It's here! The long awaited sequel;

The Definitive September #COMEX #Silver #Shadowcontracts thread!

The amount of Shadow contracts this month has surprised even me.

NONE of the numbers make sense anymore!

So the Theme of this month will Be;

AUDIT THE COMEX @CFTC!!! 1/z

The Definitive September #COMEX #Silver #Shadowcontracts thread!

The amount of Shadow contracts this month has surprised even me.

NONE of the numbers make sense anymore!

So the Theme of this month will Be;

AUDIT THE COMEX @CFTC!!! 1/z

https://twitter.com/DesoGames/status/1299700579237756936

Let's start with clarification.

#Shadowcontracts don't have to be delivered on the same day, though #Comex doesn't display those numbers exactly.

Within 24 or 48 hours is enough to not-make-sense in a #FUTURES market. What about contracts made 15 minutes before closing? 2/z

#Shadowcontracts don't have to be delivered on the same day, though #Comex doesn't display those numbers exactly.

Within 24 or 48 hours is enough to not-make-sense in a #FUTURES market. What about contracts made 15 minutes before closing? 2/z

It makes NO sense that in a #FUTURES market, On Monday the 28th of September, 47 contracts where made that HAD TO BE delivered on September 29th.

That was the Final September delivery date. All September 20th contracts HAD TO BE DELIVERED BY THAT DATE.

Why not wait 1 day? 3/z

That was the Final September delivery date. All September 20th contracts HAD TO BE DELIVERED BY THAT DATE.

Why not wait 1 day? 3/z

Sure. There's nothing in the rules saying this can't be done.

That's another clarification i want to make:

This. Is. Not. #Fraud. All of it is #legit.

There still are LEGAL ways to corner markets. "Buy up all the silver" works if you have enough cash AKA the Hunt Brothers. 4/z

That's another clarification i want to make:

This. Is. Not. #Fraud. All of it is #legit.

There still are LEGAL ways to corner markets. "Buy up all the silver" works if you have enough cash AKA the Hunt Brothers. 4/z

#JPMorgan has plenty of cash. They are also, conveniently, most of the market. Even so, me thinks people focus on the #villain a bit too much, and not enough on the plot.

Speaking of the villain though;

bloomberg.com/news/articles/…

And that stuff *is* illegal. 5/z

Speaking of the villain though;

bloomberg.com/news/articles/…

And that stuff *is* illegal. 5/z

Goes to Character, your honor.

Anyways, what i'm focused on is this:

61.52% of all Eligible #Silver on the #Comex is allocated to #JPMorgan. They *are* the silver market.

And as much as some people focus on Registered, it can only be moved TO Registered, FROM Eligible. 6/z

Anyways, what i'm focused on is this:

61.52% of all Eligible #Silver on the #Comex is allocated to #JPMorgan. They *are* the silver market.

And as much as some people focus on Registered, it can only be moved TO Registered, FROM Eligible. 6/z

