Why? Because investors are like, wow 😮 JPO is so worried & cutting so much in an emergency cut then maybe I should worry about earnings.

Buy the rumors, sell the facts👈🏻

Fear is back today 👈🏻🙈

Should have cut. Now they have to do emergency cuts.

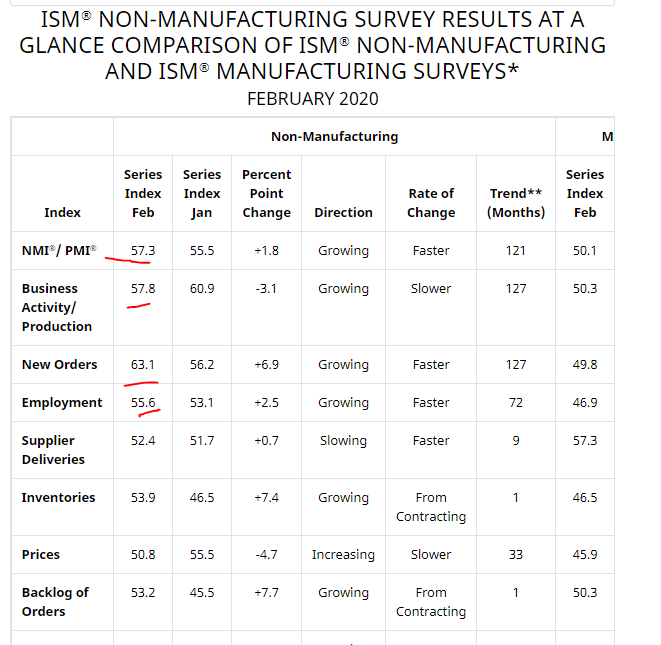

Similar to state PMIs, services way worse.

BOTH ENGINES SPUTTERING!

Not to mention the fact that Korea got domestic demand issues now.