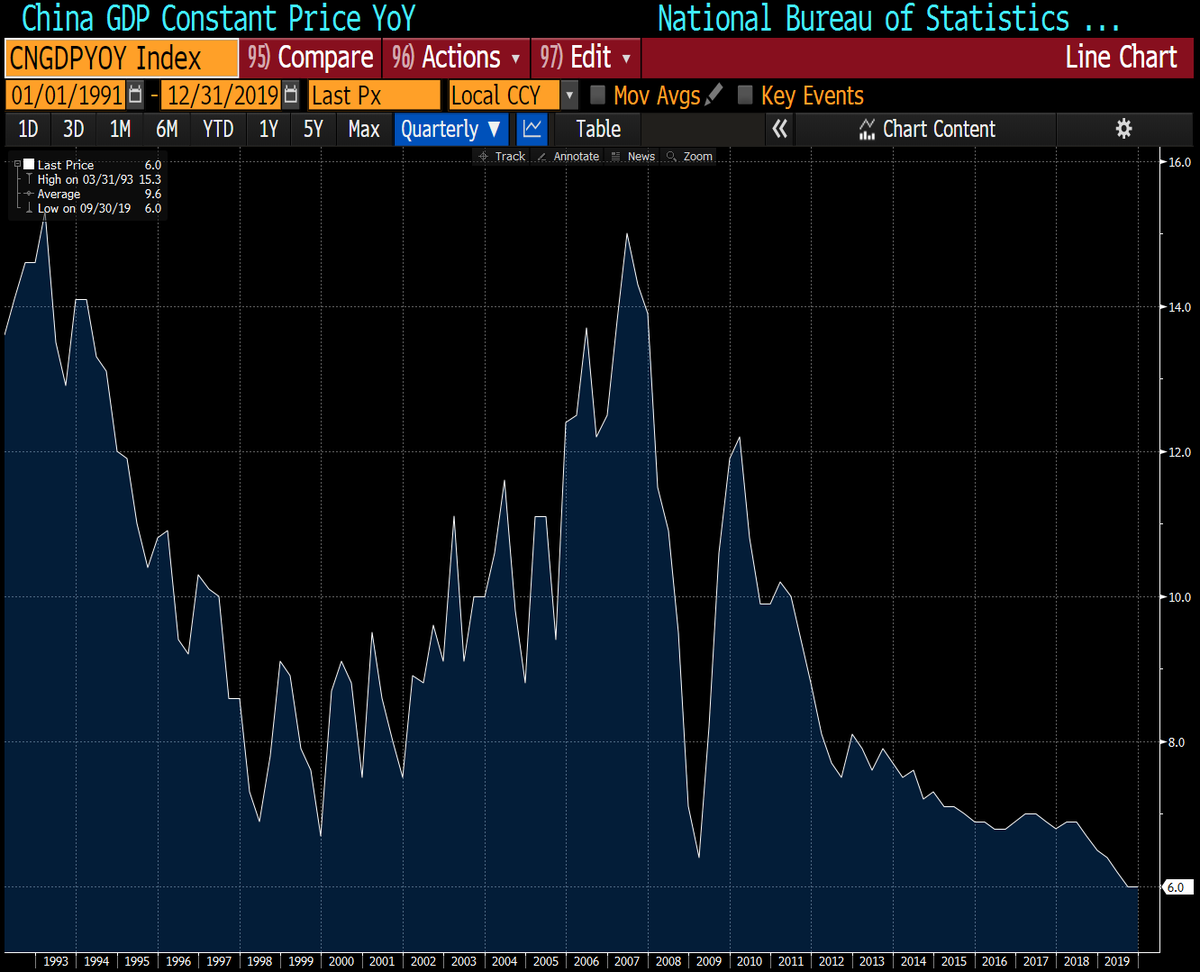

-Global depression more likely now than 2019

-Gold, #Bitcoin, Real Estate, US Cash to buy the dip.

-I don't see why you would risk being heavy in stocks right now.

-Not a bad idea to look at building an emergency food storage.

-Global recession more likely if Bernie gets elected.

Can markets survive this

cc @JamesGRickards @RaoulGMI @Jkylebass?

cc @AriDavidPaul ?