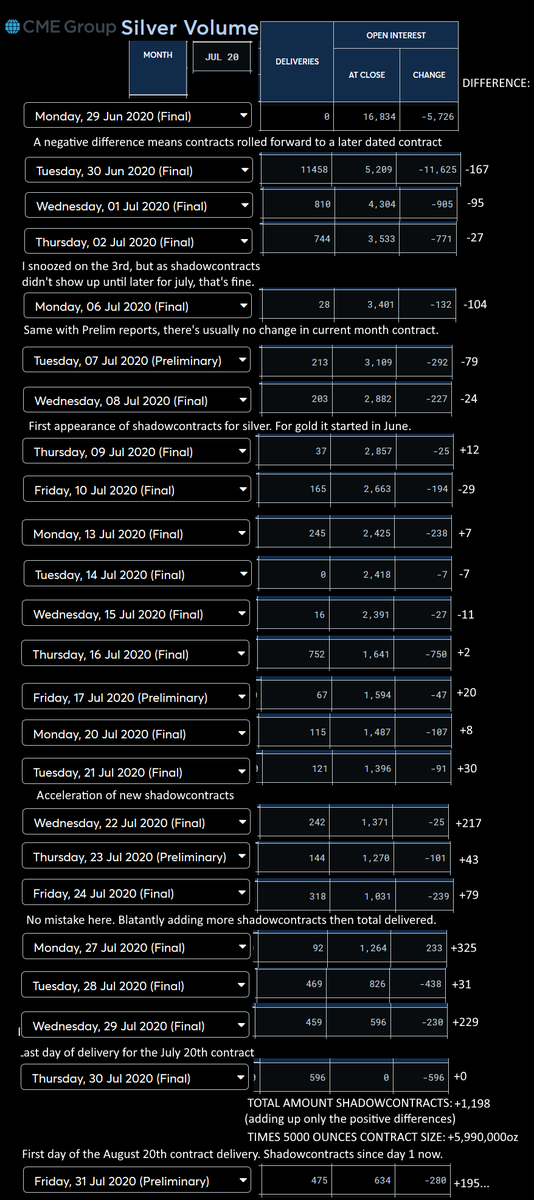

Here's what happened in June, and will happen again in December. Posted side by side for comparison

You can see #JPMorgan went up 26 million ounces of #Silver on the books total since.

Something's strange too. 33Moz where moved in June, when 11458 contracts where delivered. 7/z

You can see #JPMorgan went up 26 million ounces of #Silver on the books total since.

Something's strange too. 33Moz where moved in June, when 11458 contracts where delivered. 7/z

11458 x 5000oz per contract = 57,290,000 ounces.

That's a gap of 23,953,963 ounces of #Silver. Reported on the 30th but Activity date of 29th... A day before the deliveries?

NONE of this makes sense. Again, goes to the theme here: The #COMEX is broken AF. 8/z

That's a gap of 23,953,963 ounces of #Silver. Reported on the 30th but Activity date of 29th... A day before the deliveries?

NONE of this makes sense. Again, goes to the theme here: The #COMEX is broken AF. 8/z

Now let's get into the Overarching Pattern which has continued since August.

Last month we saw the #Shadowcontracts disappear and only arrive piecemeal because the #Comex was gearing up for September #Delivery.

In Short, they had to make sure they could meet obligations. 9/z

Last month we saw the #Shadowcontracts disappear and only arrive piecemeal because the #Comex was gearing up for September #Delivery.

In Short, they had to make sure they could meet obligations. 9/z

So it comes fully in line with expectations that Tuesday the 1st and Thursday the 3rd of September saw #Silver #Shadowcontracts return, in volume as well. 115 contracts means 575k oz.

Naturally, you still have #deliveries to make, so the amount of contracts are sporadic. 10/z

Naturally, you still have #deliveries to make, so the amount of contracts are sporadic. 10/z

I did say below 2500 OI the price'd be free and clear to float, which hasn't happened. But i also said at the same time, we're all riding #JPMorgan's dick here. What they want, goes. That's a monopoly kids!

Instead my price prediction shows in the #Shadowcontracts pattern. 11/z

Instead my price prediction shows in the #Shadowcontracts pattern. 11/z

2 days later, after Tuesday the 8th (Monday's missing because of #Laborday, which might've affected the pattern a little), there's the notable change that contracts stop rolling over completely.

After Friday the 11th, there is no more roll-over until the 25th. 12/z

After Friday the 11th, there is no more roll-over until the 25th. 12/z

Which is in itself also suspicious. As i've been trying to teach my new followers; Changes in patterns means something. If it was a #glitch, it'd be consistent.

Bad code is Bad code. It doesn't go away or come back.

If there was a #human change, there was a human #motive. 13/z

Bad code is Bad code. It doesn't go away or come back.

If there was a #human change, there was a human #motive. 13/z

Human #motives have "Origins" or "Reasons". Meaning something external changes that aligns (or doesn't) with your #motive and you adjust your actions accordingly.

