If Buy & Hold was working then how come Investors stay invested only for 2-3 years in Equity asset class? After some time, SIP portfolio is nothing but Lump Sum.

1)Markets are rerating. Higher PEs are the new Norm

2)Market is Polarised due to 10-15 large cap stocks doing well

3)Now Large Caps are over stretched but Mid and Small Caps are fairly valued

4)Invest in Mid & Small

1.Should you stick to old Mantras like #BuyandHold, #SIPKaroBhoolJao and #DoNotTimeMarkets?

2.One should not bracket #Investors but bracket strategies as #AGGRESSIVE or #CONSERVATIVE based on Market Valuations

4. Move away from Market Cap Bias. Let FM decide on Large, Mid, Small cap allocations

5. Stop following EXPERTS blindly and apply #LOGIC & #COMMONSENSE

6.Be #PROACTIVE & not #REACTIVE

1. Concentrate on Downside Protection

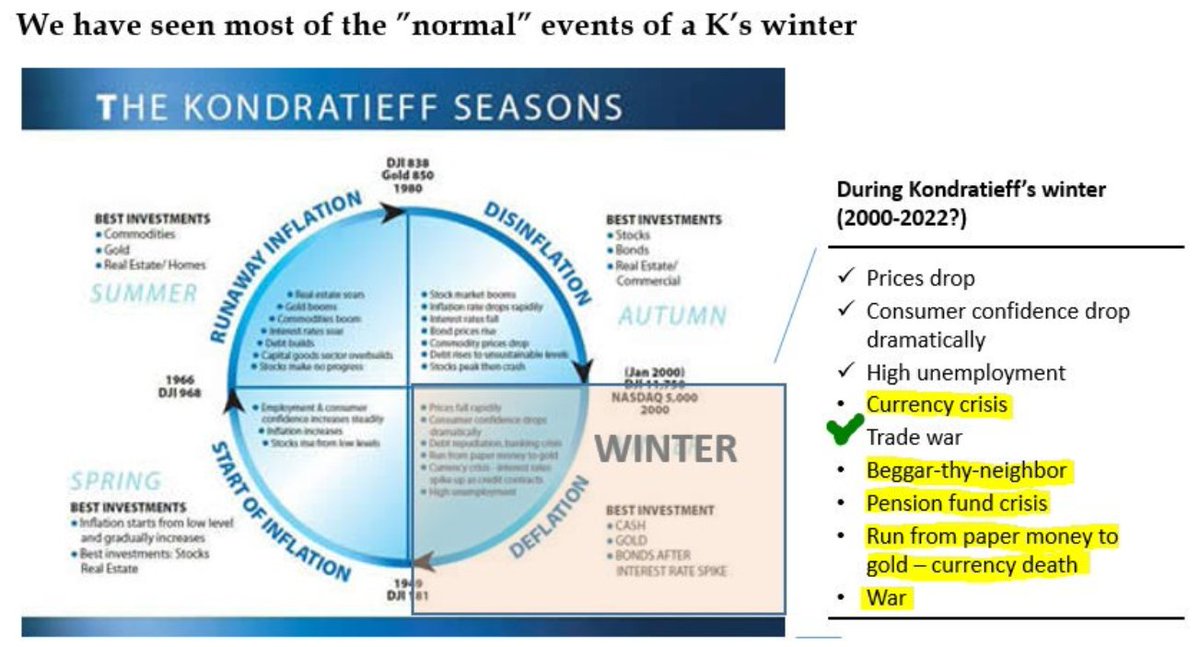

2. Be in the Right Asset Classs at Right Valuations

3. Do not be part of Herd Mentality of Investors

4. Follow PROCESS & DISCIPLINE