The #RealInvestmentReport is out!

The #rally that started 3-weeks ago ended abruptly as concerns of #inflation, the #Fed and rising #recession risk spooked #investors. With the Fed set to hike #rates next week, we increased hedges and cash last week.

realinvestmentadvice.com/rally-fails-as…

The #rally that started 3-weeks ago ended abruptly as concerns of #inflation, the #Fed and rising #recession risk spooked #investors. With the Fed set to hike #rates next week, we increased hedges and cash last week.

realinvestmentadvice.com/rally-fails-as…

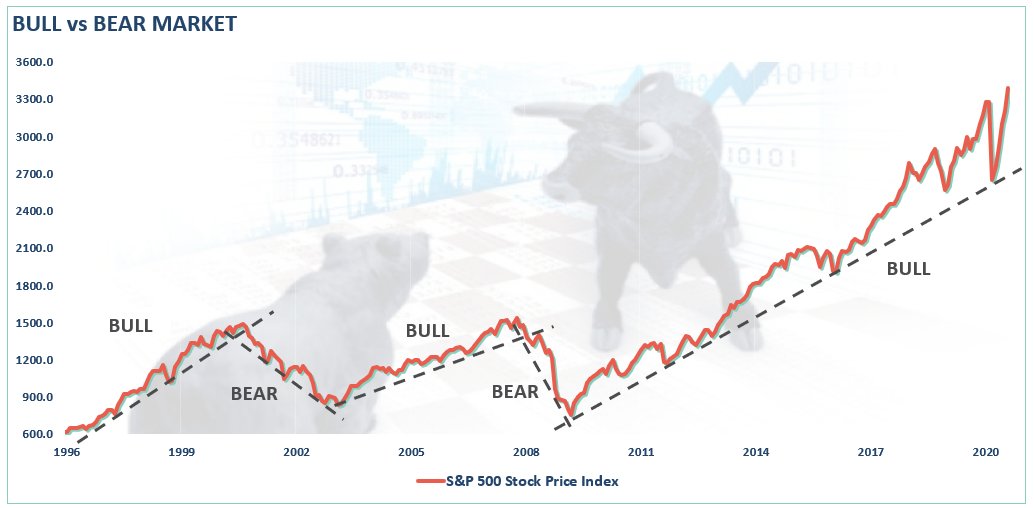

After struggling at the 38.2% resistance level, #inflation, #recession risks, and the #Fed spooked #investors last week. #Market now retesting previous lows. Now back to short-term oversold, looking for a small bounce next week to add to #short #hedges.

realinvestmentadvice.com/rally-fails-as…

realinvestmentadvice.com/rally-fails-as…

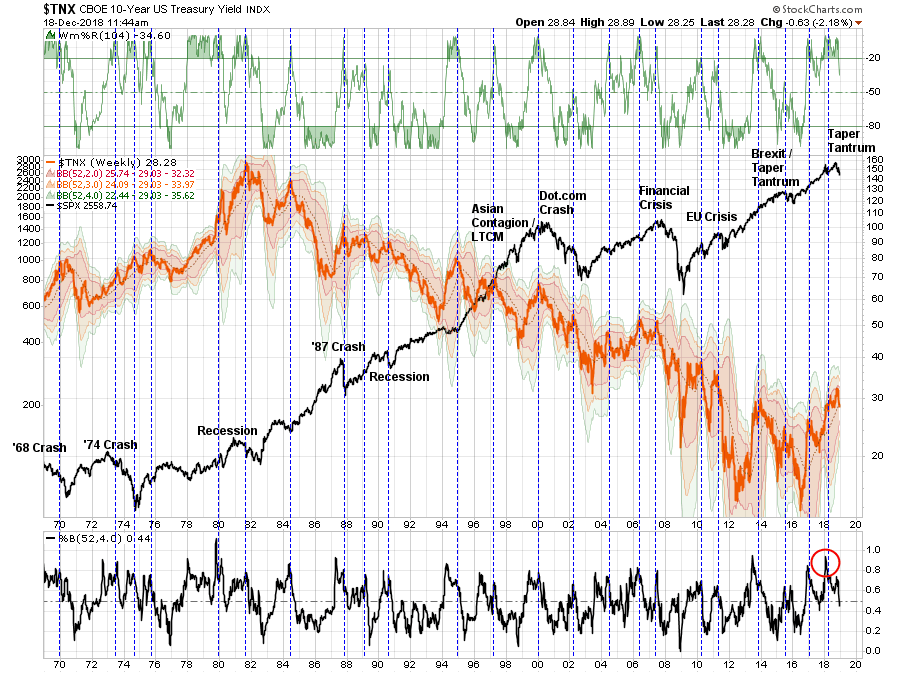

With the #Fed tightening their #balance sheet and hiking #rates, the 10-year yield is starting to top. Much like we saw in 2018, when the Fed breaks something, yields will fall quickly on the long-end (#yieldcurve inversion and #recession.)