In this case; the human motivation that changed was "Pre-Election #Obligations Can Be Met For Certain". 14/z

In this case; the human motivation that changed was "Pre-Election #Obligations Can Be Met For Certain". 14/z

What's not show in the picture is the *combined* open interest of September, October and November:

Sep02: 3482

03: 3316

04: 3111

08: 2836

09: 2617

10: 2614

11: 2591

14: 2413

15: 2553

16: 2635

17: 2655

18: 2518

21: 2622

22: 2296

23: 2118

25: 1942

28: 2094

29: 1977

30: 958

15/z

Sep02: 3482

03: 3316

04: 3111

08: 2836

09: 2617

10: 2614

11: 2591

14: 2413

15: 2553

16: 2635

17: 2655

18: 2518

21: 2622

22: 2296

23: 2118

25: 1942

28: 2094

29: 1977

30: 958

15/z

Contrast that with *when* contracts stopped rolling over, and *when* the #shadowcontracts in #silver accelerated into the month's end, to the point where there where 47 on the final day before final delivery!

Once October delivery passed, they immediately returned on Oct 1. 16/z

Once October delivery passed, they immediately returned on Oct 1. 16/z

What i mean to say: This Is Planned.

If it was random, or caused by volume, NO pattern would line up. CERTAINLY NOT open interest spread over 3 months VS the appearance, increase and decrease in these #shadowcontracts.

They have to be *made* to line up. Human activity. 17/z

If it was random, or caused by volume, NO pattern would line up. CERTAINLY NOT open interest spread over 3 months VS the appearance, increase and decrease in these #shadowcontracts.

They have to be *made* to line up. Human activity. 17/z

The reason why it's #manipulation is because they're NOT SUPPOSED TO BE correlating.

You're absolutely right to expect no pattern to exist!

Market forces such as #supply and #demand are impossible to predict, in a Fair market.

But that's not what we're dealing with here. 18/z

You're absolutely right to expect no pattern to exist!

Market forces such as #supply and #demand are impossible to predict, in a Fair market.

But that's not what we're dealing with here. 18/z

There IS a predictable situation ahead:

Economic collapse due to after effects of #Covid19 and the STUPID decision of US Democrats to politicize the #lockdown.

I don't believe it coincidence that the first shadowcontracts tests showed up in May, AFTER the reopening debate. 19/z

Economic collapse due to after effects of #Covid19 and the STUPID decision of US Democrats to politicize the #lockdown.

I don't believe it coincidence that the first shadowcontracts tests showed up in May, AFTER the reopening debate. 19/z

businessinsider.nl/trump-administ…

I can tell you that one of the reasons i found this pattern at all, is because at the start of June, i *stopped* following #Covid19 closely as i no longer considered it "The main threat".

The Response to Covid had become the main threat. 20/z

I can tell you that one of the reasons i found this pattern at all, is because at the start of June, i *stopped* following #Covid19 closely as i no longer considered it "The main threat".

The Response to Covid had become the main threat. 20/z

Never let a serious crisis go to waste. This was always in the cards, but was to be done under the guise of a #financial crisis, not a legitimate one.

#Covid19 is SO much better a cover. Meanwhile, panic pandemic demand forcing deliveries provided EVEN better cover/motive. 21/z

#Covid19 is SO much better a cover. Meanwhile, panic pandemic demand forcing deliveries provided EVEN better cover/motive. 21/z

If any reader is capable of even imagining a BETTER cover, or BETTER time with BETTER motive then now to pull the largest legal heist of #gold and #silver in history off - be my guest and leave a comment.

Finally the Cumulative numbers. They also don't make sense anymore. 22/z

Finally the Cumulative numbers. They also don't make sense anymore. 22/z

Now. Feel free to tell me how there can be 10,548 #silver contracts standing for #delivery, then actually have 11k+ deliver. That's 2,6 million Extra ounces.

While 2897 #ADDITIONAL contracts where made, representing 14,4 Moz.

Those are not small numbers people! 23/z

While 2897 #ADDITIONAL contracts where made, representing 14,4 Moz.

Those are not small numbers people! 23/z

Atleast ONE of these numbers should line up! This is a complete shitshow.

It makes NO sense. In NO situation. Except in 1:

Every man for himself. Be in the best position AFTER the collapse to win.

