For the first time in its history, the @IEA sees #fossilfuel demand peaking across all of its projections including the “business as usual” (STEPS) scenario. What does it mean for geoeconomics & geopolitics of the global #energytransition? A🧵1/13 iea.org/reports/world-…

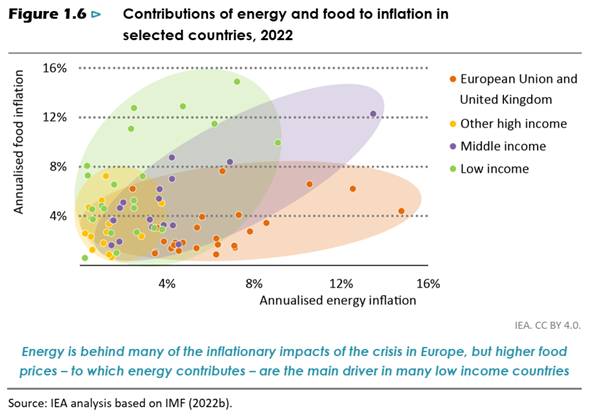

The dependency on #fossilfules is a risk to economic resilience & energy security inherent to the currently dominant economic models. High #coal, #oil and #gas prices have knock-on effects beyond energy systems reliability & fuel the global #polycrisis. 2/13

#EU, #UK, #Japan and others embedded a fatal vulnerability into their growth models as they bet on boosting #gas intensity of their economies post Global #Oilcrisis in the 1970s. Now they are forced to pay a high price for this oversight. 3/13

The ongoing #polycrisis has fundamentally changed the economics of #fossilfuels. Even in the least ambitious, “business as usual” STEPS scenario the @IEA sees peaking coal and oil and plateauing gas demand, undermining the case for new investments in #oilandgas production. 4/13

The role of #gas as a driver of economic growth or a “transition fuel” has been dwarfed by the current crisis. #Gas prices remain high well into late 2020s both for #Europe and #Asia across all scenarios, decoupling countries’ economic growth from gas use. #WEO22. 5/13

What does it mean for geoeconomics of energy? First, an unprecedented transfer of wealth from #fossilfuel importers to producers boosts the role & responsibility of #US, #MENA and others to act on #energytransition & gives them a once-in-a-lifetime opportunity to diversify. 6/13

#Russia too is making historic wins from #oilandgas exports. But its share in global #oilandgas trade is bound to halve compared to @IEA’s pre-war projections. As these revenues are being poured into its #warinUkraine, not economic growth, #Russia’s economic outlook is bleak 7/13

As the era driven by #fossilfuels is coming to an end, the economies with significant #renewables manufacturing and #CRM processing capacities gain a wholly new geoeconomic role. This market is dominated by #China atm but #EU, #US, #India & others are growing their roles. 8/13

The ongoing crisis further strengthened the economic case for #renewables as more cost-competitive and resilient to geopolitical and geoeconomic shocks than #fossilfuels. For import-dependent #EMDE, boosting #renewables investment is 🔑to economic resilience & security. 9/13

#WEO22 Bottomline: Despite the ongoing polycrisis, the #NetZero emissions economy by 2050 remains within reach. Some policies incl. #IRA & #REpowerEU have brought us one step closer to the goal but much remains to be done. 10/13

First priority is to accelerate deployment of #efficiency & demand-side measures to halt global energy demand growth. Share of efficiency & end-use investments needs to double in #NZE & requires additional $900tn p.a., or 32% of the total clean energy investments in 2030. 11/13

Another🔑priority is to unlock $$$ flows for #EMDE. #Cleanenergy investments in EMDE need to increase fourfold & account for over $2tn p.a., or more than 1/2 of total clean energy investments by 2030. #US, #EU & others need to clearly signal their support on this at #COP27. 12/13

Finally, it is🔑to make sure the shift to clean energy-based economy takes developing countries on board. Focus on local value creation, esp. in #renewables manufacturing, #CRM and clean industry clusters should be the core of North-South & South-South partnerships alike. END

For more on the changing economics of #gas throughout all of @IEA's #WEO22's scenarios see this great thread by @GodzinskaKamila

https://twitter.com/GodzinskaKamila/status/1585676026046304256

• • •

Missing some Tweet in this thread? You can try to

force a refresh