A THREAD

1. Markets work on 2 things. Earnings and anticipation of earnings. Good anticipation begets good results and bad begets bad. Many other things being variable.

2. Another thing that matters as well

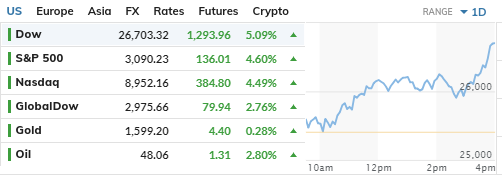

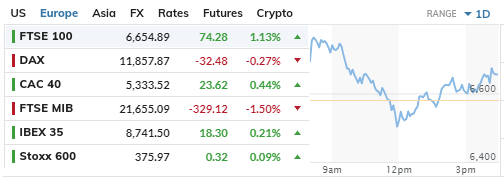

3. American markets being the largest ones in the world lead the way for other markets in most cases. Not all but many. Specially the European markets follow suit of Dow.

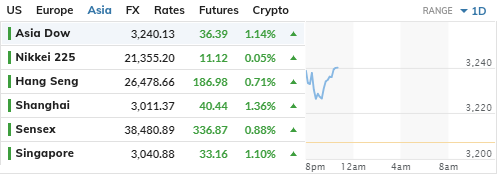

4. Chinese markets of late have

5. When the market is in a euphoric state, bulls are in control and bulls at times become exuberant

6. Markets can

7. Shares go up because investors anticipate earnings to be good in the future. But when a pandemic happens

8. Under normal circumstances a bad event happens, people get shocked, recover from the shock, forget about that event

9. A virus like corona is not a shock. It is a slow but solid reality. A reality that will wipe out $4 trillion from the global GDP. And this is an initial estimate.

10. Companies in the next quarter and the

11. Greed is no longer a trigger. Fear is the king. And fear based on reality. An unknown reality whose extent is not known. How bad can things get ? Nobody knows.

12. An interest rate cut in EU has not helped either. When IR cuts do not stimulate a market

13. One man’s’ panic in the market SOMETIMES is another man’s fortune. But when all men are panicking then it is nobody’s fortune.

14. This market is not going to rebound anytime soon to its previous levels.

16. On top of a slow down in the commodities market. Interest rates already at the lows in most countries. Earnings

IT WAS A RECIPE FOR DISASTER and the disaster has occurred.