And it is clear Who won.

It's time to prepare. #JPMorgan certainly did.

24/END

It makes NO sense. In NO situation. Except in 1:

Every man for himself. Be in the best position AFTER the collapse to win.

And it is clear Who won.

It's time to prepare. #JPMorgan certainly did.

24/END

TAGS! (pls like it really helps!)

@PalisadeRadio @goldsilver_pros @ArcadiaEconomic @wmiddelkoop @BullionStar @MacleodFinance @michaeljburry @PeterSchiff @mike_maloney @zerohedge @GeorgeGammon @chrismartenson @ArnoWellens @RonPaul @KitcoNewsNOW @andrewmaguire1 @CFTC @maxkeiser

@PalisadeRadio @goldsilver_pros @ArcadiaEconomic @wmiddelkoop @BullionStar @MacleodFinance @michaeljburry @PeterSchiff @mike_maloney @zerohedge @GeorgeGammon @chrismartenson @ArnoWellens @RonPaul @KitcoNewsNOW @andrewmaguire1 @CFTC @maxkeiser

Adding in the videos if you haven't seen em!

The video that started it all:

It recaps, talks and explains the August thread in a very concise and down to earth manner. If you don't understand a lick of what i've written, WATCH THIS FIRST! then come back.

The video that started it all:

It recaps, talks and explains the August thread in a very concise and down to earth manner. If you don't understand a lick of what i've written, WATCH THIS FIRST! then come back.

The second interview that i've done with Robert Kientz goes deeper into the numbers.

Be sure to check the rest of his channel out too! He's done his own digging on this and since he saw my video has been digging like a bloodhound.

Be sure to check the rest of his channel out too! He's done his own digging on this and since he saw my video has been digging like a bloodhound.

Finally i wanna apologize for snoozing on a few days. My health's been really bad this month, aside from being bad all year past getting the Rona at the end of February. I missed silverfest (so i owe @ArcadiaEconomic an interview whenever he wishes :D) cause of stomach issues.

I'll try to keep track of October but at this point if more people don't start asking questions or spreading this there's little more i can do :D I need rest, badly.

As what's next; Setting up Desogames.com for these long form articles is now my no.1 priority.

As what's next; Setting up Desogames.com for these long form articles is now my no.1 priority.

I'm working on the podcast on the side whever i have time, that'll come right after that too. I already know how i'll record and spread it.

On that note; go Follow me on Twitch.tv/Desogames. I'll be recording it there Live on Saturdays in the future.

On that note; go Follow me on Twitch.tv/Desogames. I'll be recording it there Live on Saturdays in the future.

I won't just be talking Silver, but general economic things as well; as well as have guests on if anybody dares to come. It'll be a completely free thinking space, my own space, cause that's what i want ^_^

End November it's a vacation then in December we'll get ready for '21.

End November it's a vacation then in December we'll get ready for '21.

More content WILL come :D I've worked far too hard to get any sort of attention at all on these issues, there's far FAR more things i've got an unsalted opinion on and by god at this point voicing it has become therapeutic.

So y'all are gonna get it :D Onto the future!

So y'all are gonna get it :D Onto the future!

PS; people who wanna help spread this might not realize what the best way is :D Best to:

1. Like the first tweet

2. Quote-tweet the first tweet

3. Like the tweet with tags.

The Algorithm likes QT's, and liking the tweet with the mentions makes it show up in their notifications.

1. Like the first tweet

2. Quote-tweet the first tweet

3. Like the tweet with tags.

The Algorithm likes QT's, and liking the tweet with the mentions makes it show up in their notifications.

AND i'm adding this to this entire thread. The other big thread i made the other day.

If you're wondering WHY anybody would go through such elaborate lengths to drain the #Comex of all #silver and #gold, well....

If you're wondering WHY anybody would go through such elaborate lengths to drain the #Comex of all #silver and #gold, well....

https://twitter.com/DesoGames/status/1311639977818836993

• • •

Missing some Tweet in this thread? You can try to

force a refresh