realinvestmentadvice.com/rally-fails-as…

realinvestmentadvice.com/rally-fails-as…

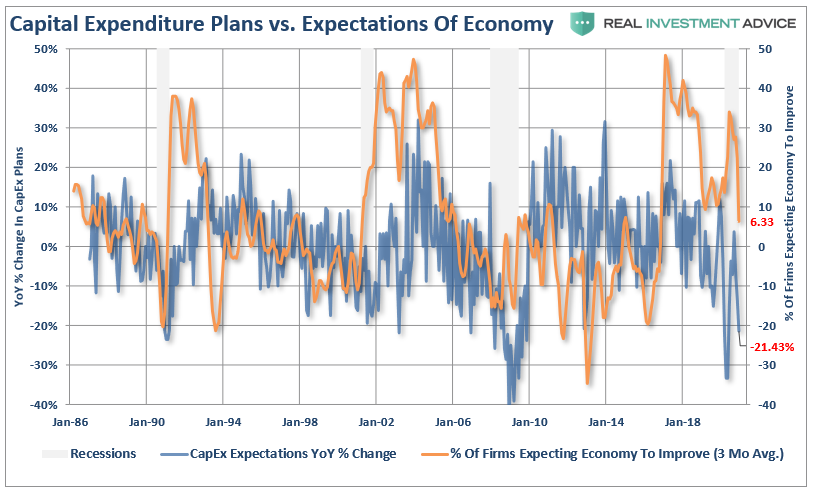

A couple of things about #inflation

1) When inflation runs above 5% it has always been coincident with a #recession.

2) Spikes in inflation are never resolved by drifting lower. It crashes as the economy grinds to a halt. (Same with #oil prices.)

realinvestmentadvice.com/rally-fails-as…

1) When inflation runs above 5% it has always been coincident with a #recession.

2) Spikes in inflation are never resolved by drifting lower. It crashes as the economy grinds to a halt. (Same with #oil prices.)

realinvestmentadvice.com/rally-fails-as…

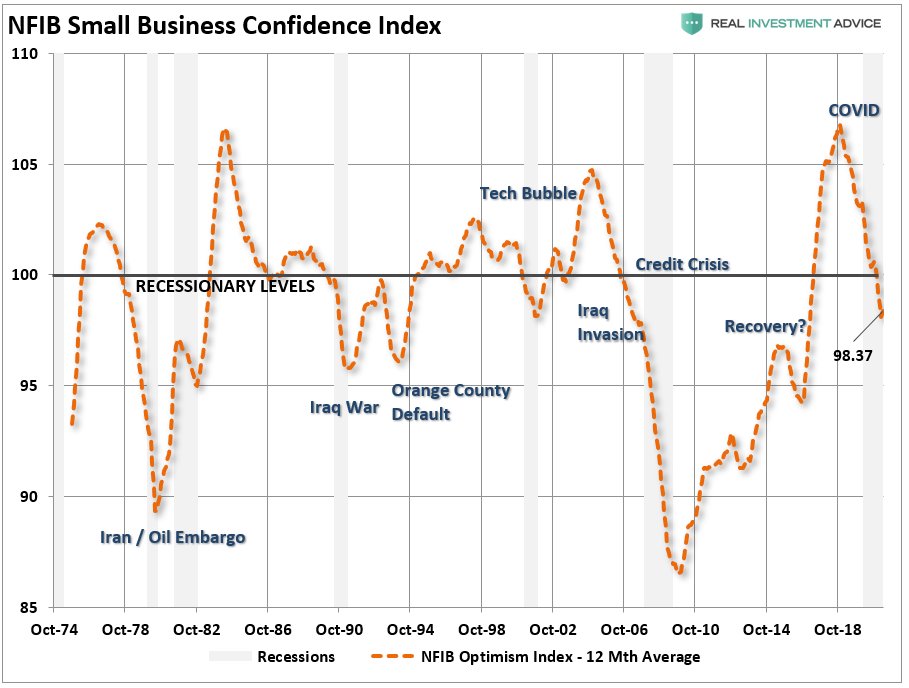

#NFIB survey indicators are hitting levels always coincident with #recession onsets.

realinvestmentadvice.com/rally-fails-as…

realinvestmentadvice.com/rally-fails-as…

Market very oversold after this week's plunge. (Lower left panel). A small bounce next week to sell into would not be surprising.

realinvestmentadvice.com/rally-fails-as…

realinvestmentadvice.com/rally-fails-as…

The WEEKLY technical composite is back to historically low levels after a brief bounce over the last two weeks.

Any bit of good news, or just lack of news, could elicit a sellable bounce.

realinvestmentadvice.com/rally-fails-as…

Any bit of good news, or just lack of news, could elicit a sellable bounce.

realinvestmentadvice.com/rally-fails-as…

• • •

Missing some Tweet in this thread? You can try to

force a refresh