and why “Buy and Hold” may not be so easy this time around.

To start, a history lesson: When George Washington died in 1799, he didn’t know that dinosaurs existed. In fact, no one did.

It wasn’t until the paleontologist Richard Owen coined the term dinosauria, meaning “terrible lizard”, in 1841 that dinosaurs became mainstream.

Just think about how many things you do on a daily basis that rely on discoveries from the last two centuries.

The first time clocks were standardized across the U.S. was November 18, 1883 with the creation of Eastern Standard Time (EST)

The first person to prove that diseases could be caused by microorganisms (i.e. germs) was the Italian entomologist Agostino Bassi in the early 1800s.

Though Fredic Tudor was shipping ice cut from the lakes of New England to the Caribbean in 1805, the first refrigerator for home/domestic use wasn’t invented until 1913 by Fred W. Wolf Jr.

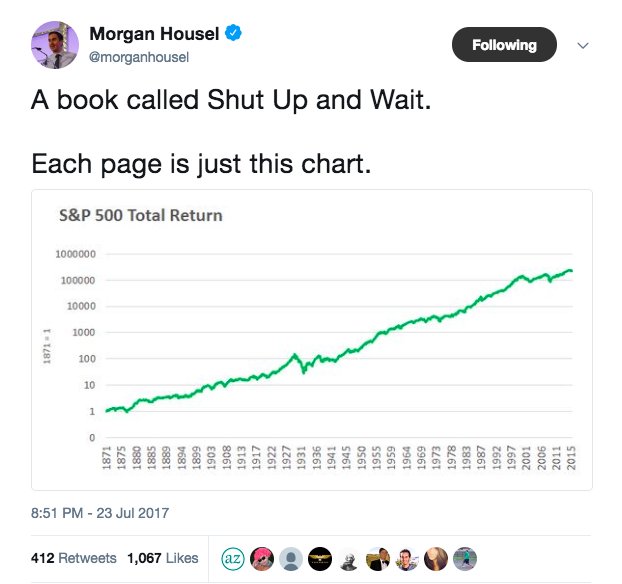

And while it is easy to see how the world has changed in the last two centuries, it isn’t as easy to see how the investing world has changed even in the last 100 years.

However, this point is only obvious today because we have the benefit of hindsight, ubiquitous data, and modern computational resources.

Therefore, why should we have expected investors from this time to “buy and hold” when they had little data to support such a decision? We shouldn’t.

The investment world has changed so much in the last half century that many historical comparisons are useless.

Why?

Because investing is a game that is based on the preferences and information of OTHER participants.

The rise of cheap, diversified investing options might make investing seem easier now, but this isn’t necessarily true.

Maybe, behaviorally, the next panic will be that much harder than what we would have expected.

I don’t know for sure, but nothing comes for free.

Knowledge can also be a curse, my friends.

Thank you for reading and happy investing from Of Dollars and Data. Travel safe and happy holidays!