It is ironic that #BASF the the biggest #chemical company in the world and largest #energy user in #europe published its annual results yesterday, on the anniversary of the start of the invasion of #Ukraine by #Russia.

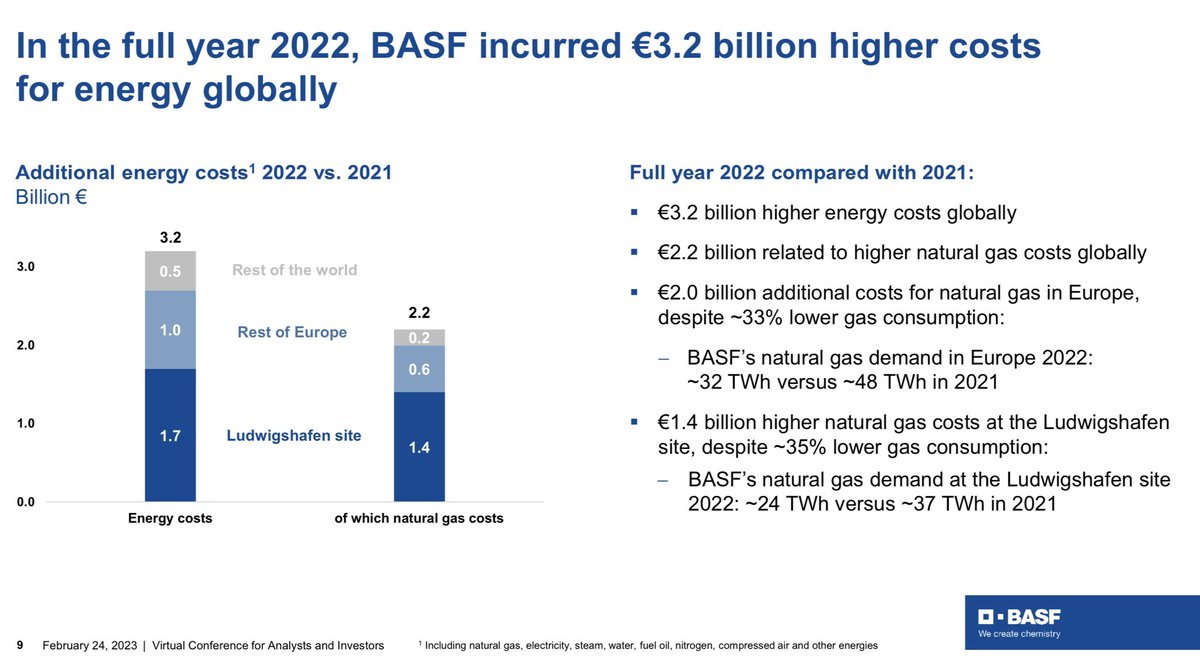

The impact for #BASF is massive. The company:

- Generated a net loss of EUR627 in 2022, down from EUR5.5bn in 2021

- Spent an extra EUR3.2bn in higher #energy costs last year, EUR2.7bn of which was in #europe

- Generated a net loss of EUR627 in 2022, down from EUR5.5bn in 2021

- Spent an extra EUR3.2bn in higher #energy costs last year, EUR2.7bn of which was in #europe

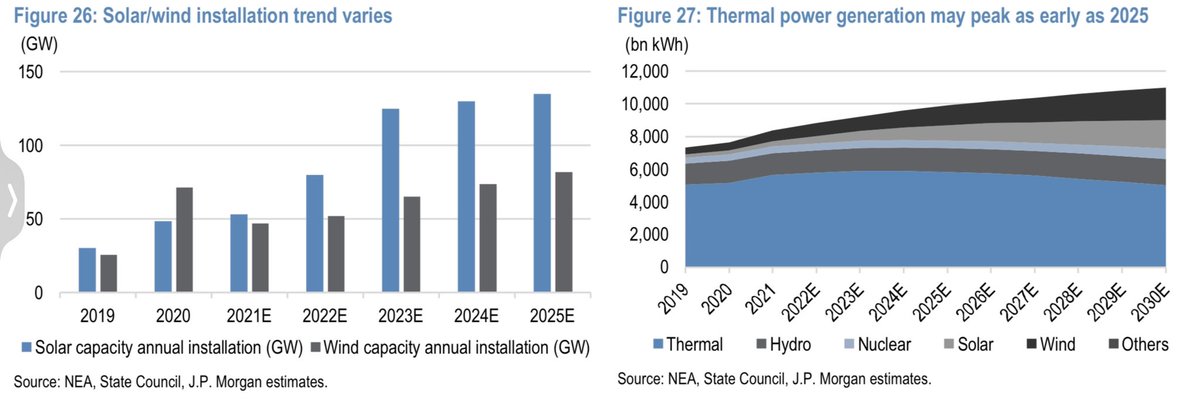

The good news for #BASF is that they have over the last years moved the business beyond #germany and #europe with the #Chinese business now more important and profitable than the #europe.

Finally, CEO Brudermüller best summed up the situation when he said “Europe’s competitiveness is increasingly suffering from overregulation, slow and bureaucratic permitting processes, and in particular, high costs for most production input factors.” That is #sleepyeurope

• • •

Missing some Tweet in this thread? You can try to

force a refresh